Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

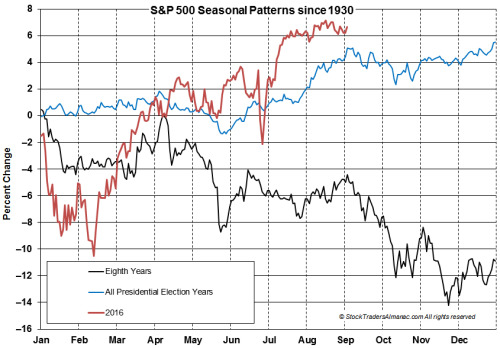

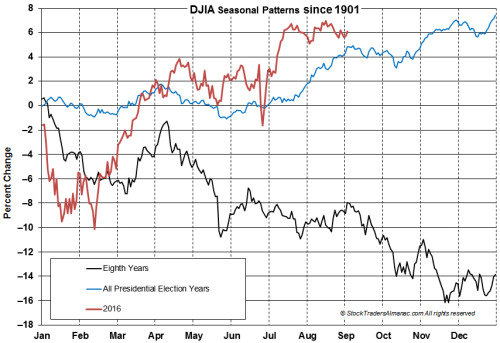

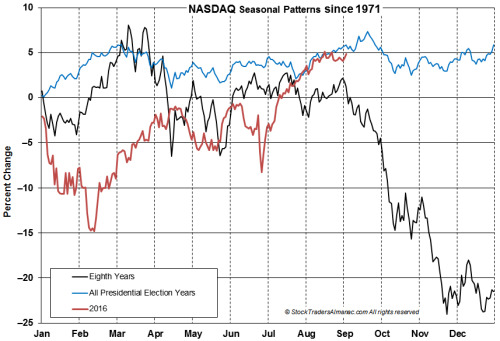

Following six straight months of gains from February through July, Dow Jones Industrial Average declined 0.2% in August. S&P 500 had been up for five months straight before slipping 0.1% in August. NASDAQ and Russell 2000 performed better in August, up 1.0% and 1.6% respectively. Overall August performance was weaker than past election years although not far off as tech and small caps did outperform. As of last Friday’s close, DJIA was up 6.12% year-to-date, S&P 6.66% and NASDAQ 4.84%. DJIA and S&P 500 are above average compared to past election years, but NASDAQ is still slightly below.

The market is now navigating the weakest part of the calendar year, September. Even in election years the month has been challenging. This weakness is apparent on the following updated “Eighth-Year” charts. In past election years, DJIA and S&P 500 have peaked early in September and then decline through mid-October. NASDAQ tends to rally until mid-September before surrendering its gains.