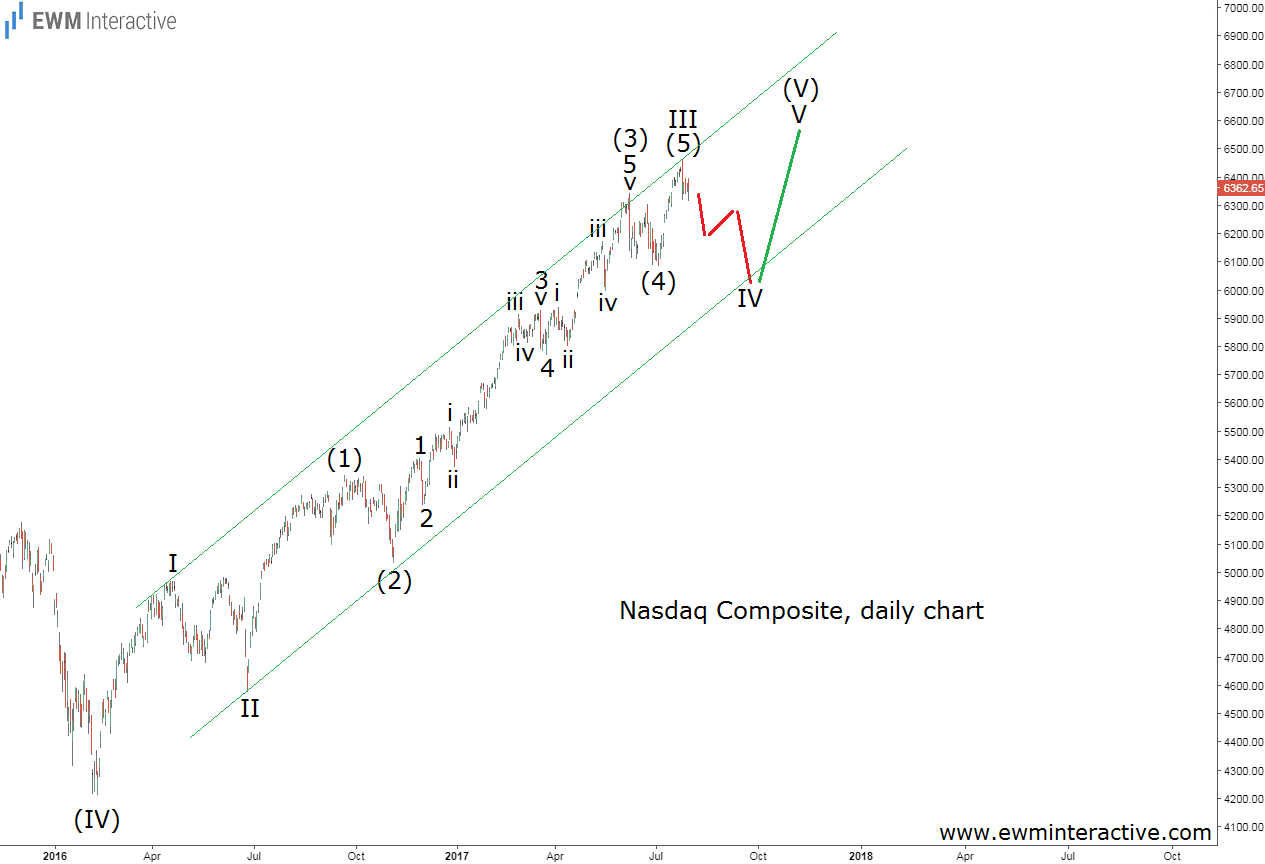

Less then three months ago, while it was hovering around 6360, we published an ARTICLE about the NASDAQ Composite, saying that “6500 is still on the table“, but a decline to at least 6100 should first be expected. Here is the Elliott Wave analysis this prediction was based on.

The reason we were expecting a short-term dip first, was the fact that wave III seemed to have terminated at 6461. Therefore, wave IV down was supposed to follow. Then, the uptrend was going to resume in wave V, thus reaching a new all-time high above 6500.

Wave IV turned out to be shallower than expected. The NASDAQ Composite fell to only 6177 before reversing to the north again. The market closed at 6586 yesterday, significantly above our 6500 target. Take a look at the updated chart below.

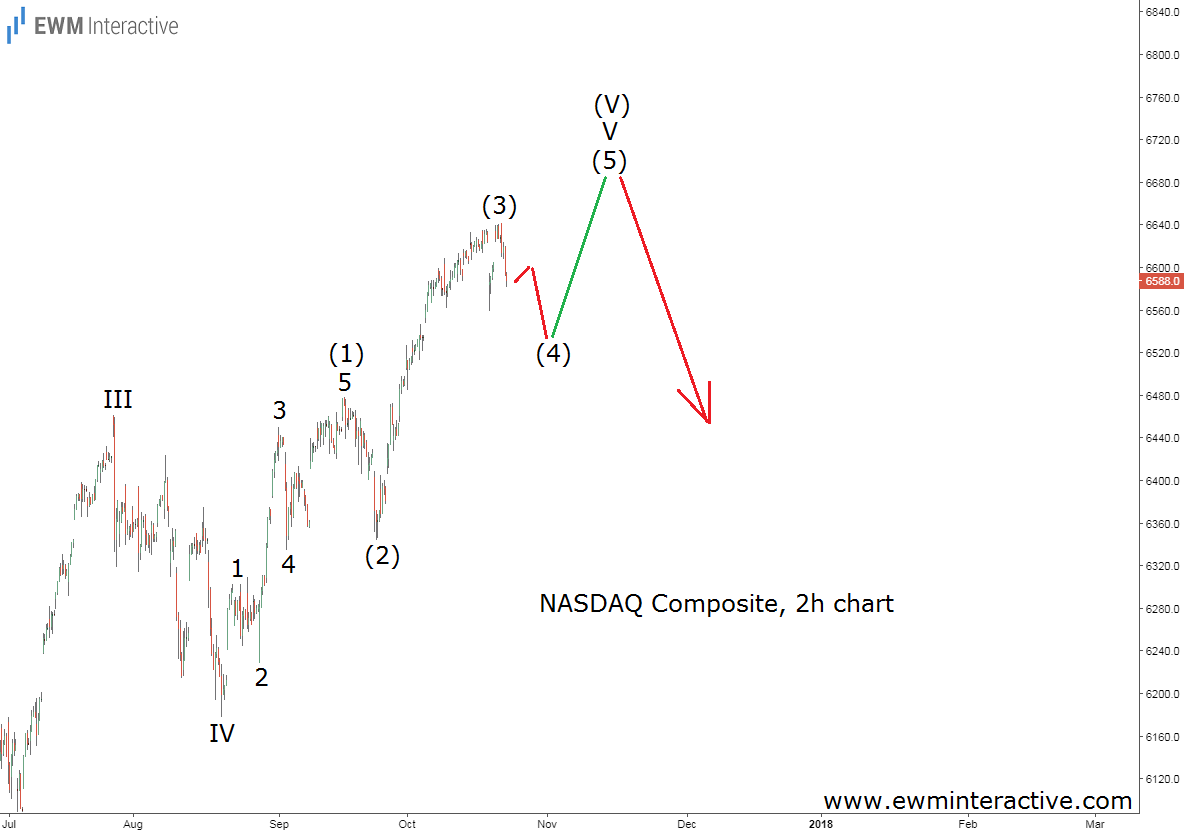

Wave V has been in progress since the bottom of wave IV at 6177, which means the entire impulsive rally from the bottom of wave (IV) at 4210 is almost over. According to the theory, once the impulse is complete, a three-wave correction in the opposite direction should be anticipated. If we keep in mind the big picture, it could be a major one. So, what is left of wave V of (V)? The 2-hour chart below comes in handy.

Wave V is also supposed to have a five-wave structure. So far, that is not the case, since waves (4) and (5) are still missing. Wave (4) cannot overlap the top of wave (1) at 6478. As long as this level holds, the bulls are likely to lift the NASDAQ Composite above 6640. 6700 looks quite reasonable.

Nevertheless, the higher the price goes, the riskier it gets. Instead of joining the uptrend, we believe investors should simply stay aside, because trying to pick the top and short is not a good idea, either.