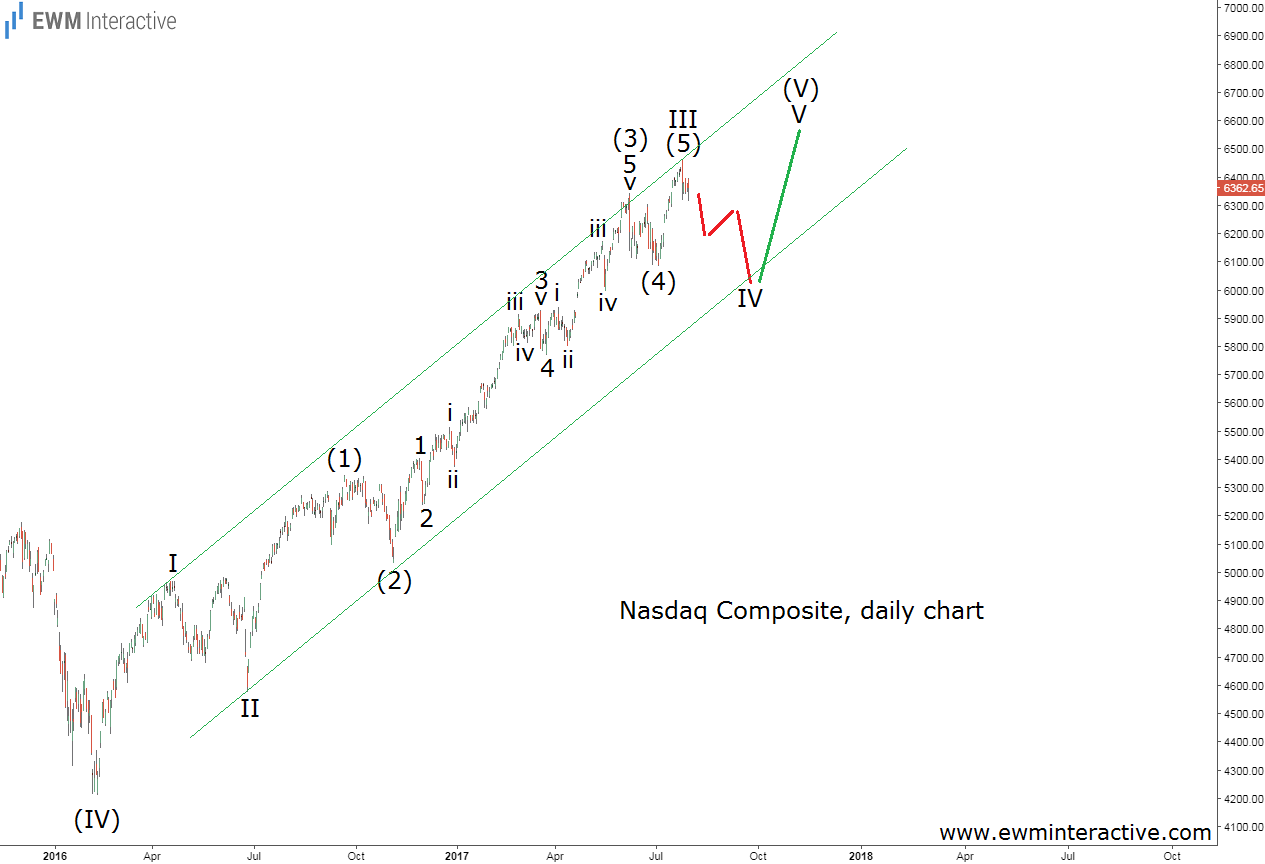

We wrote about the Nasdaq Composite on March 8th. While the index was trading near 5830 its weekly chart suggested the bulls should be able to lift the price to around 6500. Last week, 6461 was reached, so it is time to take a closer look and see what is left of this uptrend. Not much, judging by the Elliott Wave analysis of the daily chart below.

The chart allows us to see the wave structure of the rally from 4210 in February, 2016, marked as wave (V) on the weekly time-frame. In theory, the fifth wave could develop as either an ending diagonal or a regular five-wave impulse. Here, it look like a diagonal pattern is highly unlikely, so we think wave (V) is going to be a normal impulsive pattern, labeled I-II-III-IV-V, as shown above. Wave I travels to 4970, followed by a pullback in wave II down to 4574, where the start of wave III was given. As you can see, waves IV and V are still missing. Since wave III looks complete, we could now expect a three-wave decline in wave IV to drag the Nasdaq to the support area of the lower line of the trend channel, before the bulls return for a final push in wave V of (V).

If this count is correct, the Nasdaq Composite should decline to around 6100-6000 and then rise to a new all-time high again. 6500 is still on the table, but chances are the bulls are not going for it right away. They have to take a rest first.