The champagne popped yesterday after the Nasdaq Composite Index (CCMP) rallied 1.8% and surpassed the 20,000-point milestone for the first time. Strength from most of its mega-cap components underpinned yesterday’s rally, a common theme since the tech-heavy index bottomed at 10,213 back in 2022.

Since then, the CCMP has added 96% (as of December 11), with NVIDIA (NASDAQ:NVDA), Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Meta (NASDAQ:META), Tesla (NASDAQ:TSLA), and Alphabet (NASDAQ:GOOGL) contributing to roughly two-thirds of the overall gain. (NVDA alone has added around 18%.)

With the index marching to another new high yesterday, the next logical question is how sustainable is this rally. From a technical perspective, and based on the size of the consolidation range prior to the breakout above the 2021 highs earlier this year, a minimum price objective sets up near 21,600. However, don’t expect to get there in a straight line.

The index is overbought and approaching the upper end of a rising wedge formation (bearish pattern). As highlighted in the middle panel of the chart below, the 96% rate of change over the last 491 trading days (tracing back to the December 2022 low) is not unprecedented but rarely exceeded. In addition, the percentage of CCMP constituents registering new 52-week highs has declined since the November 6 post-Election Day rally. The divergence between price and breadth implies fewer and fewer stocks are supporting the advance.

Collectively, the technical evidence does not mean a top on the CCMP is near but suggests investors should consider tactically buying dips within the longer-term rising price channel vs. chasing this latest breakout. In the event of a pullback, support for the index sets up at the 20-day moving average (dma), the recent November highs (19,287), and near the July highs (18,674).

The Nasdaq Surpasses the 20,000-Point Milestone

Source: LPL Research, Bloomberg 12/12/24

Disclosure: Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

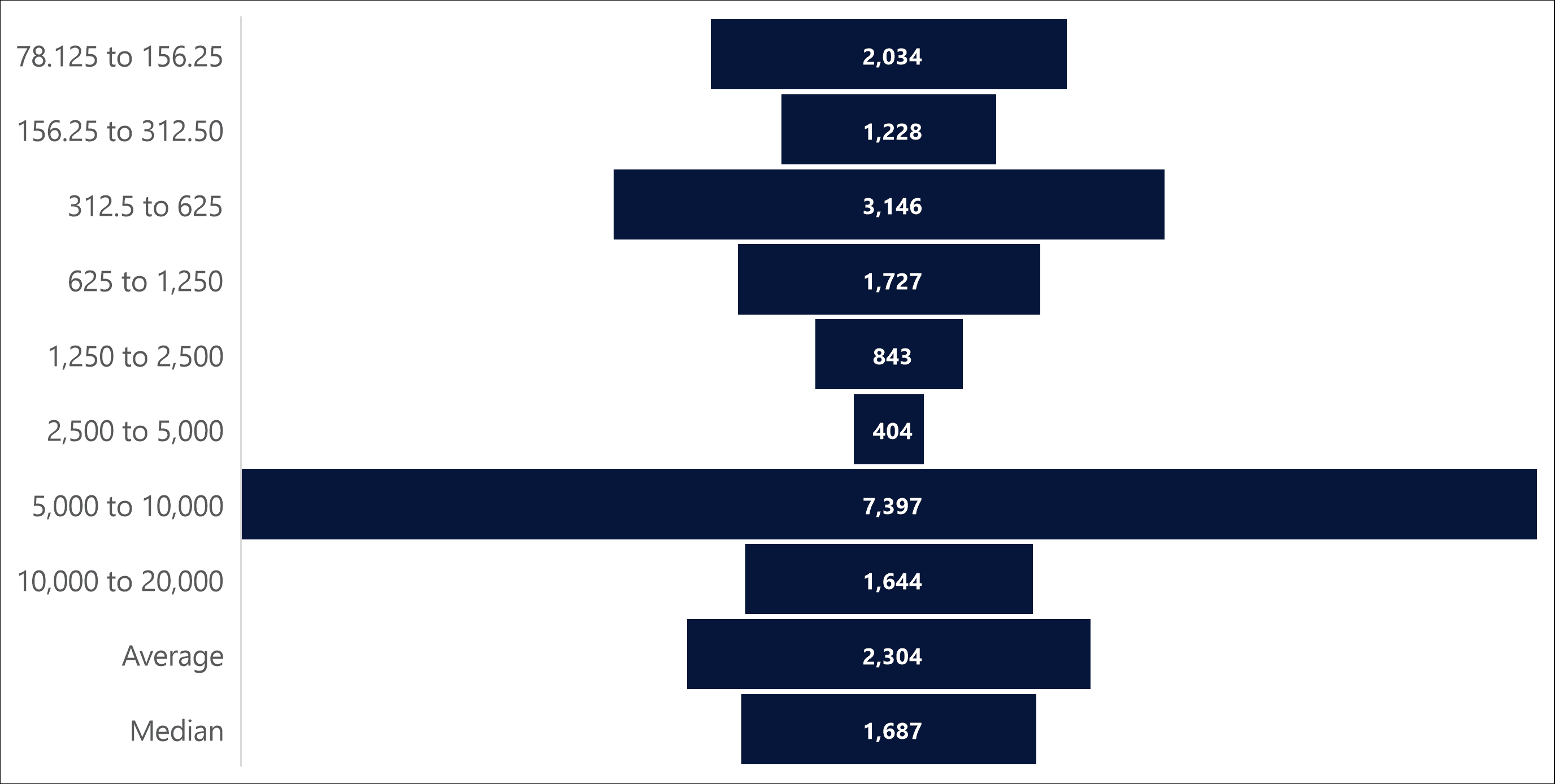

Round numbers such as 20,000 can act as important milestones and psychological reference points, often making them key support and resistance levels to monitor. They also serve as a benchmark for progress, with investors usually comparing them to previous milestones. In the bar chart below, we highlight this progress based on the number of days for the Nasdaq to double, dating back to 1974.

It took the index 1,644 days to double from the 10,000-point milestone to the 20,000-point milestone. While this may sound like an extended period, it is in line with the median number of days to double (1,687) — not to mention significantly shorter than the 7,397 days for the index to double from 5,000 to 10,000 during the March 2000 to June 2020 period.

Number of Days for the Nasdaq to Double (1974–YTD)

Source: LPL Research, Bloomberg 12/12/24

Disclosure: Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

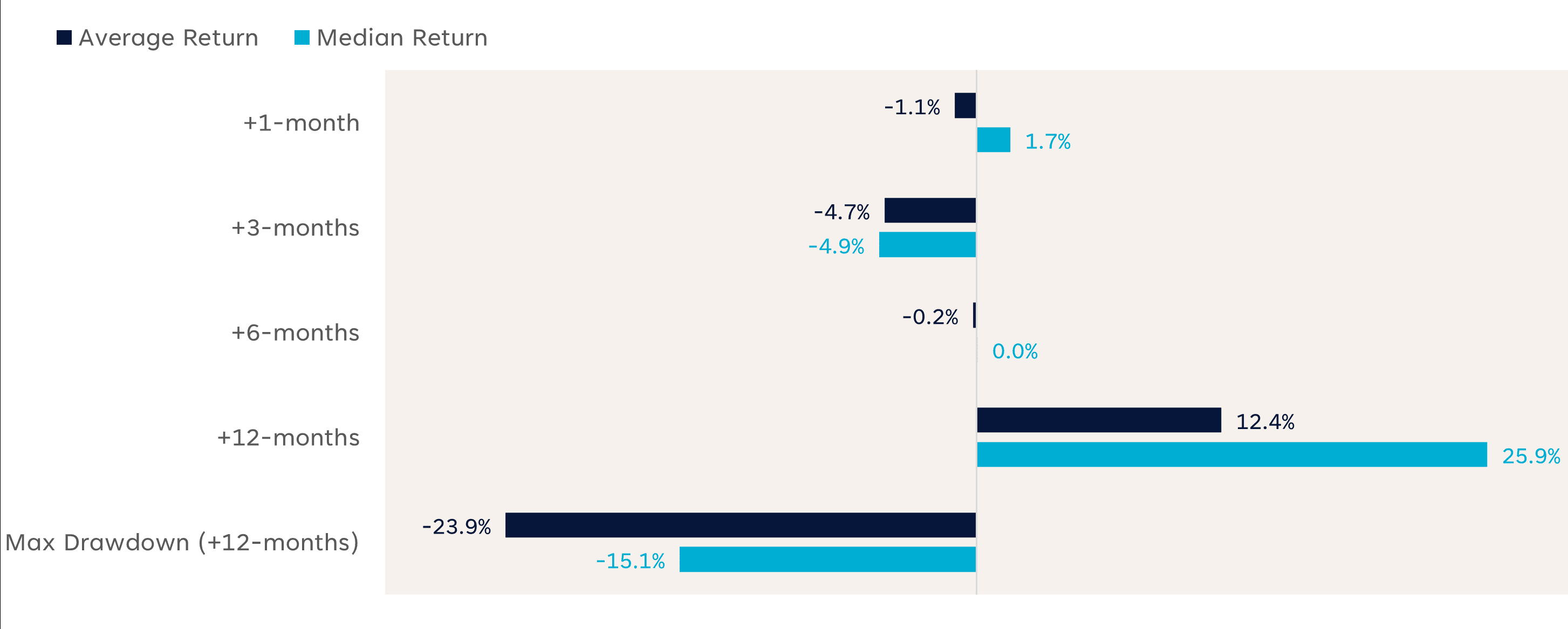

Regarding future performance, momentum after the CCMP doubles tends to slow down on a shorter-term basis. Using the same ranges and dates from the previous chart, we found average and median returns were mixed over the following six months. However, performance has historically improved longer term, with the post-12-month average and median returns at 12.4% and 25.9%, respectively. Acknowledging the CCMP doubling dataset is both limited and arbitrary, history suggests the tech-heavy index could be due for a breather before longer-term momentum resumes.

Nasdaq Performance After Doubling (1974–2021)

Source: LPL Research, Bloomberg 12/12/24

Disclosure: Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

Summary

The Nasdaq has generated an impressive rally off its late-2022 bear market lows. The proliferation of Artificial intelligence (AI) over the last two years has been a major driver behind the advance on the tech-heavy index. However, this has also created building concentration risk as only a select number of mega-cap names continue to drive the outperformance.

And while the AI story is far from over, along with the Nasdaq’s current uptrend, technical evidence suggests the index could be due for a pause or pullback. Tactically, this implies investors should consider buying dips for index exposure vs. chasing the latest rally.