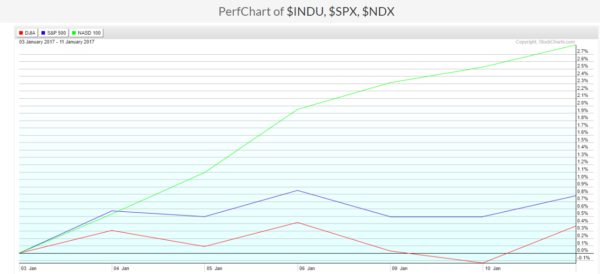

Since the beginning of the year the Nasdaq 100 has been the darling of the stock market. All indexes opened higher following the New Year's Day break, but since then, the Nasdaq 100 has been making new all-time highs seemingly every minute. From January 3rd close until Wednesday’s close it was up 2.83% in just 7 days. Put in that perspective, it does not seem too fast or an overheated response. Just a steady grind higher.

But the chart below shows this move to in fact be unusual. The chart shows the Nasdaq 100 performance as well as that of the Dow Jones Industrials Average and the S&P 500. The larger two indexes have moved nearly sideways during this 7 day run up in the Nasdaq 100. They have had a few small gains and small pullbacks, but both are up a fraction of what the Nasdaq has moved.

One reason could certainly be that the news cycle has been pulling a lot of large cap stocks into the story. Uncertainly it's not a time to buy these names, whether the discussion is real or blather. Or it could just be normal rotation within the stock market that occurs during a bull run. This is a very short term picture. But pulling back to a longer view shows that the Dow and S&P are just consolidating major moves higher. No sign of pain or caution. Rotation seems a safe explanation for now.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.