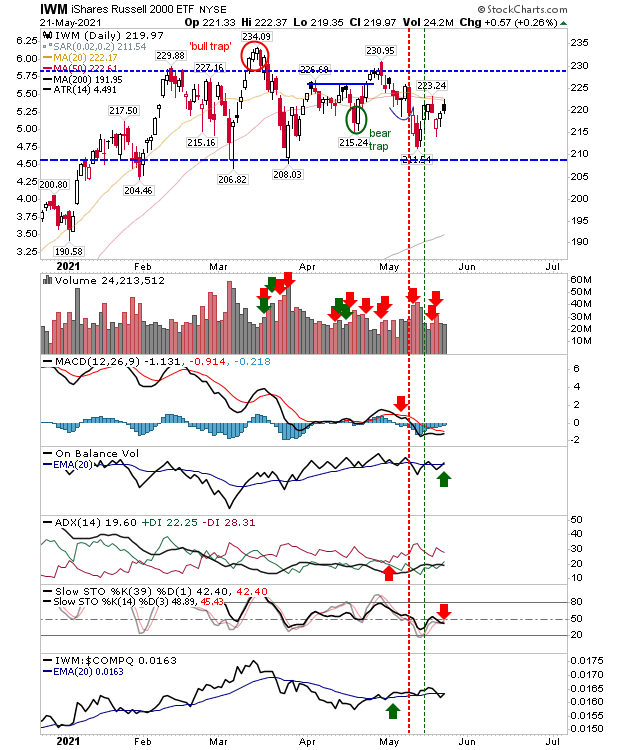

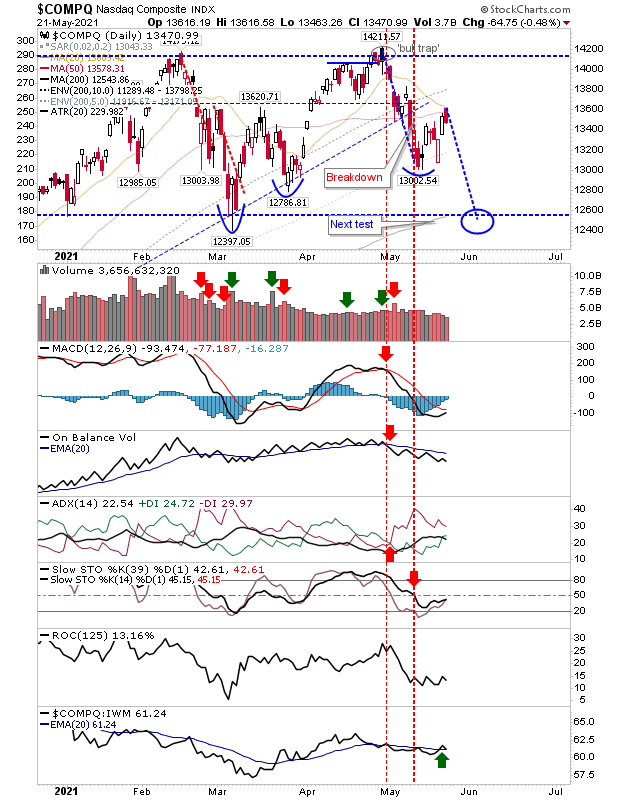

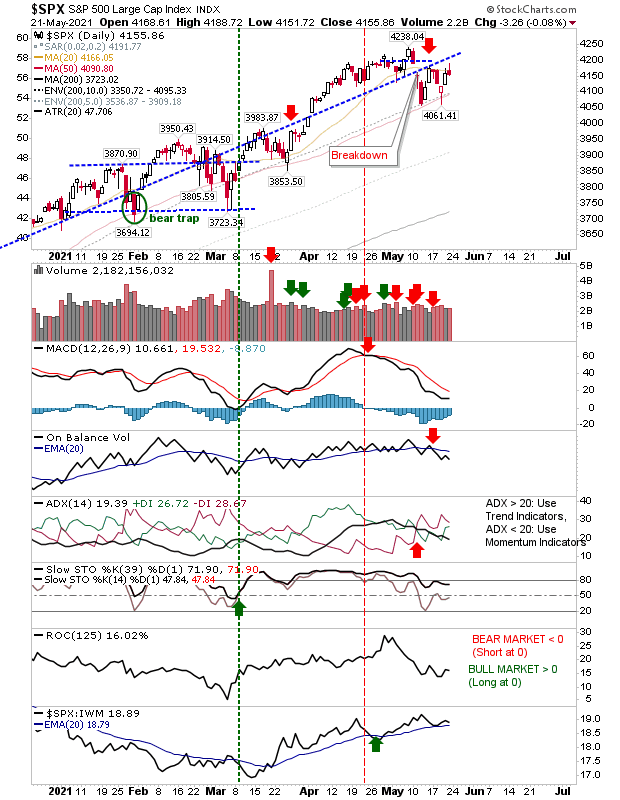

The mid-week bounce ran into trouble by Friday's close as the Russell 2000, NASDAQ and S&P ran into their 20-day MAs, leaving behind bearish candlesticks in the process. The NASDAQ and Russell 2000 also tagged their 50-day MA. It could be a long week ahead for the indices.

The Russell 2000 is still range bound, but I don't like to see 'black' candlesticks, particularly when near resistance, but real selling pressure doesn't kick in until $210 (via IWM) is lost. Technicals edge bearish with ADX and MACD firmly on the bearish side of the ledger, but On-Balance-Volume is zig-zagging and stochastics is caught at the mid-line.

The NASDAQ is also range bound, with the adjusted measured move target down now likely aligned to its 200-day MA. Technicals are all bearish with only relative performance positive vs the Russell 2000.

The S&P is struggling to challenge the 4,200 level and hasn't fully closed the breakdown gap from early May. Stochastics (momentum) are the most bullish of the lead three indices, but other technicals are bearish, although it too has a relative advanced versus Small Caps. A test of the 50-day MA looks next.

We have to see how the week starts, but if indices can push to challenge all-time highs it will negate Friday's bearish set-ups. But, weakness lasting beyond the opening half-hour will cause trouble.