After two days of selling, markets were stuck in a quick pause. It was a narrow-range day, so there was not much to work with, but it was interesting to see where this buying occurred.

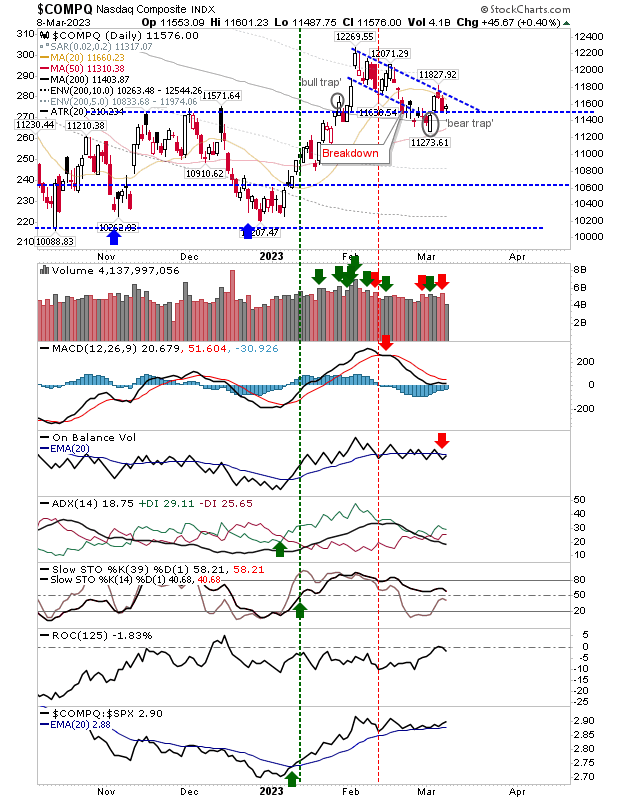

For the Nasdaq, the buying was again at breakout support. Volume was well down on Friday's distribution, so that I wouldn't expect any big bounce here, but it might be enough to keep losses from piling on. There was a new 'sell' trigger in On-Balance-Volume to add to the current 'sell' trigger in the MACD. However, stochastics remain on the bullish side of the fence. For now, the 'bear trap' remains in play.

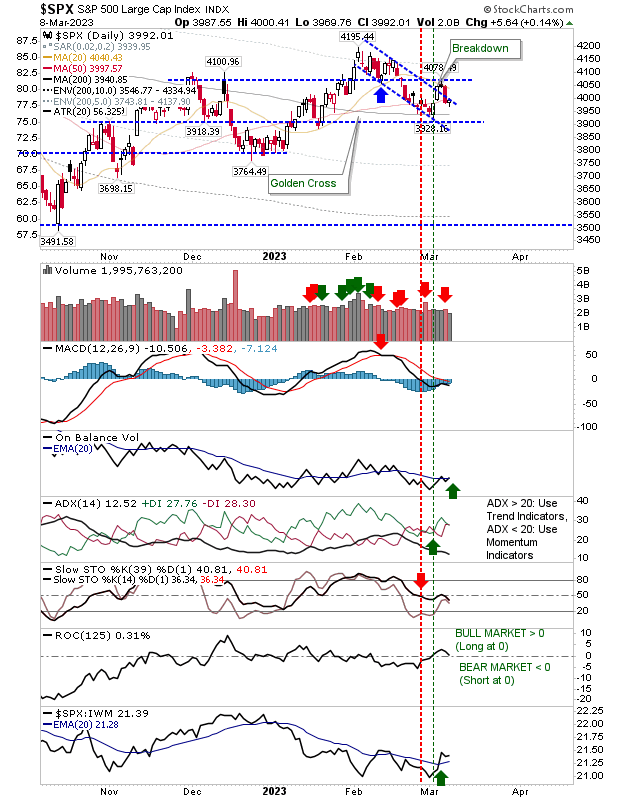

In the case of the S&P 500, the buying kicked in at its 50-day MA. This was enough to see a new 'buy' trigger in On-Balance-Voume and an acceleration in relative performance against Small Caps. However, more worrying, there was a clear reversal at the mid-line of stochastic, which today's buying did nothing to reverse - but, in fact - made worse. I would consider the S&P 500 vulnerable to further losses.

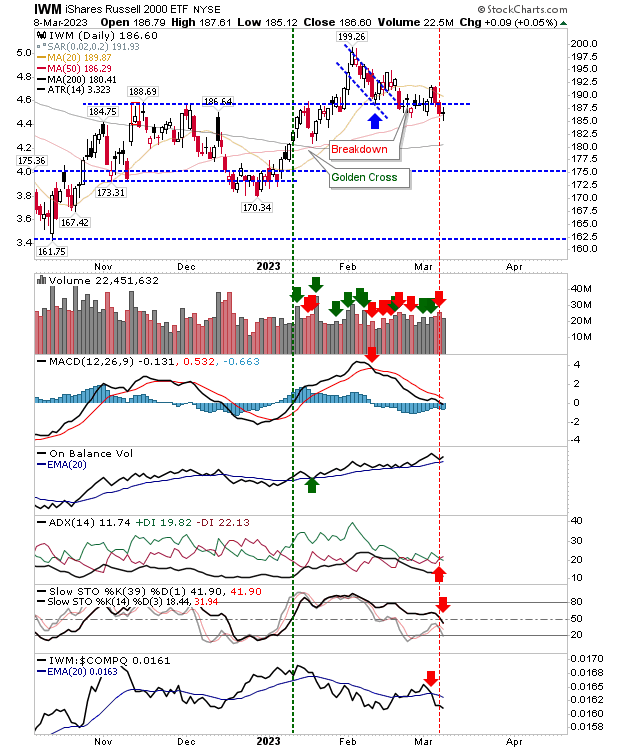

The Russell 2000 also saw buying at its 50-day MA. Buyers came in at its 50-day MA with a neutral doji, but it wasn't enough to prevent a loss of the stochastic mid-line, a 'sell' trigger in the ADX, nor an acceleration in the loss of relative performance. The MACD trigger 'sell' remains unchallenged. The index remains close enough to breakout support, suggesting it can maintain the rally from December lows, but it would need a positive day tomorrow.

I'm not sure today's buying will change too much or stop further profit-taking, but all lead indexes have defendable support, so that I wouldn't be shorting markets. Let's see what the next bounce does.