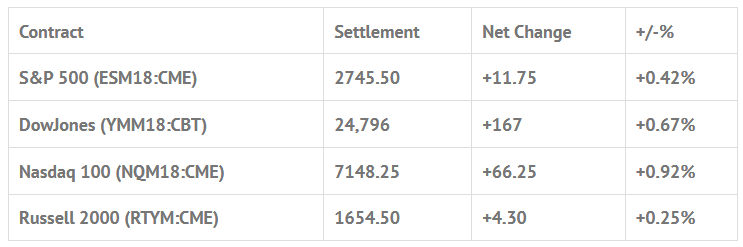

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed higher: Shanghai Comp +0.75%, Hang Seng +0.31%, Nikkei +0.28%

- In Europe 10 out of 13 markets are trading higher: CAC +0.66%, DAX +1.17%, FTSE -0.36%

- Fair Value: S&P -0.18, NASDAQ +1.69, Dow -0.36

- Total Volume: 844k ESM & 700 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Redbook 8:55 AM ET, PMI Services Index 9:45 AM ET, ISM Non-Mfg Index 10:00 AM ET, and JOLTS 10:00 AM ET.

S&P 500 Futures: #ES Overlooks European And China Trade Wars

When the news broke that China and the US could not reach an agreement on the tariffs over the weekend, it sounded like the global stock markets could be in trouble. That didn’t end up being the case though. Asian markets closed with gains, the Nikkei logged its biggest increase in six weeks, and the Stoxx 600 was up over 0.50% midday.

The Globex overnight trading range for the S&P 500 futures was 2729.00 to 2746.75, with 160,000 contracts traded. The first print off the 8:30 CT futures open was 2742.00, and the ES immediately shot up to a double top at 2749.25 around 10:00. From there, the futures pulled back to 2740.50 and then rallied up to the 2746.00 area. After another pullback down to 2740.00, the ES rallied up to 2747.75 around 12:10 CT. After that, the ES pulled back to the vwap at 2743.50 at 2:30 as the MiM went from $360 million to buy to $463.00 to buy. The actual MOC ended up at $143 million to buy. On the 2:45 cash imbalance reveal, the ES traded 2747.25, then traded 2746.75 on the 3:00 cash close, and settled the day at 2745.25 on the 3:15 futures close, up +11.50 handles, or up +0.42% on the day.

We all know Monday’s tend to be the low volume day of the week, but yesterday’s volume was ridiculous, and it was also a precursor of things to come as the summer trade kicks into gear. When you take the 844,000, subtract 160,000 for Globex, minus 70% for the algos and hft’s, that means only 205k ES traded on the day.

June 7th ‘Switch Day’

S&P Dow Jones Indices will make the following changes to the S&P 100, S&P 500 and S&P SmallCap 600 effective prior to the open of trading on Thursday, June 7:

Netflix Inc. (NASDAQ: NASDAQ:NFLX) will replace Monsanto Company (NYSE:NYSE:MON) in the S&P 100, and Twitter Inc. (NYSE: NYSE:TWTR ) will replace Monsanto in the S&P 500. Bayer (DE:BAYGN) Aktiengesellschaft is acquiring Monsanto in a deal expected to be completed soon pending final conditions.

REGENXBIO Inc. (NASDAQ: RGNX) will replace General Cable Corp. (NYSE: BGC) in the S&P SmallCap 600. Prysmian Group is acquiring General Cable in a deal expected to be completed soon pending final conditions.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.