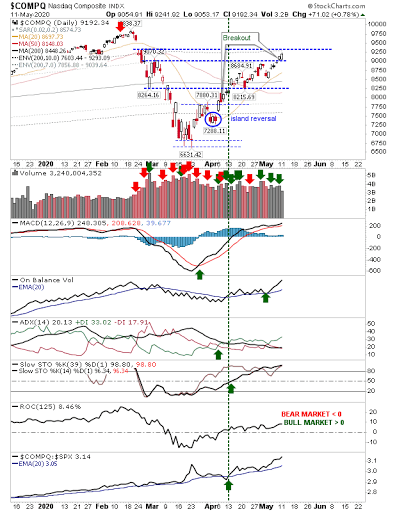

Market action remained somewhat low key yesterday, with only the NASDAQ trading any action of note. The NASDAQ is fast approaching the next resistance level of the February(!) breakdown gap—this will probably be the last point of attack for shorts as going beyond this will fill (and therefore, negate) the breakdown gap. Trading volume for the index was well down from Friday.

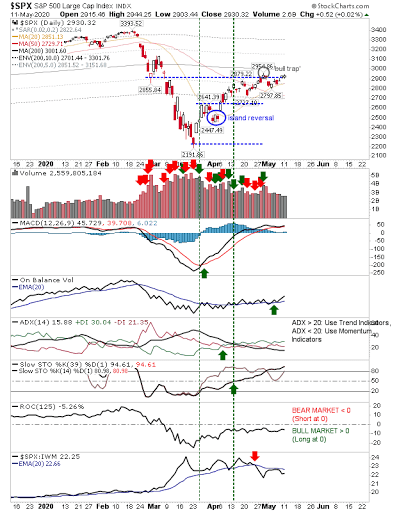

The S&P was flat on the day with technicals remaining net bullish. However, there was another relative loss against the Russell 2000. Large Caps have been underperforming Small Caps since late April, but I would consider this bullish in the larger scheme of events. The 'bull trap' remains.

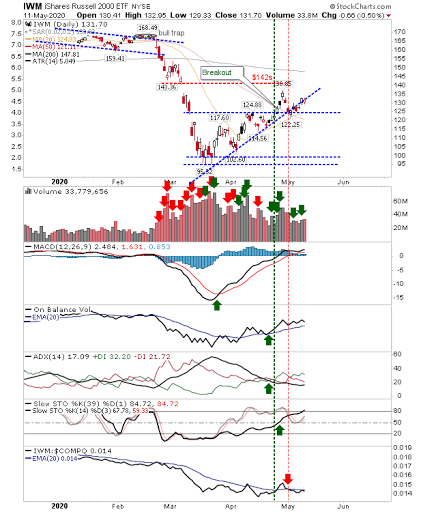

While Small Caps (via iShares Russell 2000 ETF (NYSE:IWM)) are enjoying a relative performance advantage against Large Caps, they didn't do a whole lot yesterday. The index continues to run along trendline support even as it underperforms versus the NASDAQ, but it's an index with much work to do.

Going forward, the NASDAQ is the trail blazing index and it will need to stay strong if it's to drive a breakout (and a negation of the 'bull trap') in the S&P, and to give the Russell 2000 some traction for gains.