For a month I have been tracking a possible impulse move down for the NASDAQ 100, i.e., five waves lower as per the Elliott Wave Principle (EWP), to ideally around $9,500. A week and a half ago, I showed that the index appears to be following the ideal Fibonacci-based impulse pattern rather well. Applying this pattern, I found:

“The logical conclusion is that W-5 of -iii is now underway with an ideal target zone of $9,847-10,272 (the 138.20-161.80%) while knowing that the markets do not always have to follow this perfect path. Ideally, the index should drop slightly lower, bounce back to the ideal red W-iv target zone ($10,960-11,385), and then drop one last time to the perfect red W-v target zone ($9,160-9,585). By then, the NDX should be ready for a multi-month counter-trend rally.”

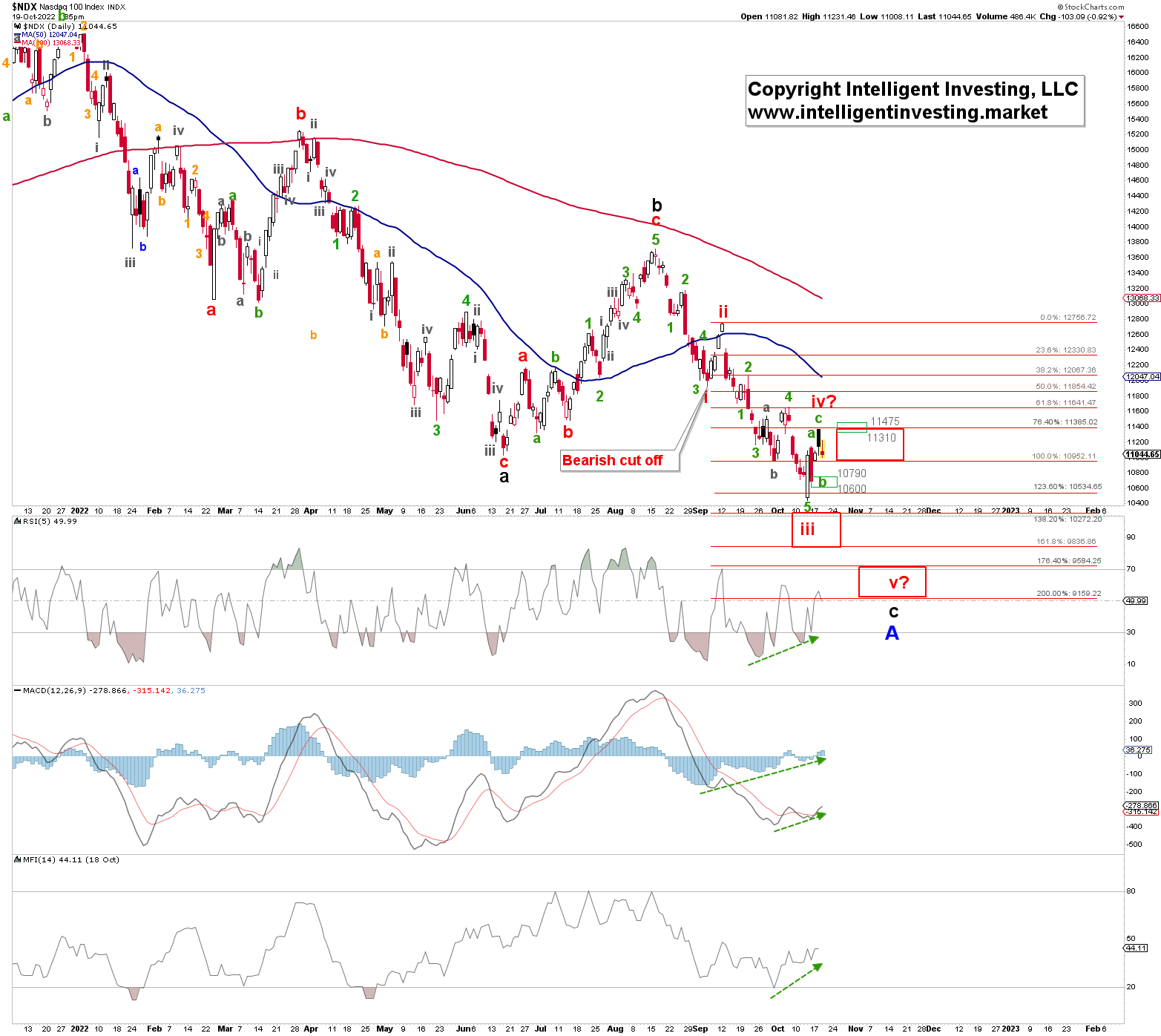

On Oct. 13, the index bottomed at $10,440 and rallied to as high as $11,368 yesterday (Oct. 18). Thus, the index came within 1.6% of the ideal (red) W-iii target zone and has reached the ideal W-iv target zone. So far, so good. See Figure 1 below.

Figure 1: NASDAQ 100 daily candlestick chart with detailed EWP count and technical indicators:

Moreover, from a shorter time-frame perspective, I showed the index should bottom around $10,600-10,790 last Friday and then rally to $11,310-11,475 (green W-b, -c boxes in Figure 1). See here.

So far today, the index appears to be reversing course. Breaking below last Friday’s low ($10,677) will strongly suggest red W-v is under way to the ideal target zone of $9,160-9,585, with the upper end preferred as that is where W-v equals W-i. A relatively common relationship between a fifth and a first wave. However, the “bearish cut-off” level I shared last remains in place for now.

“If the index does not stall in the red W-iv target zone and overlaps with the red W-i low, i.e., the Sept. 6 low at $11,928, then this impulse path is invalidated. The multi-month counter-trend rally has then already started.… . But, for now, this path continues to be an alternative.”

Bottom Line

The NDX is still following an ideal Fibonacci-based impulse to the downside rather well. Therefore, the preferred view remains the index is still on target for ~$9,375+/-210. A break below last Friday’s low will strongly support this case. Conversely, a break back above the Sept. 6 low ($11,928) will throw a wrench in the bear’s work, with a severe warning above $11,642. It will also tell us the anticipated multi-month bear market rally challenging the August highs is already under way. Thus, with the EWP, we have actionable price levels as triggers for entering and exiting any desired position.