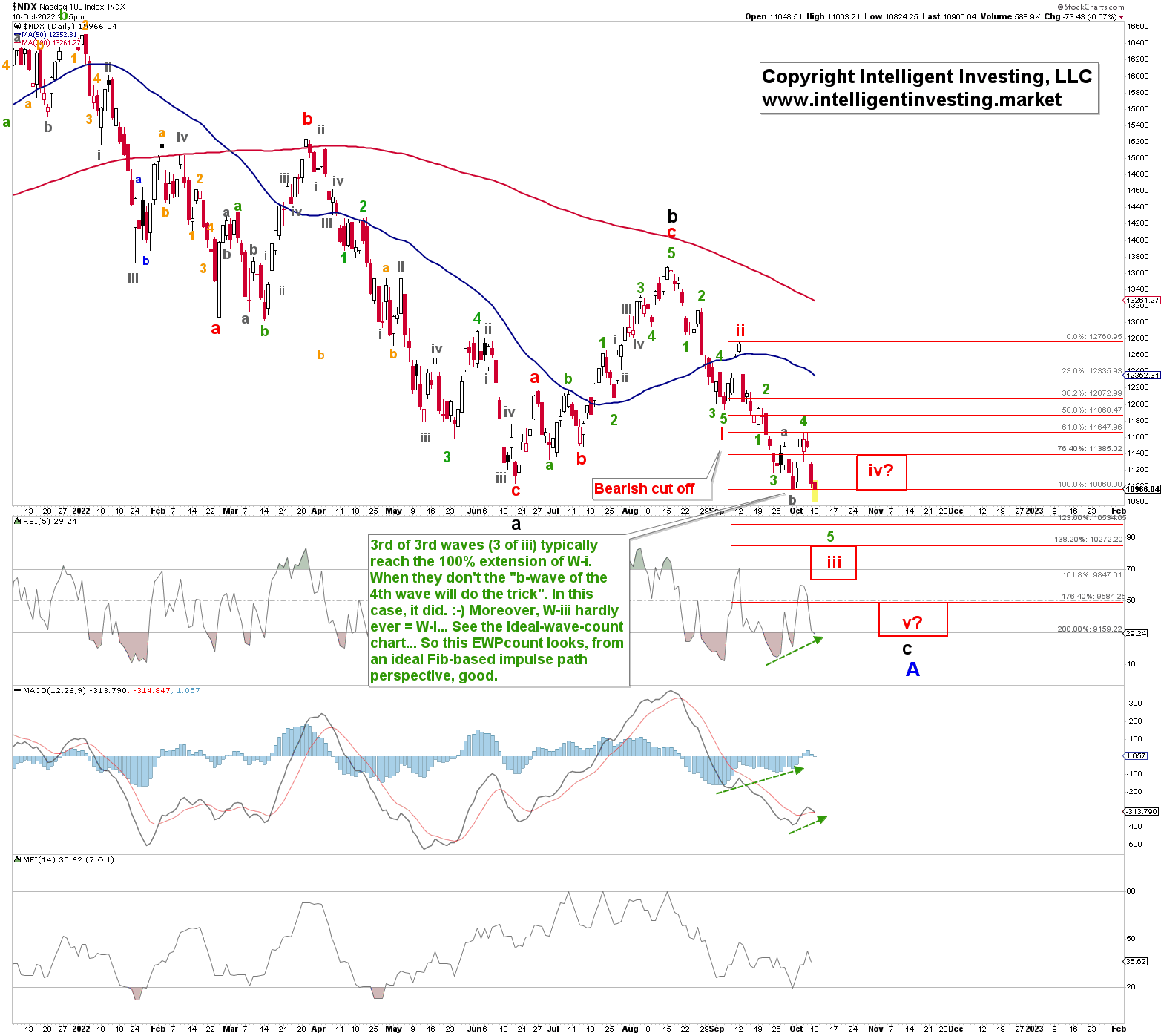

Two weeks ago, see here, I was tracking a possible impulse move down for the Nasdaq 100 (NDX) from the mid-August high (i.e., five waves lower as per the Elliott Wave Principle (EWP))

Back then, “the focus until proven otherwise” was for an ideal (green) W-3 low around $10,400+/-50, a W-4 back up to $11,150+/-50, and then a W-5 back down to ideally $10,000+/-200 to complete red (W-iii/c). The index bottomed at $10967, rallied to $11660, and traded today as low as $10825. Thus, the green path laid out back then has filled in reasonably well. See figure 1 below.

Figure 1.

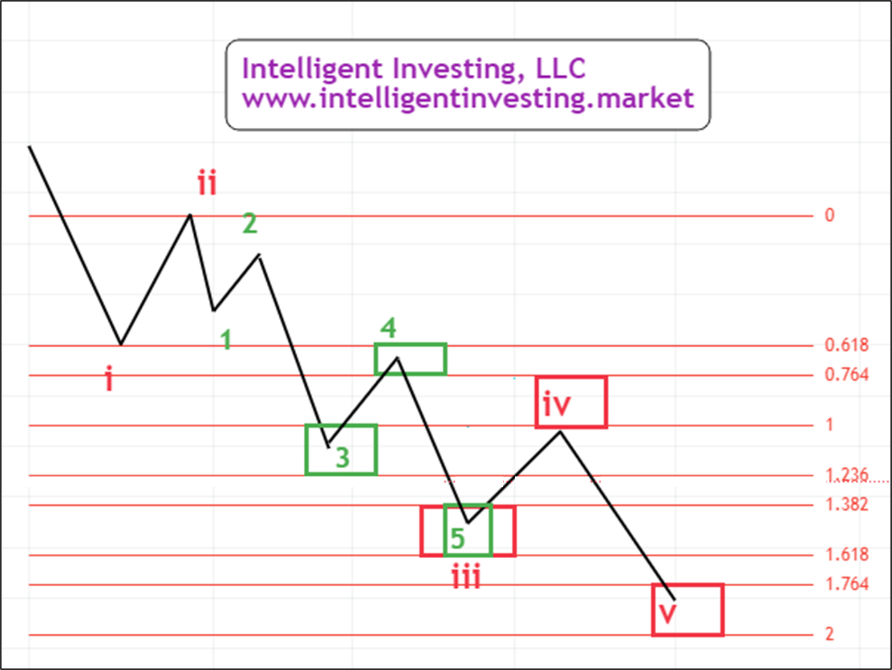

Figure 2 below shows the ideal Fibonacci-based path for an impulse (five-wave move) to the downside, which is the structure/path one applies initially to make one’s forecast: anticipate. The market will then decide how accurately it wants to fill that in for as long as “the third wave is not the shortest wave, and the fourth wave does not overlap with the first wave.”: monitor and adjust. W-3 of -iii ideally targets the 1.000 to 1.236x extension, W-4 of -iii the 0.764-0.618x Fibonacci-extension, etc.

Figure 2.

If we apply this structure to the current price action, see Figure 1, it follows that W-3 of -iii fell a little bit short but that W-b of -4 (of -iii) then reached the 100% extension (See the explanation in Figure 1). However, W-4 topped where it had to (the red 61.80% extension), and the logical conclusion is that W-5 of -iii is now underway with an ideal target zone of $9847-10272 (the 138.20-161.80%) while knowing that the markets do not always have to follow this perfect path. Ideally, the index should drop slightly lower, bounce back to the ideal red W-iv target zone ($10960-11385), and then drop one last time to the perfect red W-v target zone ($9160-9585). By then, the NDX should be ready for a multi-month counter-trend rally.

However, if the index does not stall in the red W-iv target zone and overlaps with the red W-i low, i.e., the “bearish cut-off,” then this impulse path is invalidated. The multi-month counter-trend rally has then already started, as outlined in my previous article:

“the index bottoms around $11000+/-200 … and then stages a rally back to or potentially even exceeding the August highs. It would require a break above the green W-2/b level (… $12062) to suggest this will happen. But, for now, [this] path remains an alternative… .”

Bottom Line

The NDX is still following an ideal Fibonacci-based impulse to the downside rather well and is, therefore, still on target for $9500. Only a break back above the September 6 low ($11928) will throw a wrench in the Bear’s work and tell us a multi-month Bear market rally challenging the August highs is already underway.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI