- Market breadth indicators (% of component stocks above 20-day & 50-day moving averages) have increased to above 50%.

- Short-term bullish momentum condition sighted at the retest of its 50-day moving average.

- Watch the 19,520 key short-term support ahead of a risk event; the earnings results of Alphabet and Tesla after today’s US session close.

In the past two weeks, the Nasdaq 100 CFD (a proxy of Nasdaq 100 E-Mini futures) has staged a decline of 6.2% from its all-time intraday high of 20,792 printed on 11 July to an intraday low of 19,501on last Friday, 19 July.

Also, it underperformed the value-oriented Dow Jones Industrial Average (+1.5%) and small-caps Russell 2000 (+4.7%) over the same period primarily driven by the bull steepening of the US Treasury yield curve (10-year minus 2-year).

In the lens of the technical analysis, the Nasdaq 100 CFD may have reached an inflection point for a potential bullish reversal ahead of the release of Tesla and Alphabet Q2 earnings results after the close of today, 23 July US session.

The price actions of Tesla (NASDAQ:TSLA) and Alphabet (NASDAQ:GOOGL) are likely to have a significant impact on the Nasdaq 100 because both are in the top 10 component stocks of the Nasdaq 100; ranked 7th and 8th respectively, in terms of market capitalization.

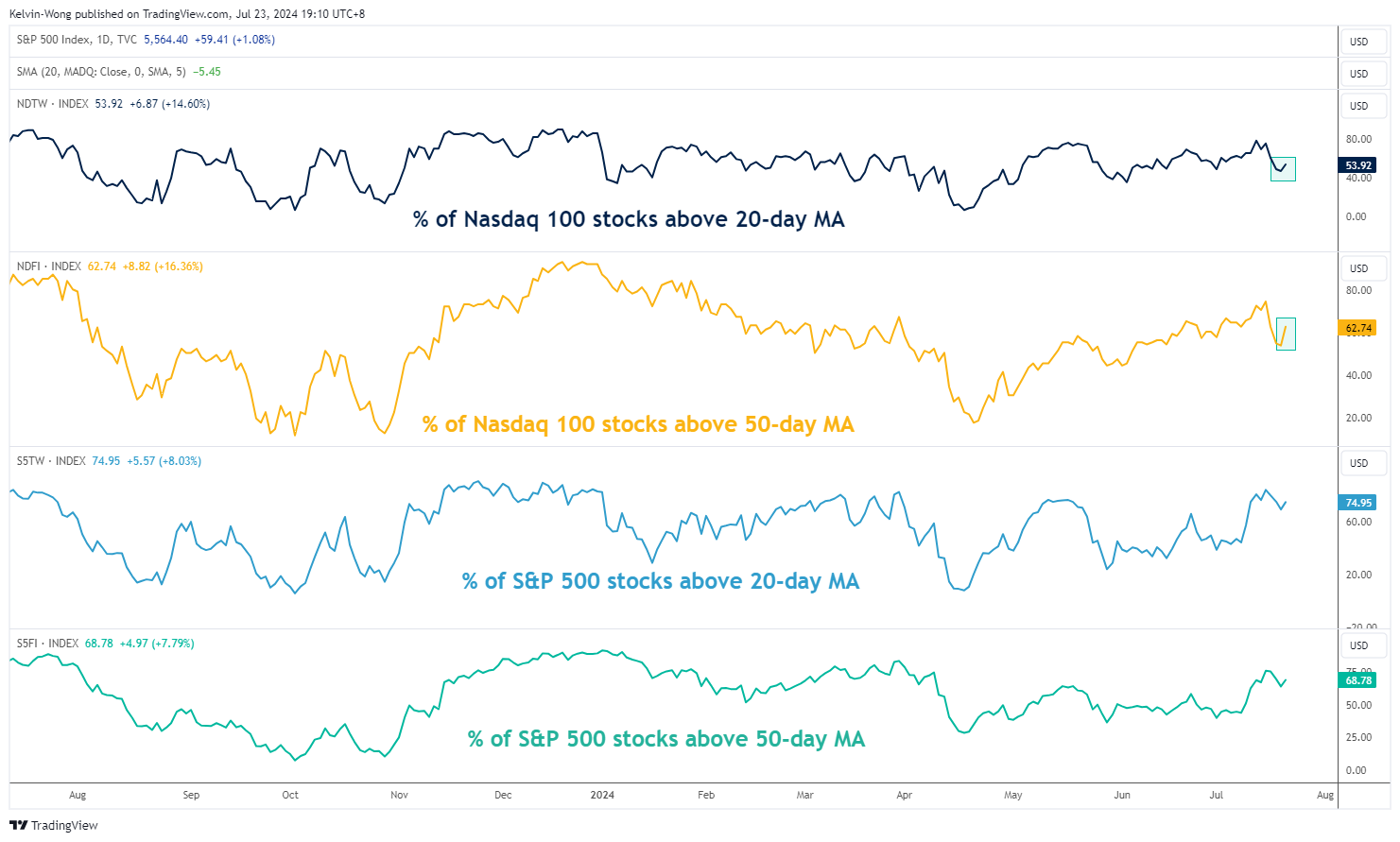

Market Breadth Has Improved

Fig 1: Market breadth indicators of Nasdaq 100 and S&P 500 as of 22 Jul 2024 (Source: Trading View)

After a recent slide to around 50% from 12 July to 19 July on the percentage of Nasdaq 100 components stocks trading above their respective 20-day and 50-day moving averages, these two market breadth indicators have managed to improve on Monday, 22 July where both hit above the 50% mark again (see Fig 1).

The percentage of Nasdaq 100 component stocks above their 20-day moving averages increased from 47% on Friday, 19 July to 54% on Monday, 22 July.

In addition, the percentage of Nasdaq 100 component stocks above their 50-day moving averages jump more significantly from 54% on Friday, 19 July to 63% on Monday, 22 July.

These current positive market breadth observations suggest the short and medium-term uptrend phases of the Nasdaq 100 remain intact.

Short-Term Bullish Momentum Condition Sighted

Fig 2: Nasdaq 100 CFD short-term trend as of 23 Jul 2024 (Source: Trading View)

After a bullish divergence condition sighted on the hourly RSI momentum indicator on Friday, 19 July, the price actions of the Nasdaq 100 CFD have a positive follow-through right at its 50-day moving average and its medium-term ascending trendline from 19 April 2023 low.

These short-term positive price actions suggest a potential bullish reversal scenario if the 19,520 pivotal support holds (see Fig 2).

The next near-term resistance zone to watch will be at 20,060/20,210 (also the 20-day moving average) and a clearance above it increases the odds of another impulsive upmove sequence to retest the current all-time high area at 20,710 before the medium-term pivotal resistance comes in at 20,900.

On the other hand, a break below 19,520 invalidates the bullish reversal scenario for a deeper multi-week corrective decline to expose to the near-term supports at 19,115 and 18,950 in the first step.