The day before the unfortunate invasion of Ukraine by Russia, when the NASDAQ 100 was trading at $13,500s, I found using the Elliott Wave Principle (EWP):

- The major wave-4 correction is close to completing its complex pattern

- The move lower is under way, and although $13,454-$13,111 would be ideal, the index has already reached low enough ($13,720) to consider a longer-term low is in place.

- A move above $15,200 would confirm the larger fifth wave to $18,000 is under way, with a severe warning for the bears above $14,700.

The index bottomed on Feb. 24 at $13,065, rallied, and then retested that low on March 14 (NDX 13,020). Now, it is back at $14,000+. Hence, my downside forecast was off by only 0.35 and 0.69%, respectively.

Although pretty close to perfect, many expect certainty and perfection in a probabilistic and imperfect world, leading to misunderstanding and frustration. That is especially true during corrections, which are invariably complex price patterns, with many overlaps, i.e., up and down moves in quick succession.

There’s not much one can do about it. One has to see the forest, not just the trees. Step away from the short-term, which is always more variable, and sit through corrections. They separate the professionals from the amateurs. In turn, this results in less short-term certainty and lower confidence forecast.

Failure to understand that is not a reflection of the EWP. As such, since as far back as June last year, my big picture view remains steadfast in that major wave-4 has likely been completed, and major-5 to NDX 18000+ is under way.

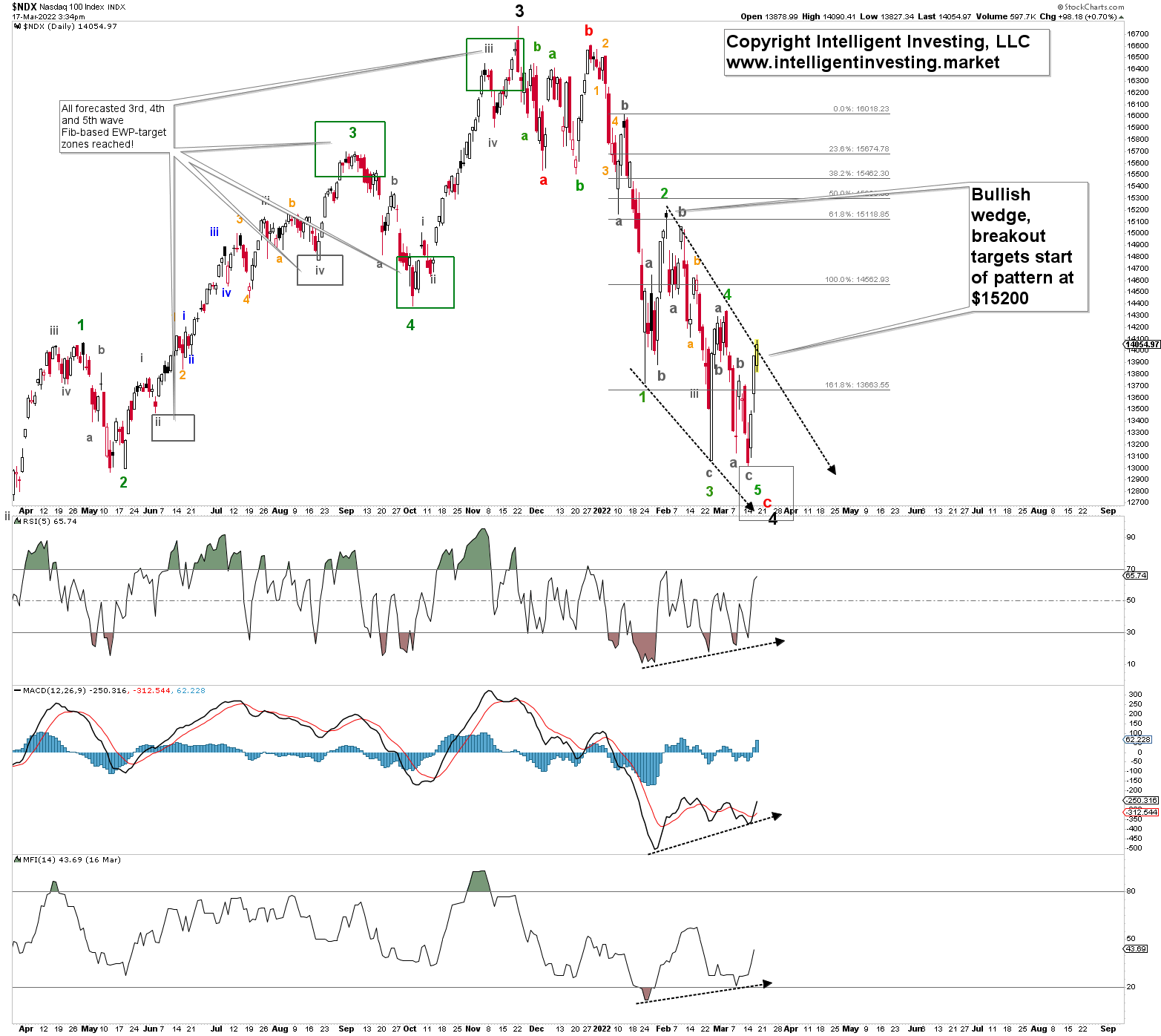

Figure 1: NASDAQ 100 daily candlestick charts with detailed EWP count and technical indicators.

I adjusted the EWP count slightly to account for the lower low on March 14 vs. Feb. 24. But this did not change the overall bigger picture. Namely, a large wedge pattern has formed, whereas all the technical indicators exhibited positive divergence.

Similar to the S&P500 (see here). All suggest the index is ready to rally back to the start of the wedge and ultimately much higher. The current three-day rally should only be part of wave-i of wave-5.

Bottom Line

Three weeks ago, I was looking for a move lower to ideally $13,454-$13,111. The NDX reached this in a two-step process (welcome to the variability of complex corrections). On Feb. 24, the index bottomed at $13,065 and three days ago at $13,020. Now, it sits at $14,000+ and breaks out from a bullish wedge pattern. This diagonal pattern targets around NDX 15,000, which should be the initial move up for the larger wave-5 to NDX 18000+. I expect a multi-day pullback (wave-ii of 5) before wave-iii of 5 gets going.

All in all, as long as the Feb. 24 low holds, which I think with high certainty it will, the index is in the initial stages of the multi-month rally to NDX 18000.