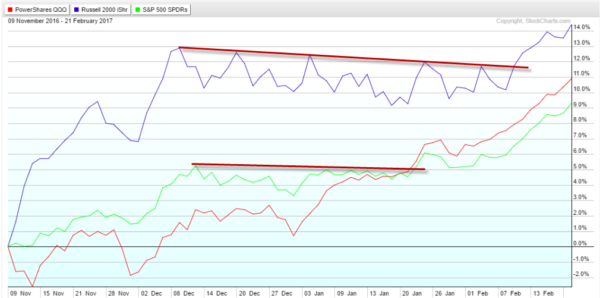

Since the election, equity markets have run hard to the upside. The biggest winner has been the Russell 2000. The IWM ETF that tracks it is up over 14% since voting day while the Nasdaq 100 (NASDAQ:QQQ) is up about 11% and the S&P 500 (NYSE:SPY) is up a little over 9%. So with a fast run like that in the markets you might think that the Russell 2000 is overheated and that you should allocate money to the other indexes as they catch up. The charts indicate that would be the wrong decision.

The chart below shows the performance of each index since election day. What is notable is the fast early move higher of the Russell, jumping 12% in a month. But then it did almost nothing until last week. That long 2-month consolidation is one reason why it deserves a closer look. You can see that the S&P 500 also had a consolidation and a recent move higher, while the Nasdaq has done nothing but steadily climb.

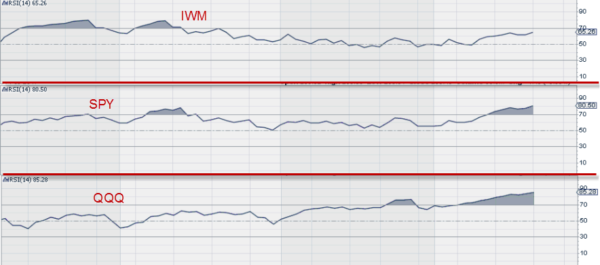

It is the second chart that should push your money into the Russell at the expense of the Nasdaq and S&P 500 right now. It shows the momentum indicator RSI, which runs on a scale from 0 to 100. It is deemed bullish over 50 (or 60 for some) and bearish under those readings. It also is labeled as overbought when the indicator gets over 70. Overbought does not mean that it is time to sell, especially at 70. But the higher the level the better the probability of a correction. With the S&P 500 over 80, it is high. It would be hard to put new money to work in it at that level. The Nasdaq is even higher though at 85. The Russell 2000 though remains in the mid 60s.

That long consolidation was able to work the momentum indicator lower to where it now has room to the upside as the price is breaking higher. This is a much better place to put money to work. As for the Nasdaq and the S&P 500, many are calling for them to pullback. And they might. But remember what happened to the Russell 2000? It did not pullback when momentum ran hot. Instead it just moved sideways. Both the Nasdaq and the S&P 500 could also work off overbought conditions by moving sideways. They could also get more overbought. The point is that this is not a signal to sell the Nasdaq and S&P 500, but to stop putting new money there for now. A better place for the short term is the Russell 2000.