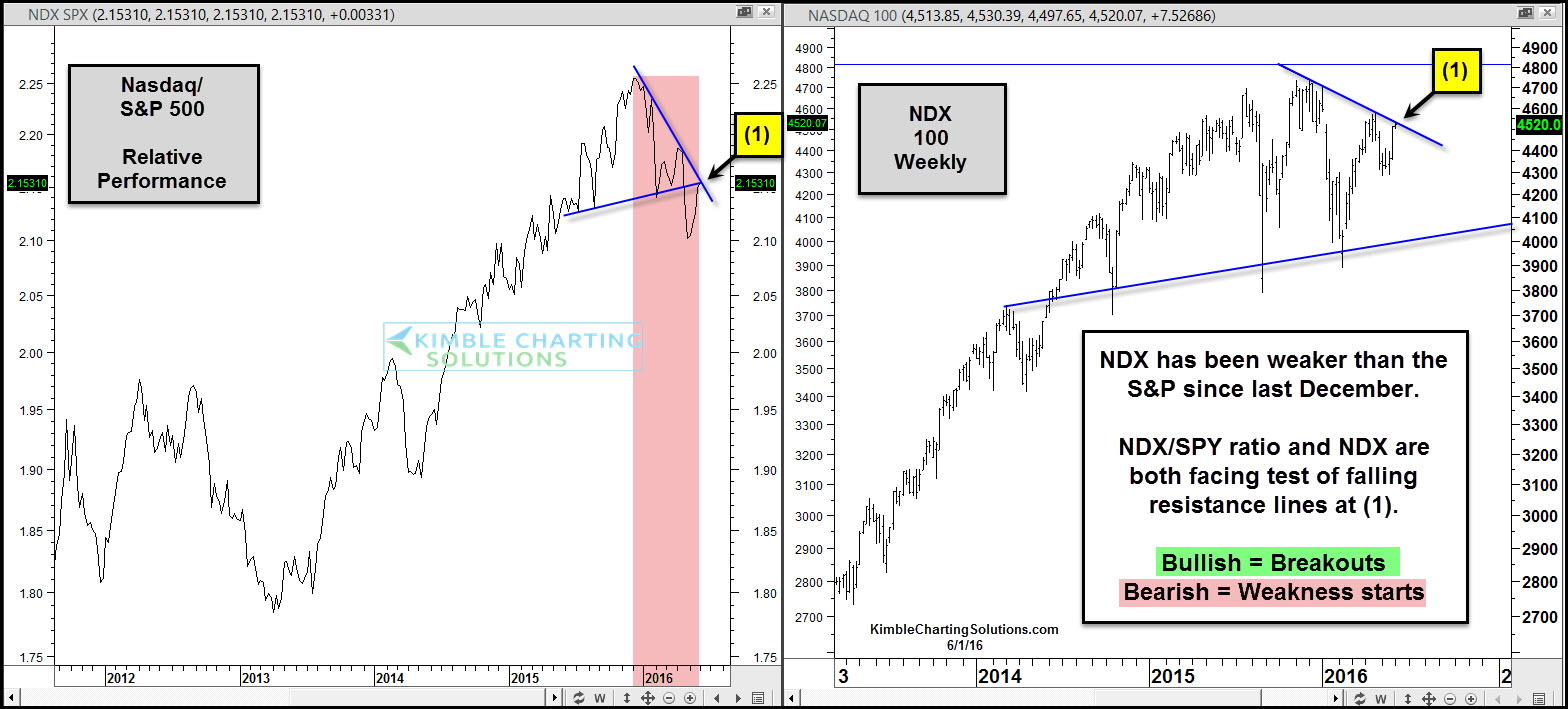

Technology stocks appear to be facing their most important resistance test of the year.

The left chart looks at the Nasdaq/S&P 500 ratio, which reflects that tech was much stronger from early 2013 through late 2015. Even though the S&P 500 doesn’t have much to brag about since December of last year, tech has even less to crow about.

The right chart looks at the Nasdaq 100 on a weekly basis. As you can see, it has created a series of lower highs since December 2015. Potentially the Nasdaq has created a head-and-shoulders topping pattern (not shown here).

Both are testing falling resistance at (1). Tech has been an upside leader since its lows back in 2002. For it to remain in a leadership role over the broad markets, buyers need to step forward and take out resistance.

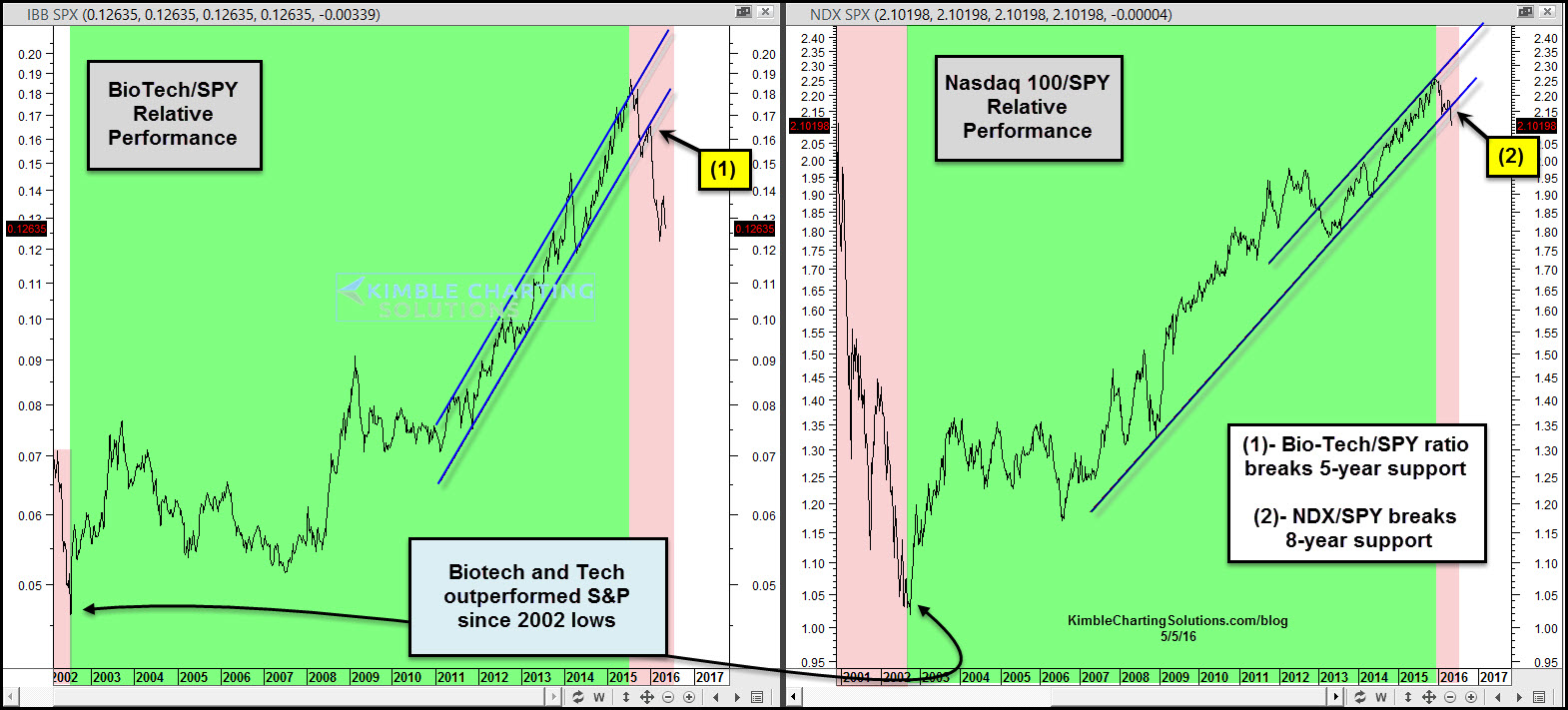

Biotech and technology have been much stronger than the broad markets for years. Both ratios have recently taken out long-term rising support lines.

The resistance tests that are in play right now in the top chart don’t appear to be your run-of-the-mill tests. Bulls do not want to see selling pressure set in at these falling resistance levels.