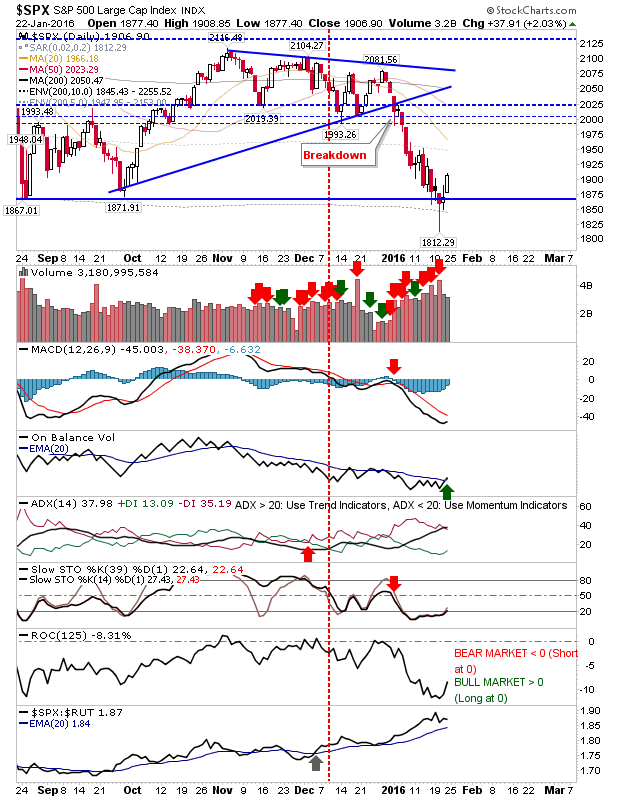

Friday did enough to confirm Wednesday's spike low as a potential Swing Low. Markets may look to rally back into the October-December trading range, but getting beyond that may prove more of a challenge. But until then, There is plenty of room to support a low volume rally.

For the S&P, there is a thick level of support from 2,000 up to 2,025. Beyond that, things quieten with the 200-day MA, then a successive level of swing highs. Technicals remain in the bears' favour, although there was a 'bull' cross in On-Balance-Volume.

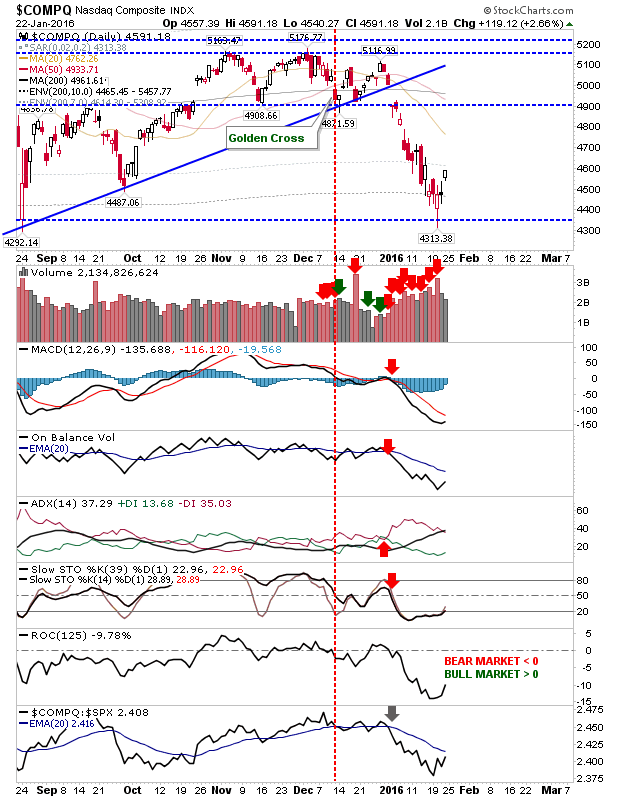

The NASDAQ is aiming for 4,900, but its first challenge is getting back to the 20-day MA.

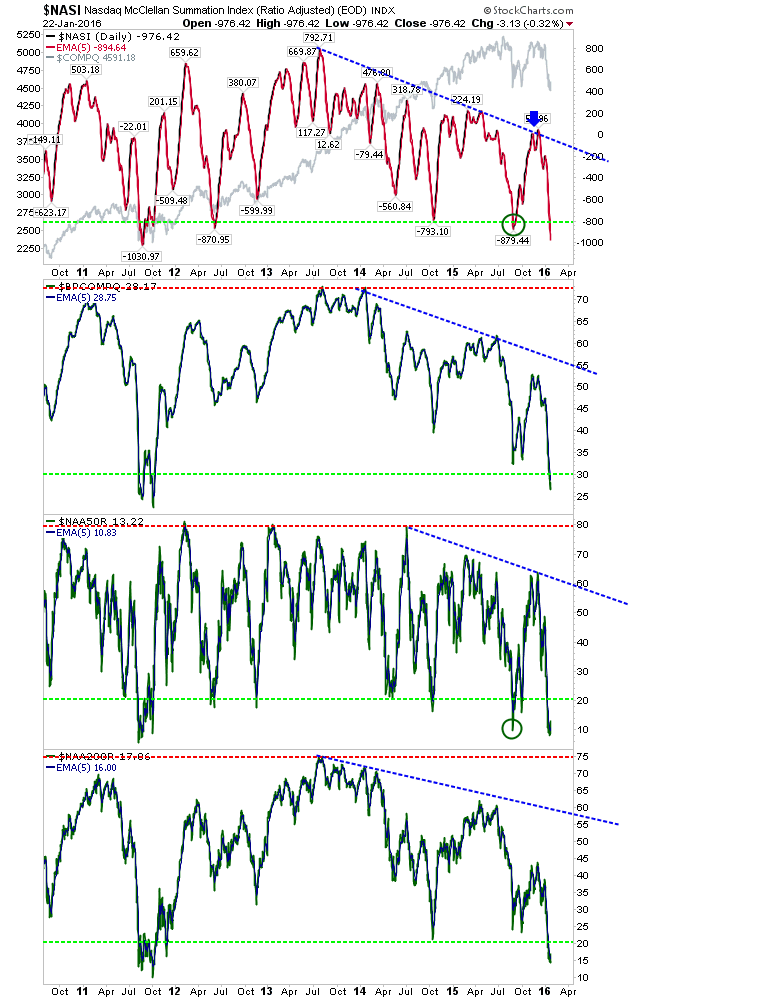

NASDAQ breadth has fallen deep into swing low territory - comparable to 2011 - across all four metrics. A trade-worthy low should be in place; weakness could be bought.

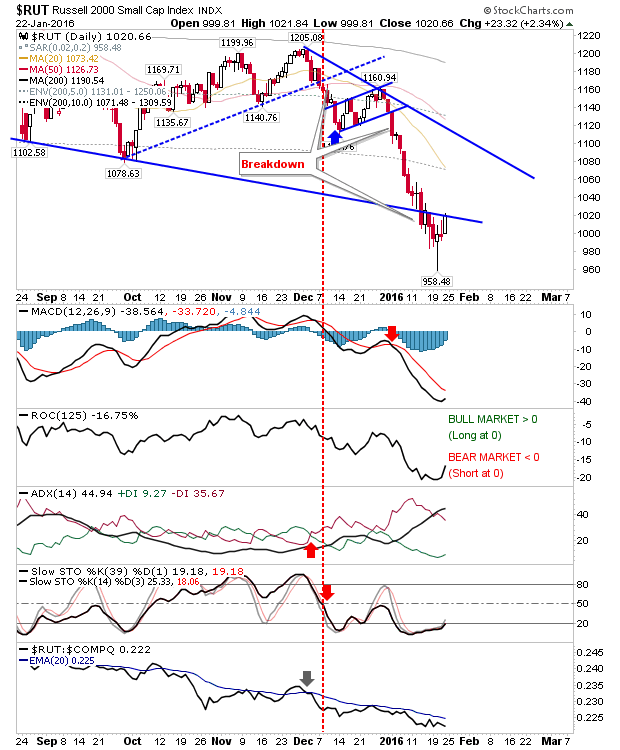

The Russell 2000, the hardest hit of the indices, could form a 'bear trap' with a higher close on Monday. The index was the first to record a 25% loss from its 2015 high to recent low. The relative performance of the index remains down, but it's getting close to a bullish cross.

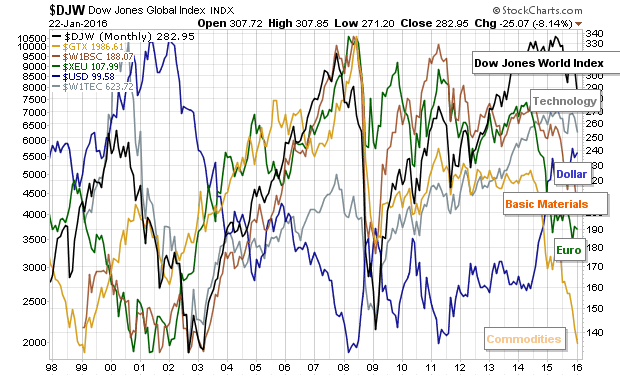

As a bonus, relative performance across different markets shows how far commodities have fallen. Historically, they look to have reached a level which could mark a bounce (1999 lows). Global stock markets (via Dow Jones Global Index (DJW)) remain closer to overbought conditions, despite the losses already experienced.

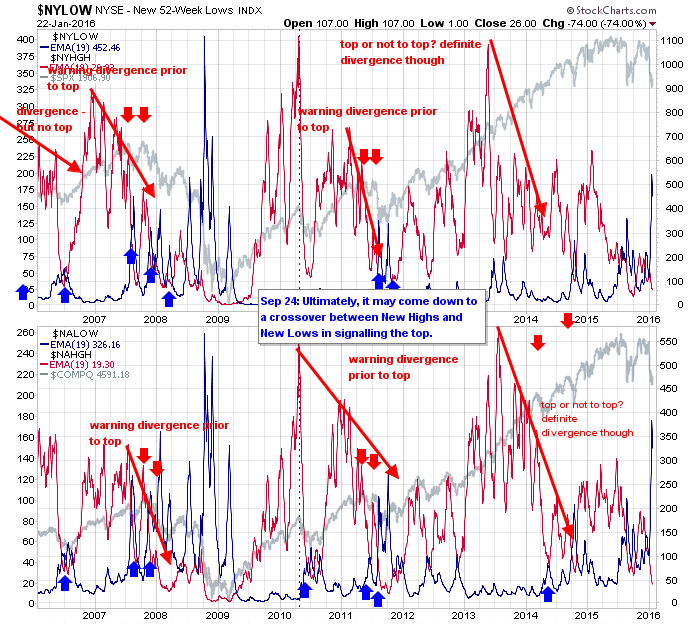

Another sign of a bottom is the spike high in the number of NYSE stocks making new 52-week lows. While further lows (and new spike highs) are possible, a decent trading low should be in place.