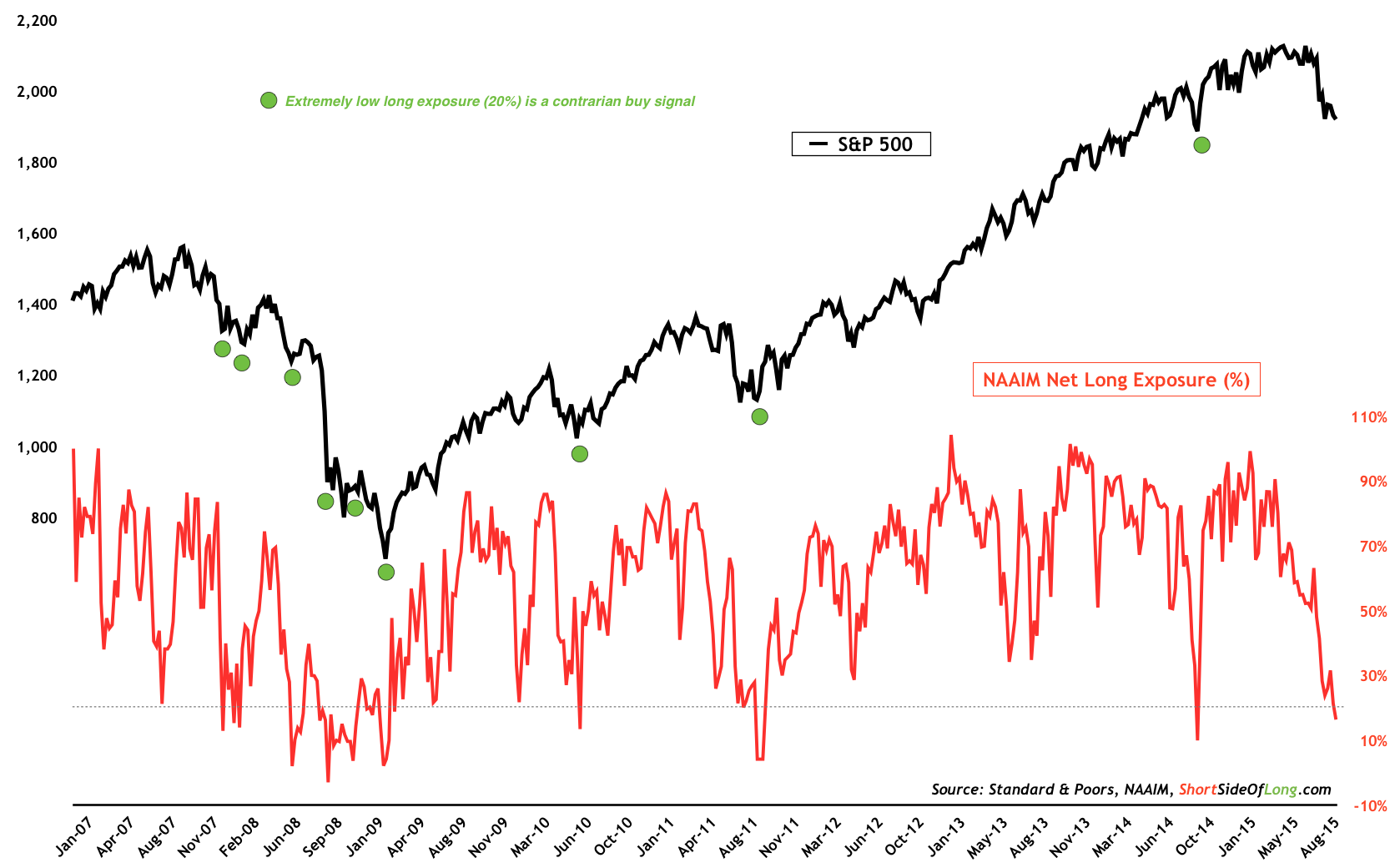

Further evidence of pessimism as fund managers cut net long exposure

Problems with VW (OTC:VLKPY and Glencore (LONDON:GLEN), poor seasonality, technical damage, slowdown in EM economies and a disappointing jobs report did not manage to knock the market down. Whenever an asset refuses to make new lows on deteriorating news and the tape rallies strongly in the opposite direction (just like Friday’s technical reversal), it is a very bullish sign. On the 1st of October, we were discussing the possibility of a double bottom, which now seems to have an above average chance of completely developing.

We have already discussed how breadth became washed out and sentiment dropped to extremely low levels. New data showed that yet another indicator registered an important buy signal late last week: National Association of Active Investment Managers. As we can see in the chart above, net long exposure by fund managers has now dropped below 20% for only the second time in the last four years. Only other time was October 2014, which also marked an intermediate bottom.

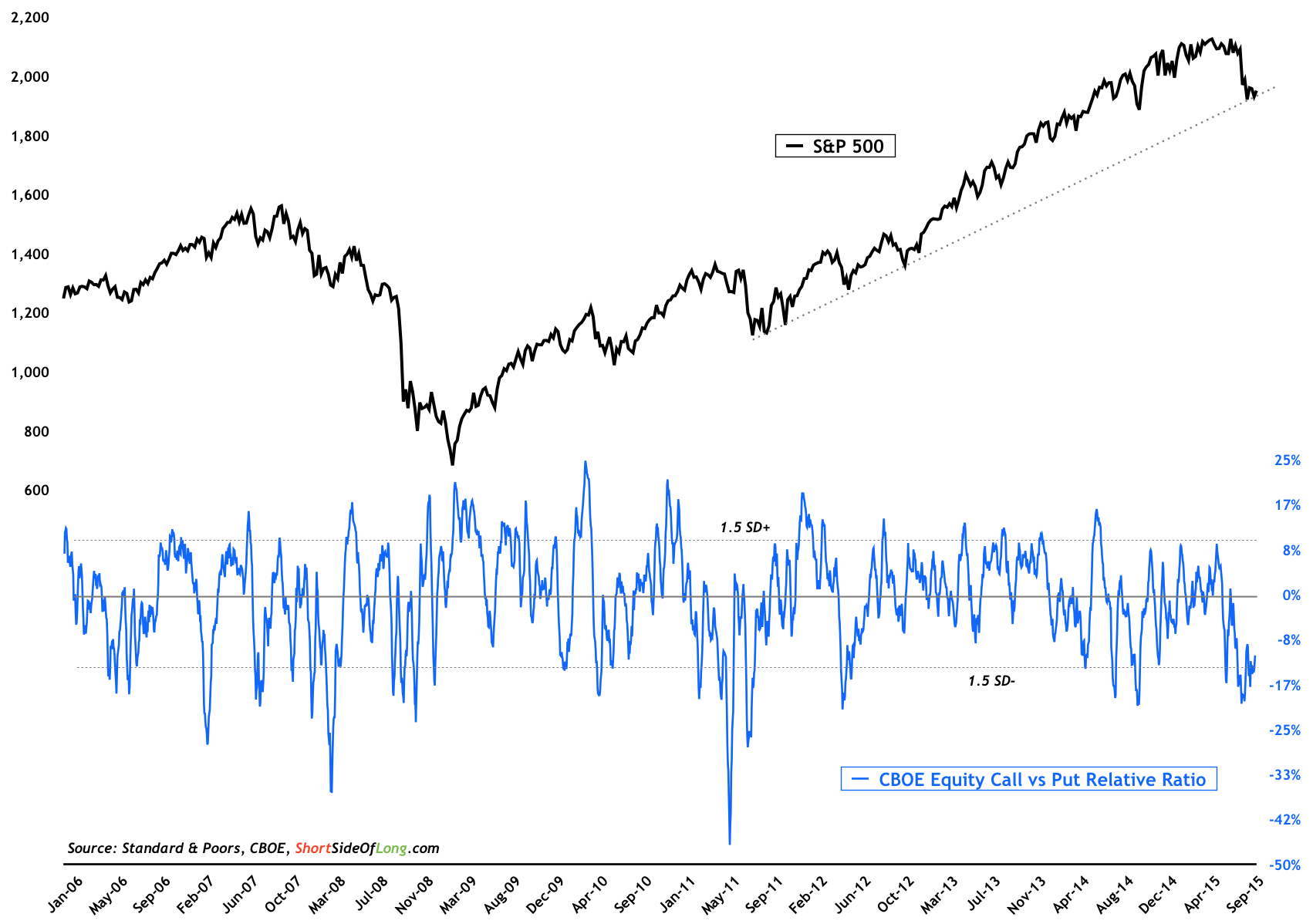

Traders have been busy purchasing plethora of put options recently

Furthermore, by late August, we saw how options trades pushed the VIX to the second highest daily reading in almost three decades, prompting us to call a capitulation bottom. These same trades have continued to load up on put options throughout majority of September, with the hope that the index will break towards lower lows. Assuming that the S&P 500’s double bottom and Friday’s outside reversal (biggest in 4 years) holds, plethora of put purchases could end up being a strong contrary signal.

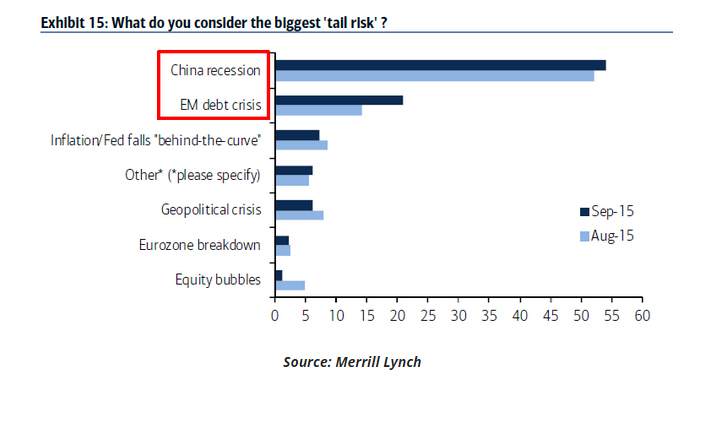

Global managers remain most worried about Chinese and EM growth

Source: Short Side of Long

Finally, global fund managers are extremely worried and fearful of the Chinese economic slowdown and the potential for a full-blown emerging markets debt crisis. I feel that whenever a certain “investment mantra” reaches a boiling point—as in being on the front page of every newspaper for several months, the central talking point of almost ever fund manager interview and most popular blogging theme across the internet—it's most likely overdone, with a reversal in the cards. The fact is, the MSCI EM Index has refused to make lower lows despite continual bearishness ever since the emotional wash out occurred during the Black Monday of 25th of August.