Regular readers might remember our timely calls on the stock, coming into the last week of August: here, here and here.

In all three of these posts we pretty much noted a similar theme: a major S&P 500 low on 25th of August in real time, just as investors' emotions clouded their intelligence and common sense. Our outlook was for a strong and sharp rebound, followed by a retest of the crash lows sometime in September and/or October:

“Short Side of Long is calling a bottom on this stock market correction. We want to make it perfectly clear that there is a very good probability that one should expect a turbulent bottoming process with more selling. A retest of the lows will most likely be in the cards, as V trough bottoms are very rare. However, the panic has already happened as Volatility Index (VIX) jumped to almost 54 points. This was the highest reading since the Global Financial Crisis and second highest reading in almost three decades (’08 was the highest).

We want to repeat ourselves, there is real panic out there right now and contrarians should be ready to act on the buy side. Seasonality for equity markets is usually weak into September and October and we here at Short Side of Long expect either September or October to mark a major low this year. We saw similar outcomes in October 1987, October 1990, October 1998, September 2001, October 2002, October 2008 and October 2011.”

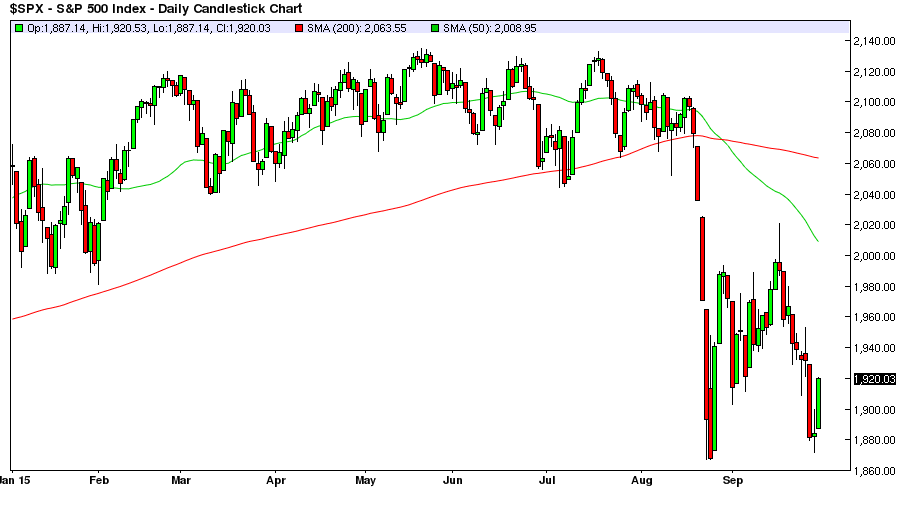

S&P 500 attempts to bottom with a potentially successful retest of lows

Source: Bar Chart

We are now potentially seeing a retest of those panic lows from late August, as the S&P 500 (via SPDR S&P 500 (NYSE:SPY)) came within a few points of the actual bottom. It is still hard to say whether the current bounce will hold, or if more selling will come in October, with lows being slightly undercut. However, one thing is for sure – markets are very much oversold and sentiment remains bearish.

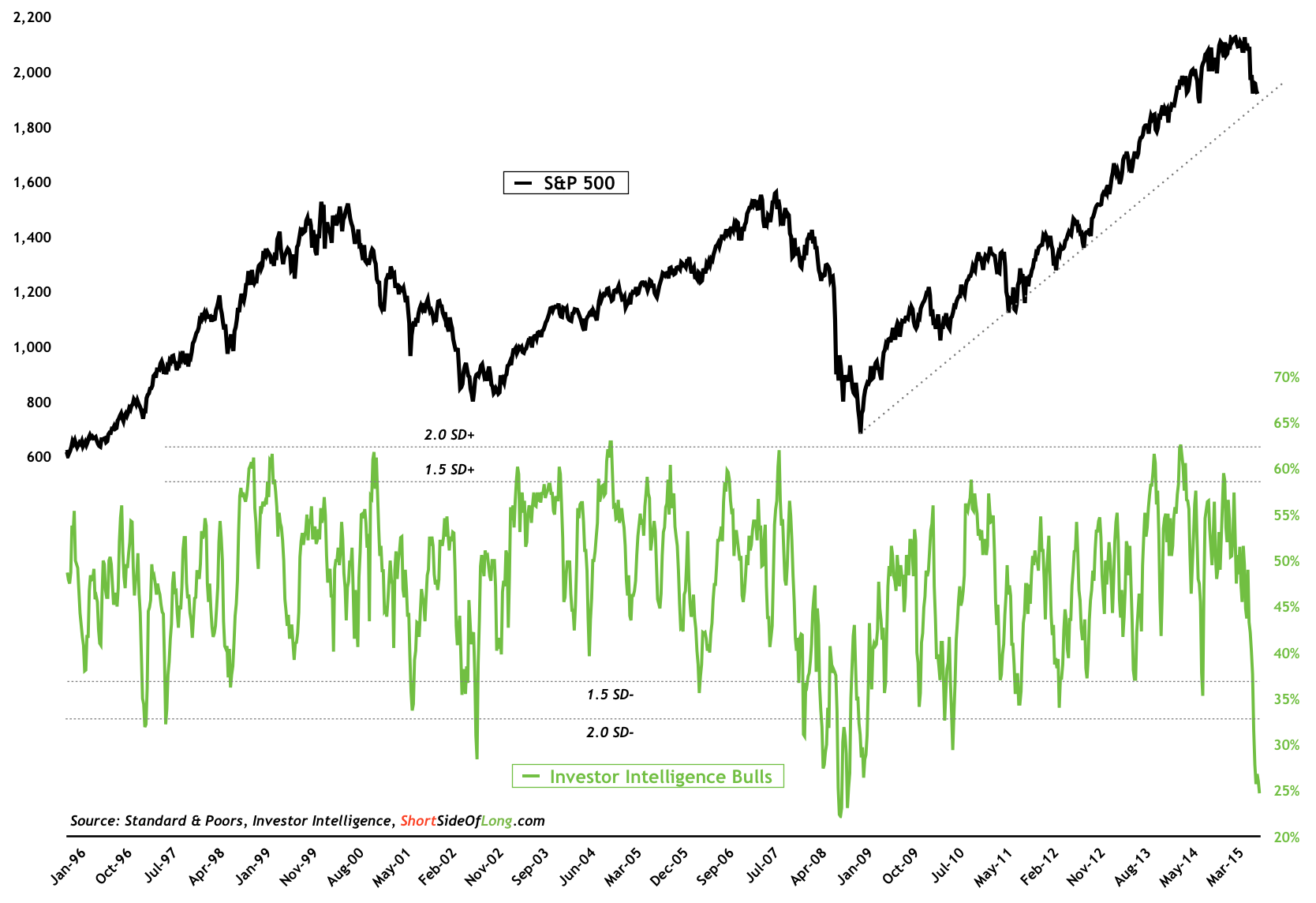

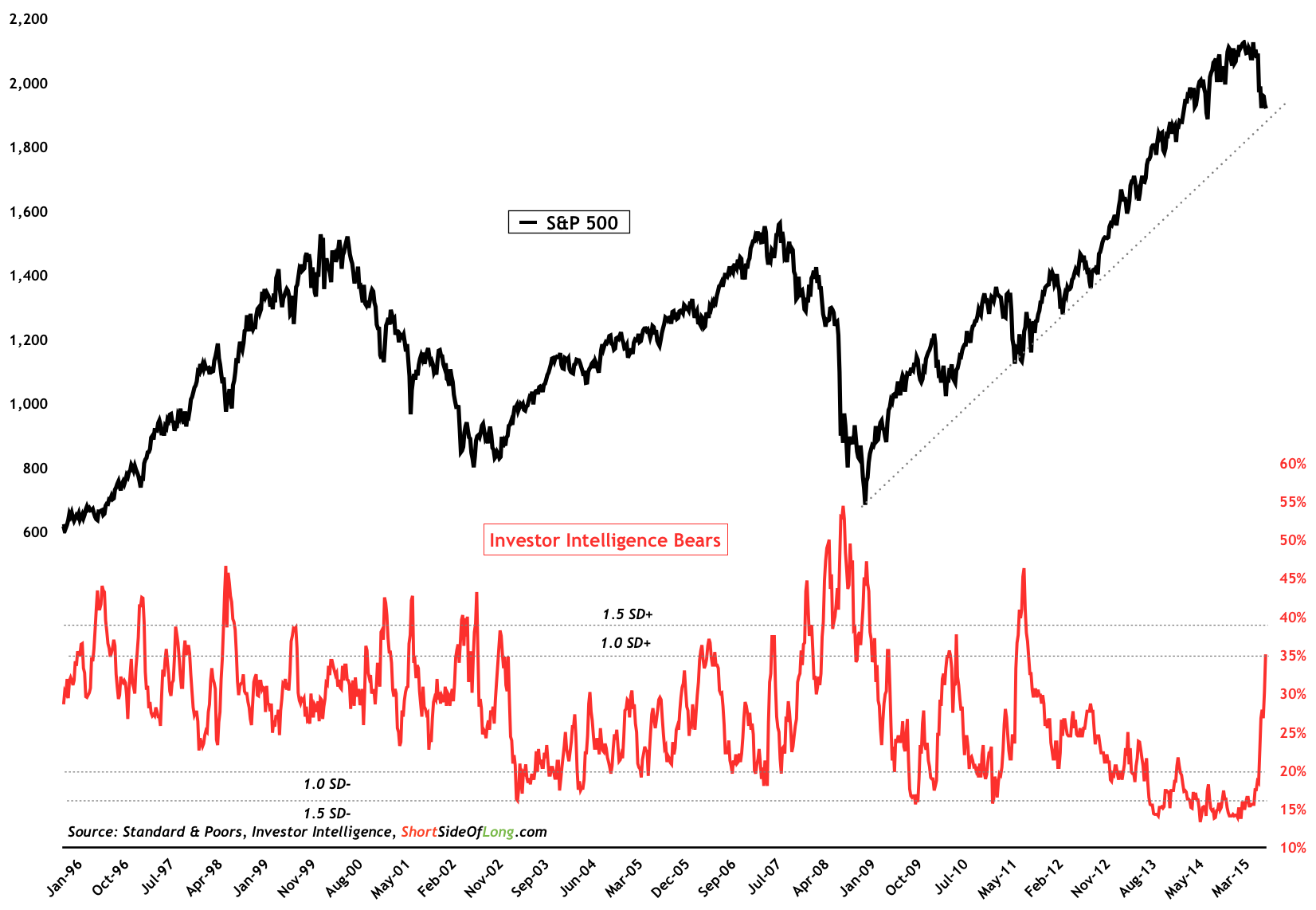

In the last post we noted two breadth indicators which signal that a major washout occurred in late August. Moreover, today’s indicator gives us an update on the sentiment via the Investor Intelligence Survey. Professional advisors and newsletter editors are definitely running for the hills. Despite the fact that price never took out the 25th of August low, bullish sentiment has dropped to some of the lowest levels in decades, while bearish sentiment continues to rise rapidly.

Despite no new lows in the index, bearish sentiment continues to increase

Source: Short Side of Long

So have we been buying and if so, what did we buy?

Yes, we have been very active on the bullish side since 25th of August, especially towards Emerging Markets (iShares MSCI Emerging Markets (NYSE:EEM)). Mind you, regular readers should remember we were correctly shorting the MSCI Emerging Markets Index for months before we called the bottom.

And yes, we are just about the only bulls on EM and Chinese stocks right now, especially Chinese banks (China Construction Bank Corp (HK:0939), Bank Of China SS (HK:3988), ICBC (HK:1398), Agricultural Bank Of China (HK:1288)), which remarkably hold a dividend yield that is higher then their P/E ratio. I’ll tell you something very important, this type of a valuation s extremely rare and you might not see it again in your lifetime. Either earnings will collapse and with it dividends will be cut, or investors have totally over-reacted.