A new round of vaccine news has returned to the markets the rotation of energy, financial and defense stocks. As a result, Dow Jones was the growth leader among the three leading Wall Street indices, adding 1.6%, against 1.2% in the S&P 500 and 0.8% in the Nasdaq 100.

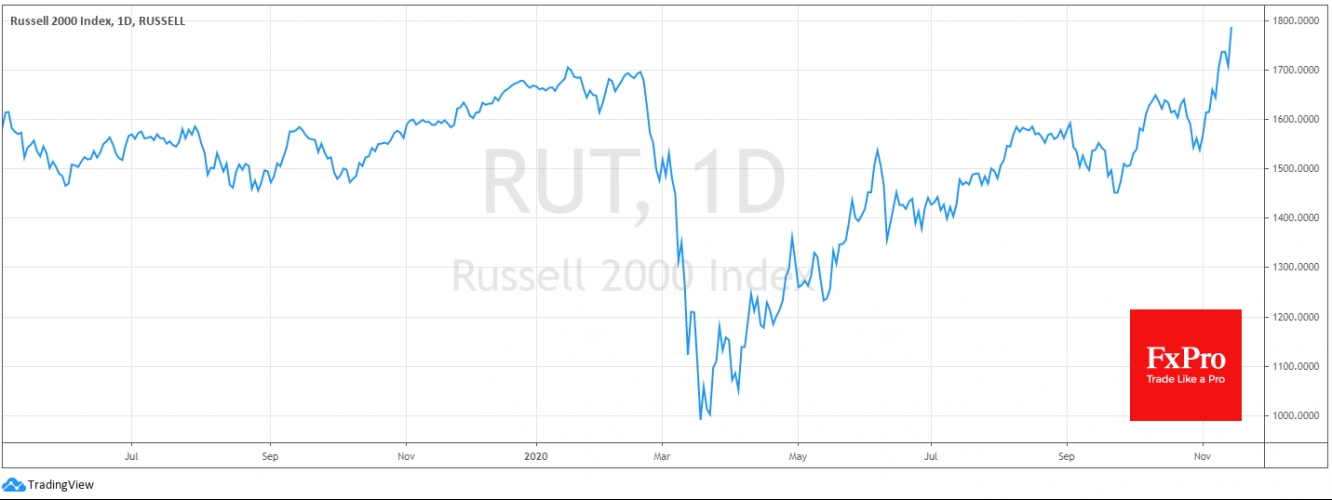

But it is also interesting that the small-cap stock indices on Monday soared even stronger with the S&P600 Smallcap having added 2.9% and Russell2000 jumped 2.4%, adding to more than 6% growth last week and rewriting its all-time highs.

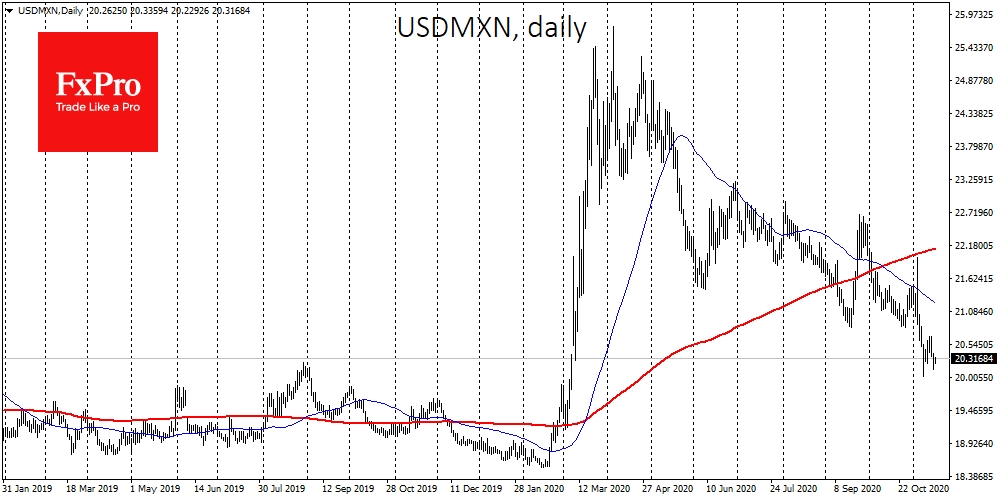

This fundamental change in index dynamics promises to have an impact on currency markets as well. Investor interest in commodity assets has been pushed up by the Mexican peso, the South African rand and the Russian rouble. All have added over 5% to the US dollar so far this month. As oil is undergoing an important test near September highs of around $42 for WTI, ZAR and MXN have already been at their peaks since early March. This is due to the expectation of a recovery in export demand, which is coupled with a tighter monetary policy. For example, USD/MXN at current levels is much closer to returning to the trading range the pair was in before the pandemic (18.50-20.20).

The Chinese yuan is now a correspondent to small-cap stocks, as business in China is based on millions of small companies servicing large factories and corporations. At present, USD/CNH has been developing its decline since May, falling into the 6.56 area, where it last traded at the beginning of the 2018 trade wars.

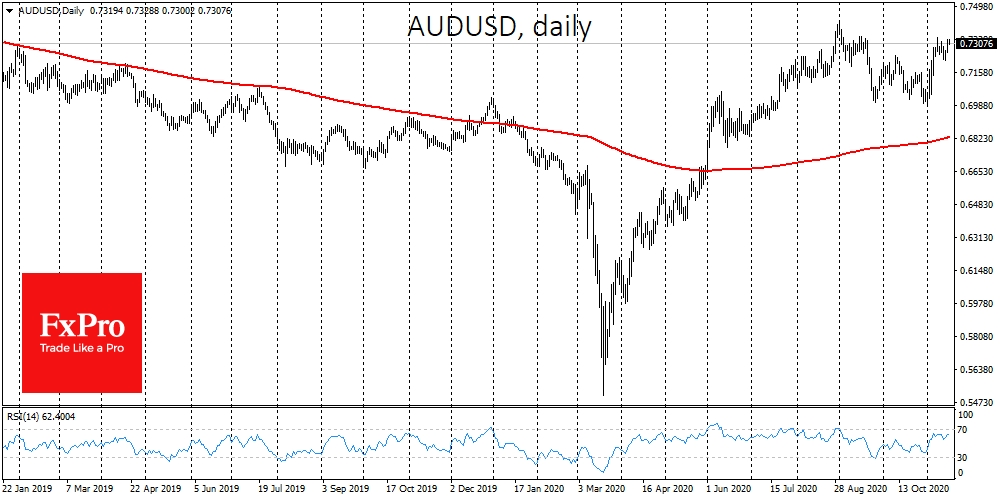

The development of interest in commodity assets, particularly metals, is capable of pushing AUD/USD up. However, this is an example of how monetary policy and trade disputes can negatively affect the global trend. The recent interest rate cuts and the expansion of RBA's QE programme, as well as the imposition of import restrictions from Australia to China, have hampered currency growth. Despite these obstacles, AUD/USD has grown by 4.4%, re-testing the area of two-year highs.

The recovery in sentiment around the banking sector may also be pulling the British pound up. GBP/USD is now trying to gain ground above 1.3200, which is very close to 1.3300, the upper limit of the trading range of the last two years.

The dynamics of cyclical stocks, small capitalization companies and several currencies note that markets are now on the verge of entering a new phase, and in some places have already crossed this line. The stock and currency markets can be representative of a return to normality.

Such a breakthrough is likely to be the first reliable signal that life is on its way back to normal, even if it is not apparent right now. Failure to reach a new level could be a signal for another sell-off in the stock and currency markets in the coming weeks.

The FxPro Analyst Team