Over faster than it began, all global markets have returned to the status quo of before the European Central Bank (ECB) and the People’s Bank of China (PBoC).

The questions that lingers is whether further central bank interventions in the next two weeks will have the same effect as what was seen after the right things were said by the ECB.

The Bank of Japan (BoJ) is likely to have a large effect on Asian trade, however, Japanese investors tend to invest back into their own nation. This leaves everything to the Fed on Thursday morning with hope that there are no moves in rates until 2016.

Sugar hits are still the more likely scenario. But all the same, the bigger question is, has central bank monetary policy run its course? The positive effects are becoming smaller and the risks are ever-present, if not growing.

GDP growth predictions from the International Monetary Fund (IMF) through to the World Bank are for global growth to remain well below average. Most expect large disruptions in emerging markets as their growth rates slow.

This week’s central bank movements are likely to be championed by markets in the interim, however, are we seeing signs that markets and economies are beginning to question its use?

What’s catching my attention

Oil fell to 2.2% overnight to a two-month low. WTI is sub-$43 a barrel and Brent is sub-US$47 a barrel. CAD and NOK were promptly smashed, putting OPEC under even more pressure. Since the Saudis announced it wants to restore prices to ‘more normalised levels’ the oil price has been in free-fall – which will give first?

Apple (O:AAPL) reported another incredible set of numbers this morning, with China growth being key to the numbers. A side fact from the number from AAPL – it reported cash on balance sheet was US$205.7 billion (approximately A$285.03 billion), which means AAPL’s cash on hand is more than the total market capitalisations of CBA, WBC and ANZ combined.

Australian bank reporting season kicks off today, with NAB reporting full year numbers. Here’s my take on what to expect.

The Banks – a preview of the FY15 numbers

The top down view

In the past year, several major events have taken place in the Australian economic landscape as well as the international landscape that should be taken into consideration when assessing the banks.

· Australian house prices have increased 10.2% year-on-year and Sydney has increased 21.5% over the same period

· The Reserve Bank of Australia (RBA) has cut interest rates twice for a 50 basis point decline in the cash rate

· Australian consumer confidence has risen 6.5% over the past year

· Australian business confidence is up three points over the past year

· Australian business conditions have added two points over the year

· Brent oil has fallen 41.7% since 31 October 2014

· Iron ore has fallen 28.9% over the same period

· Copper has lost 20.6% since 31 October 2014

· Australia’s terms of trade have touched a record deficit

· Employment has remained at GFC highs

The bottom up view

· Bad and doubtful debts (BDD) are still at the bottom of the cycle on the housing side. With 70% of bank loan books skewed to dwelling investments, BDDs are unlikely to shift dramatically this season

· However, corporate BDD is expected to see pressure as mining and mining services expanded to energy in 2015. If there is an uptick in BDD, corporate lending will be the likely sector

· Margins – the positive retail deposit taking mix is coming to an end. The cash rate cuts are creating stickiness, with 2% seen as an inflection point on real returns versus funding needs

· Capital – dividend reinvestment plans are unlikely to be affected, having seen $20 billion in capital raising in 2015. CET should be at the highest levels in recent memory

· Loan growth in second half should have remained positive, however market conditions are more likely to impact loan growth in 1H2016

· Institutional banking (IB) and wealth – patchy conditions in IB is likely to drag on earnings, wealth ‘trading’ conditions were positive, while wealth ‘management’ conditions were slightly negative

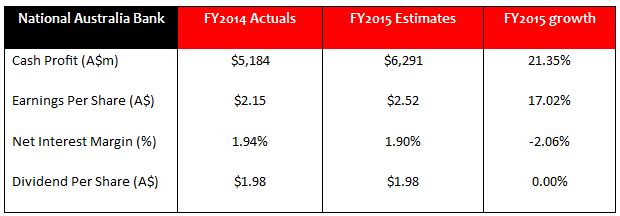

National Australia Bank (NAB) – Wednesday 28 October

Numbers that matter:

NAB specific points:

· Business banking growth is likely to ramp up, and may come at the expense of margins

· UK exit – likely to report full explanation of Clydesdale spinout. The Great Western experience suggests an IPO of the same vein will be completed by year end

· Capital – should be well ahead of peers and ASIC regulations. Clydesdale exit will only enhance this further

· Retail lending – has it reached its targeted 15%? Growth plans into 2016 should be noted

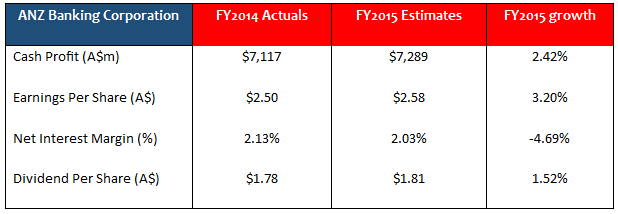

Australian and New Zealand Banking Corporation (ANZ) – Thursday 29 October

ANZ specific points:

Asian outlook – asset quality will be questioned here having seen a ‘tweak’ to its China exposure and seen a slide in emerging markets in the second half. Downside risk is increasing

Asset quality – ANZ may see a slight tick up in BDD reflecting the Asian provisions, and a tick up in corporate provisions

Margins – slight tick down in deposit mix

Strong capital position – will increase with Asian JV divestments

Westpac Banking Corporation (WBC) – Monday 2 November

Numbers that matter:

*Westpac pre-release unaudited numbers on 16 October, variance will be minimal

WBC specific points:

Costs –been increasing consistently, with IB and senior management staffing costs being the biggest culprits

Margins – deposit mix and further explanation on interest rate rises will be the impactor on NIM

Loan growth – pre-announced strong 7.7% loan growth, however, will it see increased customer churn from its loan increases?

Asset quality – highest exposure to residential lending. Quality should be benign, however it has risk if the residential market cycle moves

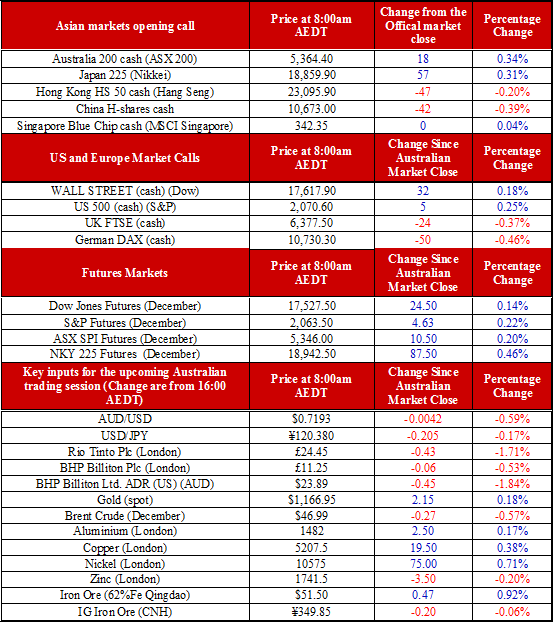

The S&P/ASX 200 is pointing higher by 15 points to 5361.