The last couple of days have been mixed. We got the last-chance-saloon bounce that markets needed if not the entire move from June lows was to retrace, but the volume for some of the indices wasn't exactly crying out in buyer demand.

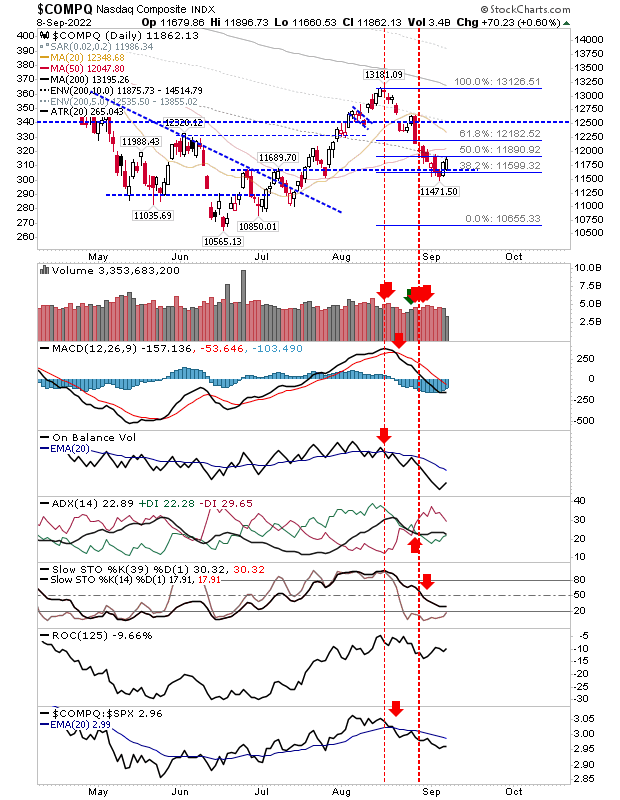

Starting with the Nasdaq, there really was very little buying volume yesterday as the index gained less than 1%. We have a 50-day MA overhead which didn't offer a whole lot of support when it was tested last week, but it may be more troublesome as resistance.

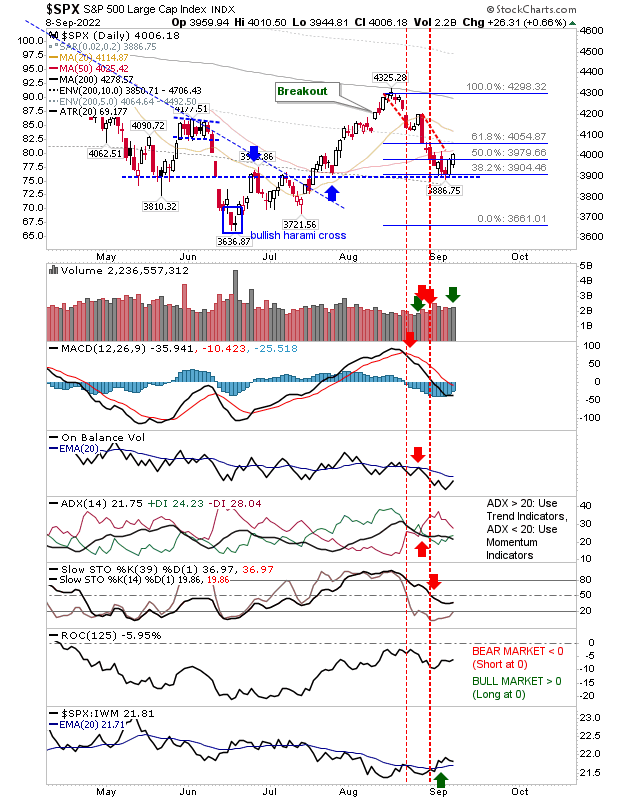

The S&P was able to register an accumulation day, but it too will have to contend with overhead 50-day MA resistance. Since the sell off, the index has adopted a position as lead index in the trio of the Nasdaq, Russell 2000 and S&P. So, bulls can look to this index for buying opportunities.

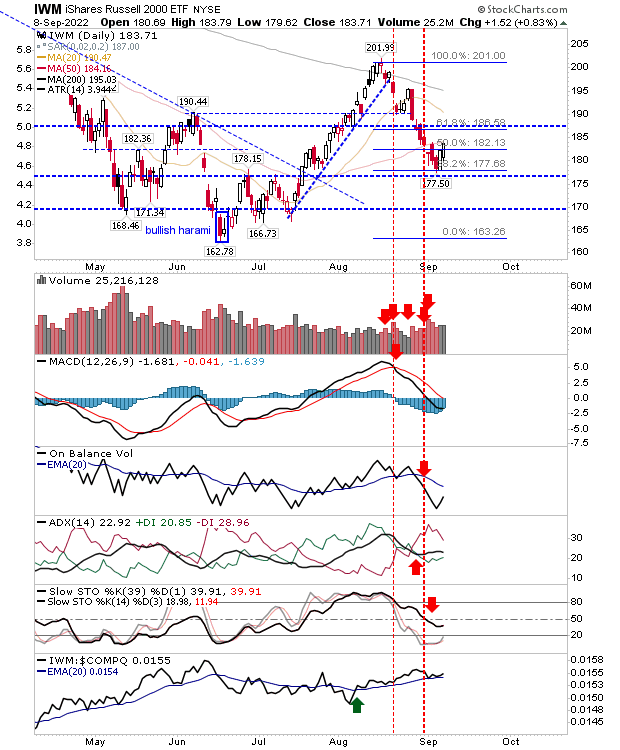

The Russell 2000 had the biggest percentage gain on the day yesterday, but is no longer the lead index (although it's outperforming the Nasdaq). As with the previous indices, its next challenge is to get back above its 50-day MA.

All indices sit in a conundrum. Momentum for the three indices is below the bullish midline but still a long way from an oversold state. Other technicals are bearish and not looking like they will be bullish anytime soon. There are plenty of overhead price resistance levels - any of which could stall what's developing over the last couple of days. While the conditions are tricky for traders, this is another good opportunity to buy/add if you are investor and have a time frame of 5 years - because all of the above is just noise in the larger scheme of things.