There wasn't much room for markets to gain without driving breakouts, so instead, indexes drifted lower without causing too much damage.

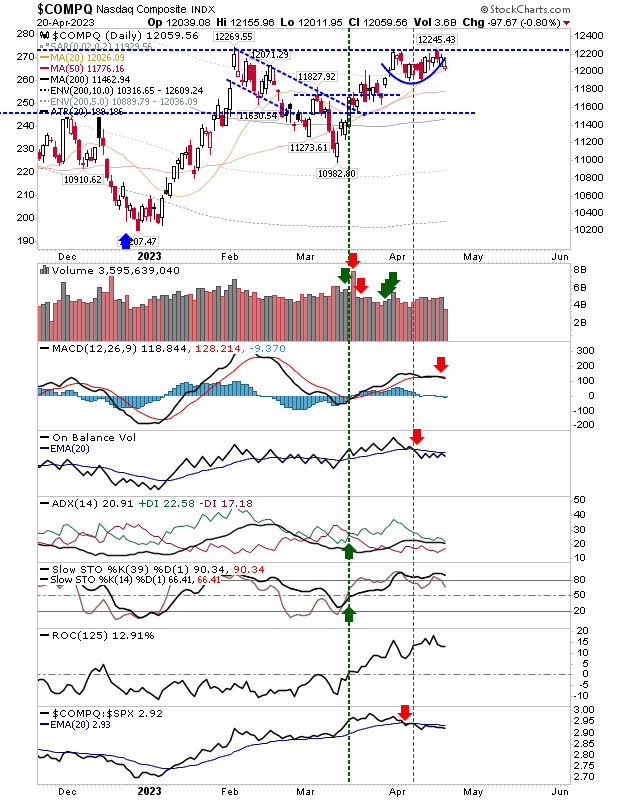

The Nasdaq retained 20-day MA support on lighter volume selling. While losses were light, there was enough selling to generate a 'sell' trigger in On-Balance-Volume.

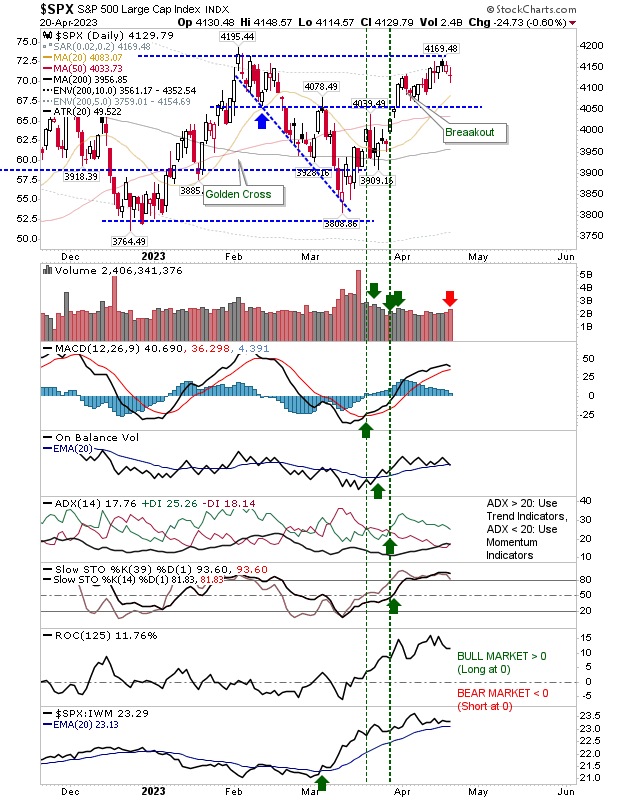

The S&P 500 had been moving higher in a relatively narrow band. Today's loss ended with a neutral doji on higher volume selling. Although technicals are net positive, the index outperforms Russell 2000.

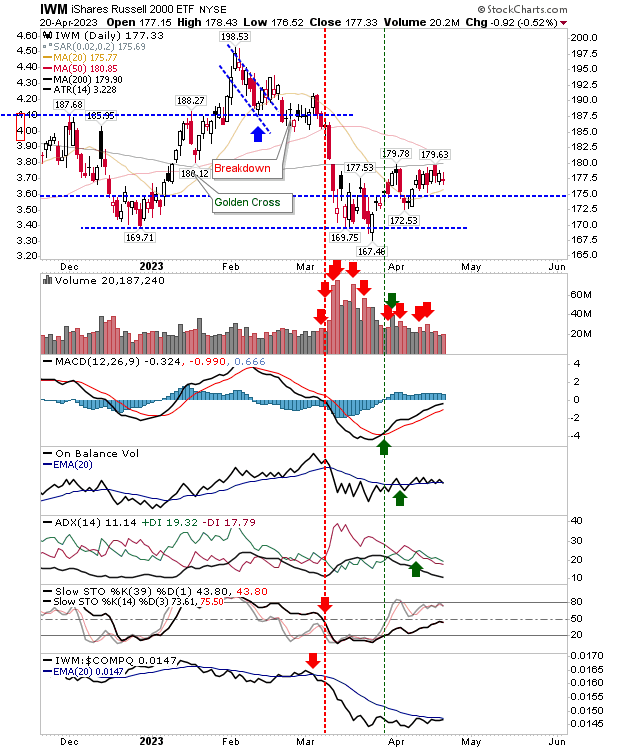

The Russell 2000 had the quietest day of the indexes. Today's doji wasn't significant selling, and action has been concentrated between 20-day and 200-day MAs. Stochastics are on the bearish side of the mid-line, although other technicals are positive.

With indexes near key resistance, it's hard to see markets post gains without marking a significant breakout, so the easy option is for markets to drift sideways.

Until there is a concerted effort, event trigger, or a catalyst of some form to drive a continuation of the rally, I suspect we will see more days like today. Sell in May and go away may be the summer's slogan.