Last week’s better-than-expected CPI and PPI releases have been sufficient to lift the indices, moving some out of their consolidation pattern. Both data sets consider inflation, with the CPI measuring the pace at which inflation is rising. CPI in July came in at 8.5% against 9.1% for June. It is this slowing that has convinced the market that inflation may have peaked.

The Fed may not be required to raise rates quite so aggressively to avoid a recession. We shall see!

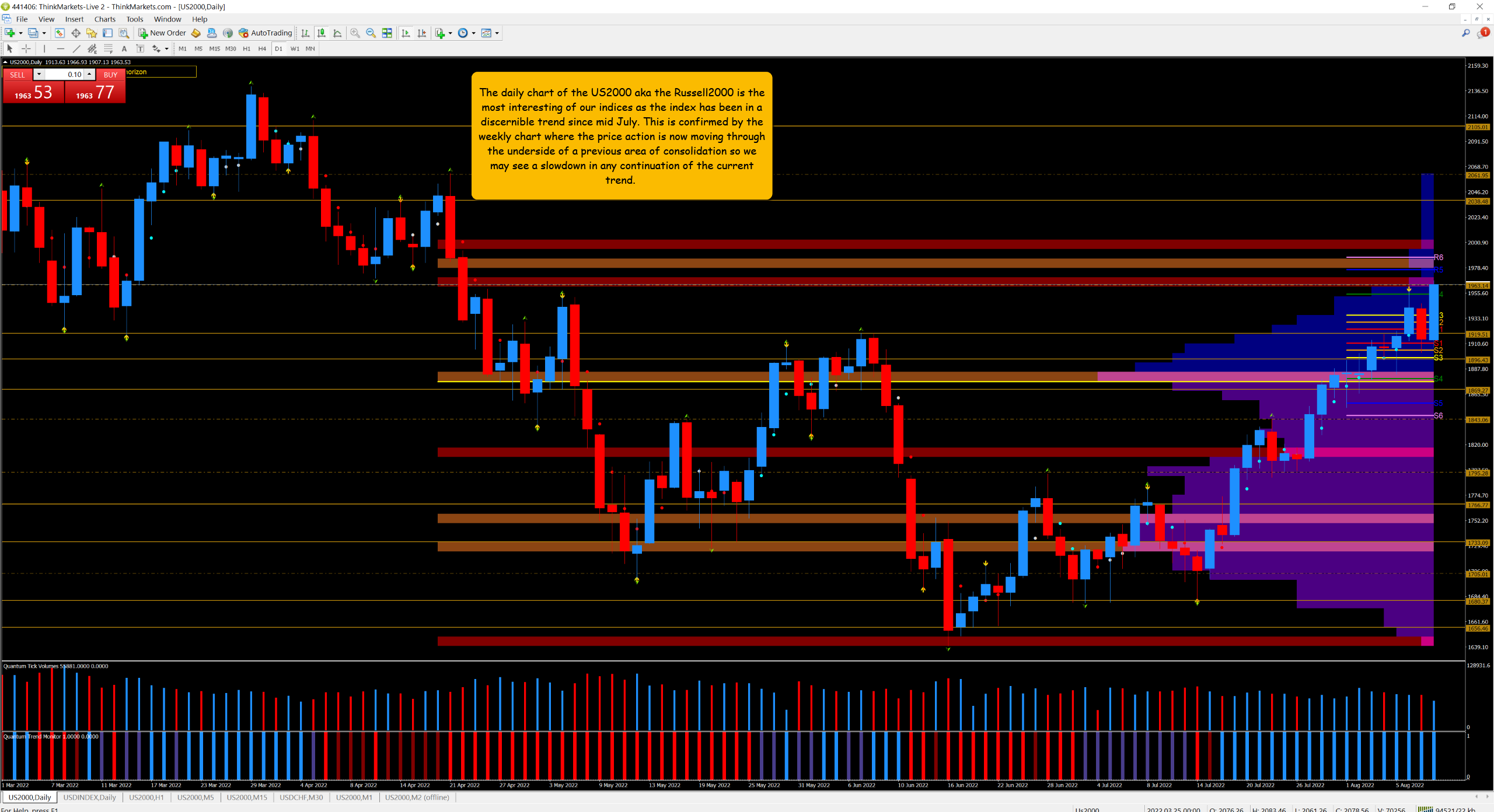

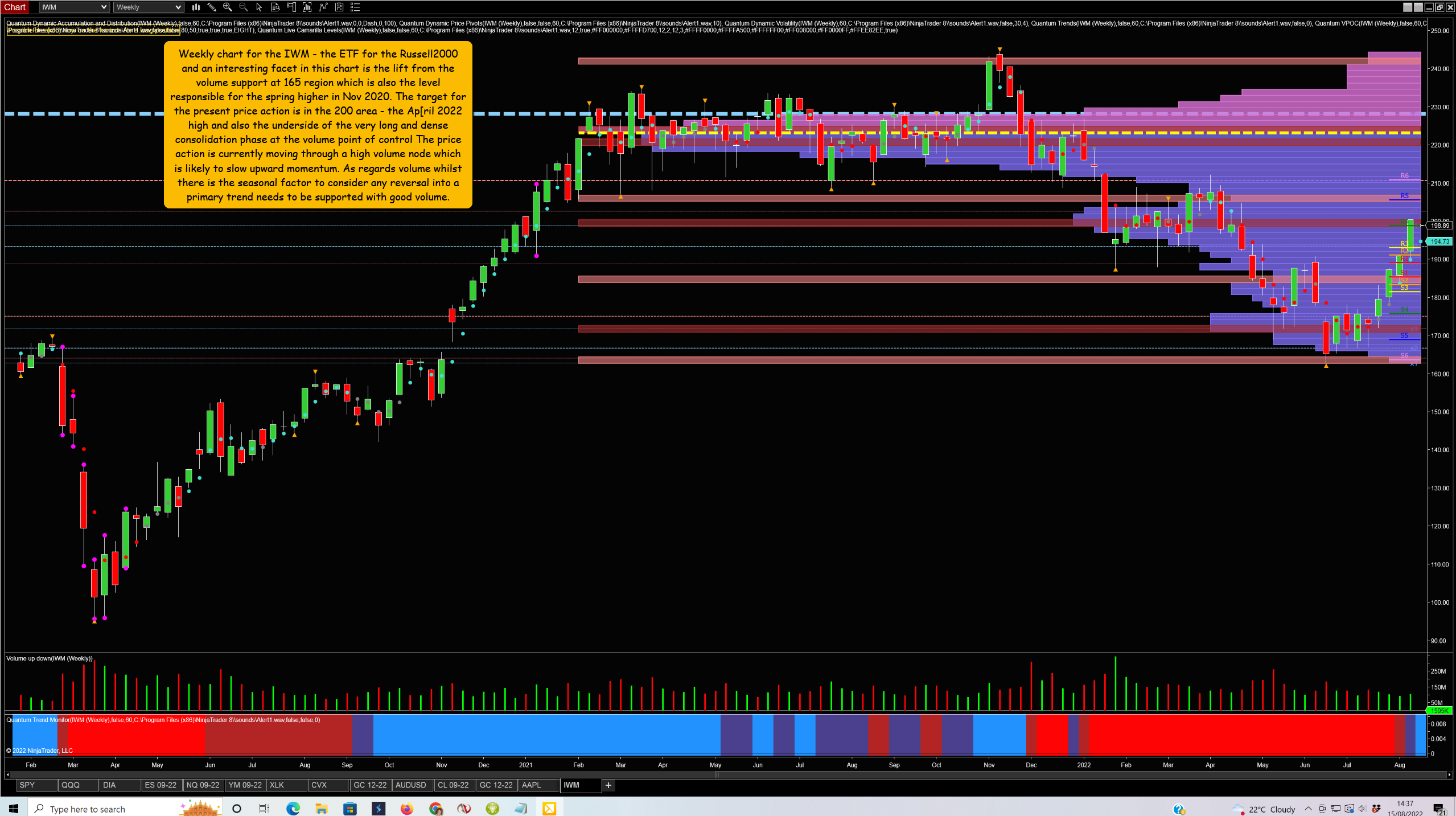

Looking at the charts for the major indices, the tech sector and growth stocks, in the shape of the Russell 2000 and associated ETFs, continue to build on the mid-June reversal. However, note my comments on the volume on the screenshot for the iShares Russell 2000 ETF (NYSE:IWM).

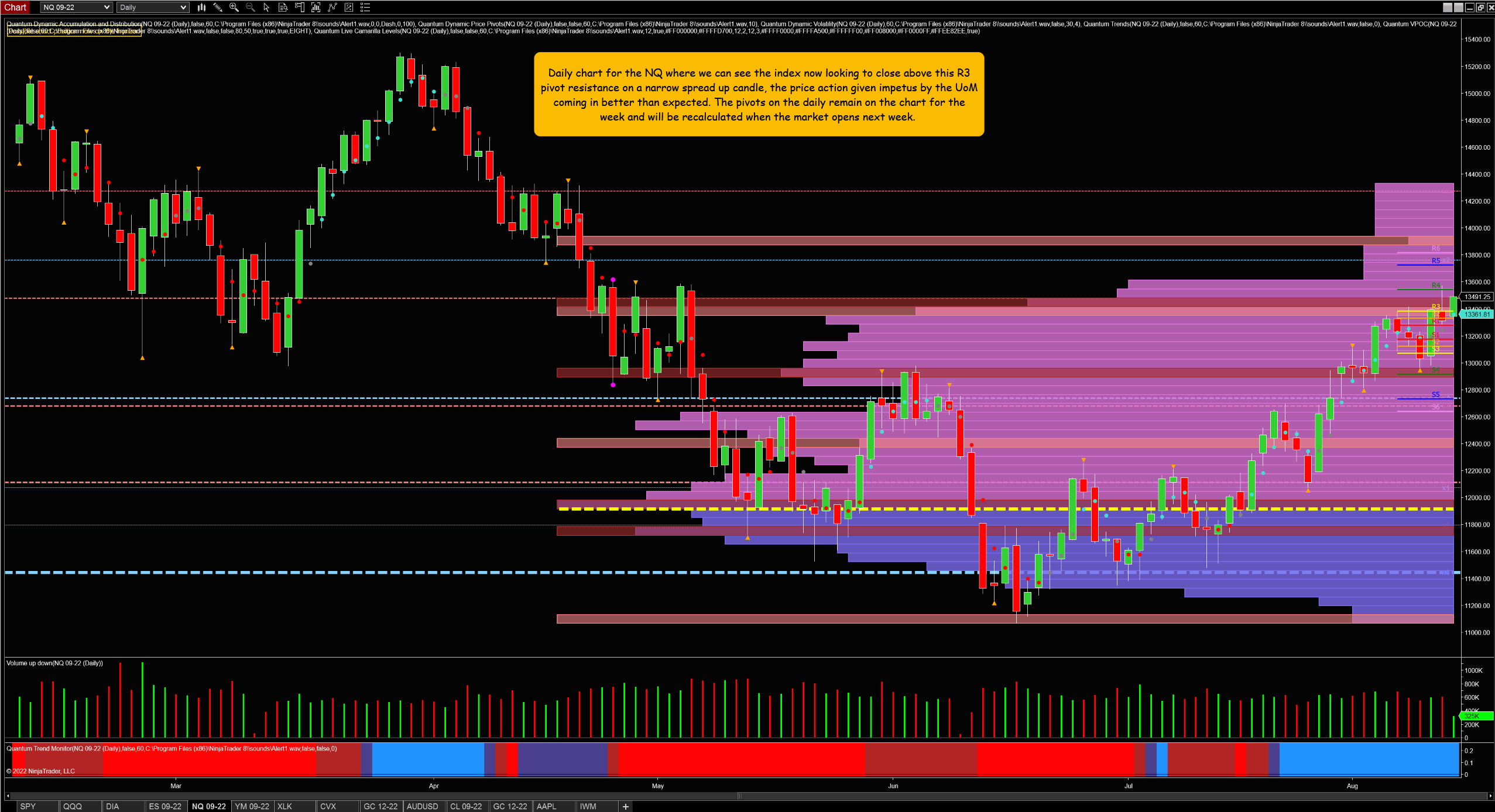

We begin with NQ, the E-mini futures for the NASDAQ. We can see the index has consolidated and traded between the S3 & R3 pivots. Last Wednesday’s up candle was on CPI day, but it failed to break and hold above the resistance at the R3. Thursday’s PPI release pushed the NQ through this resistance, but the candle closed with a deep upper wick back below the R3. This often happens on a breakout with the price action returning to test the breakout level.

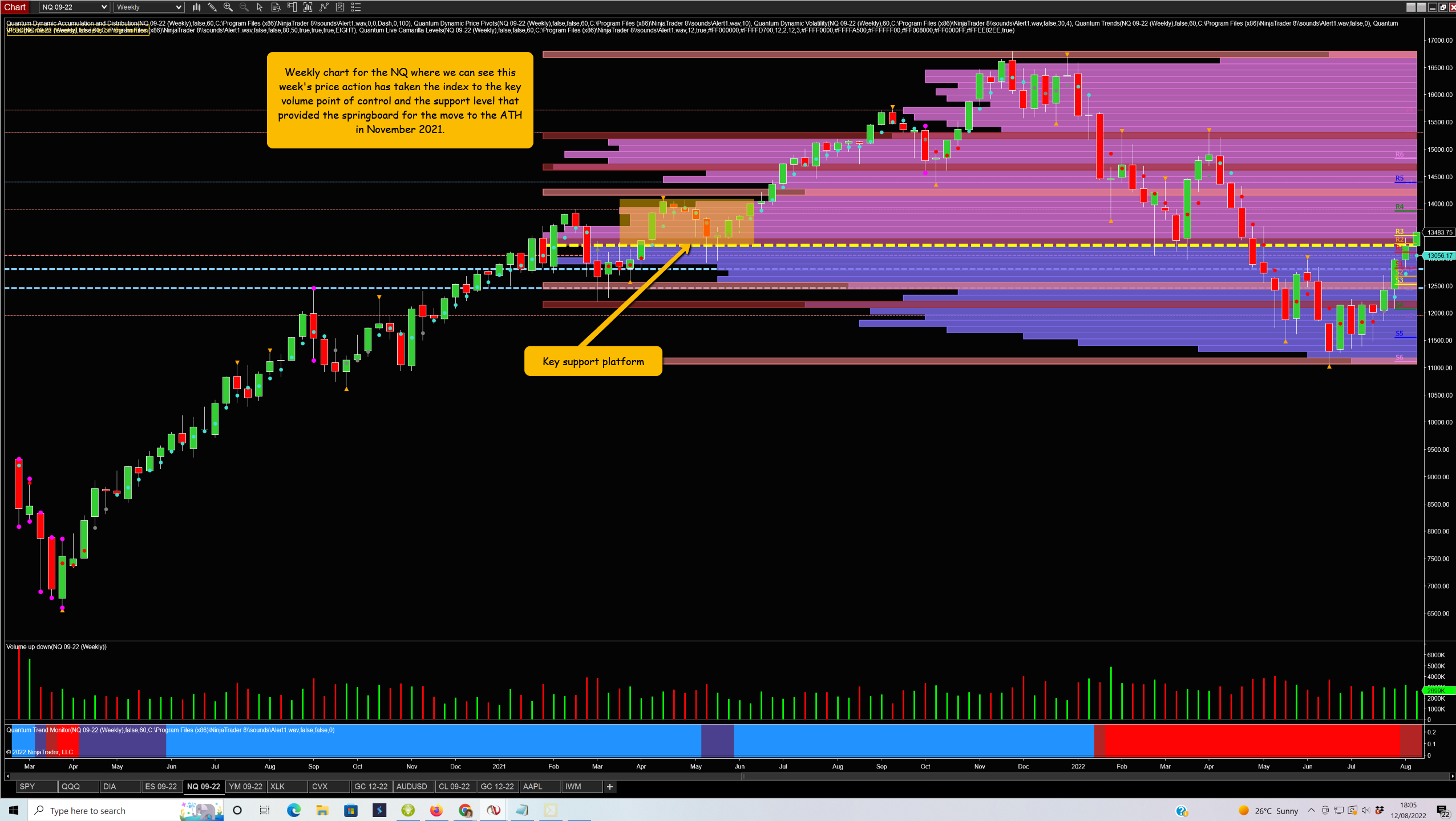

But if we consider the weekly chart, we can see why the breakout has stalled as the NQ is at the volume point of control at the 13270 area in this time frame. It is where we would expect the price action to pause. Plus, if we look over to the left of the chart, the significance of this level becomes evident as it provided the platform for the move to the all-time high in November 2021.

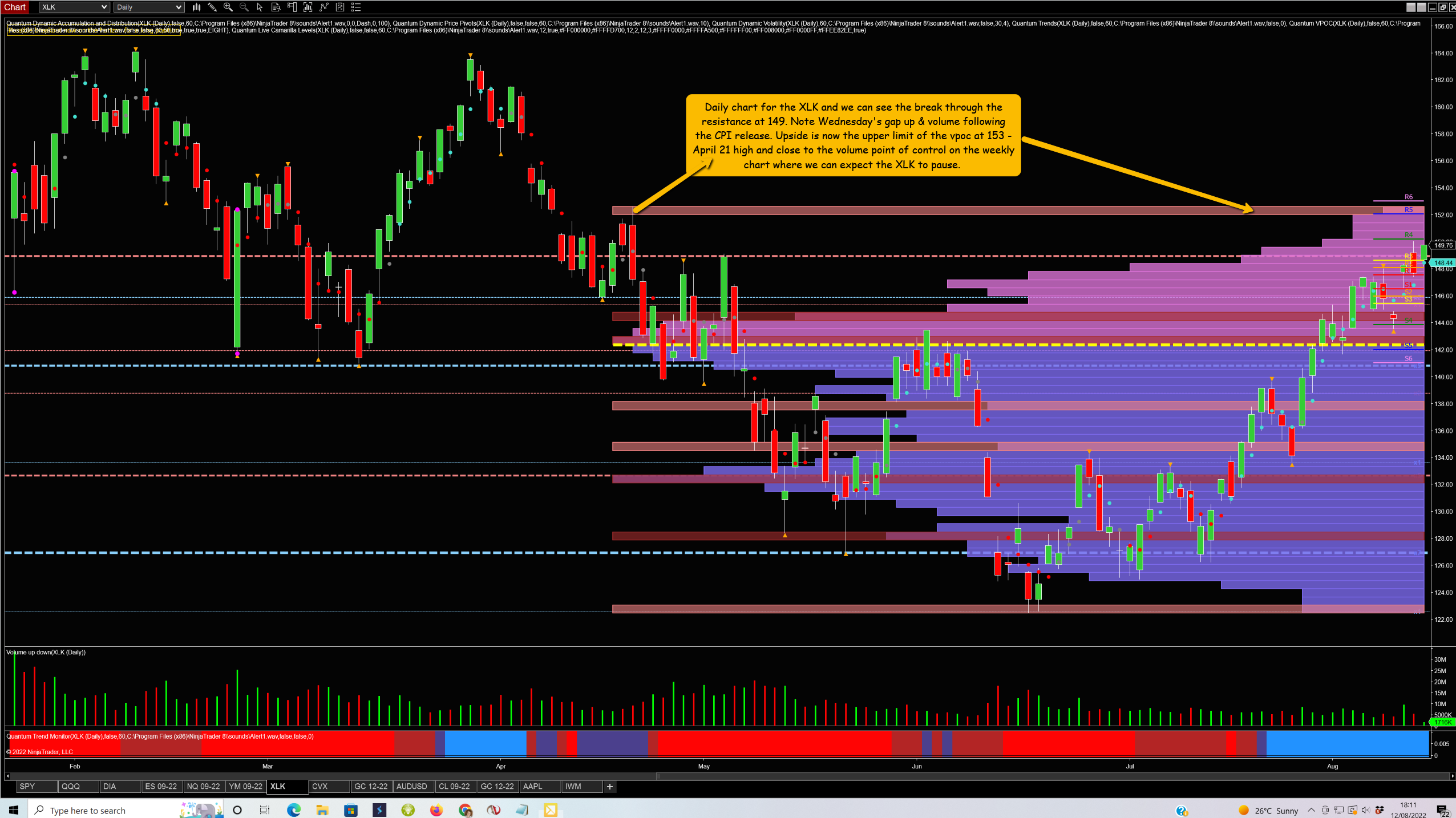

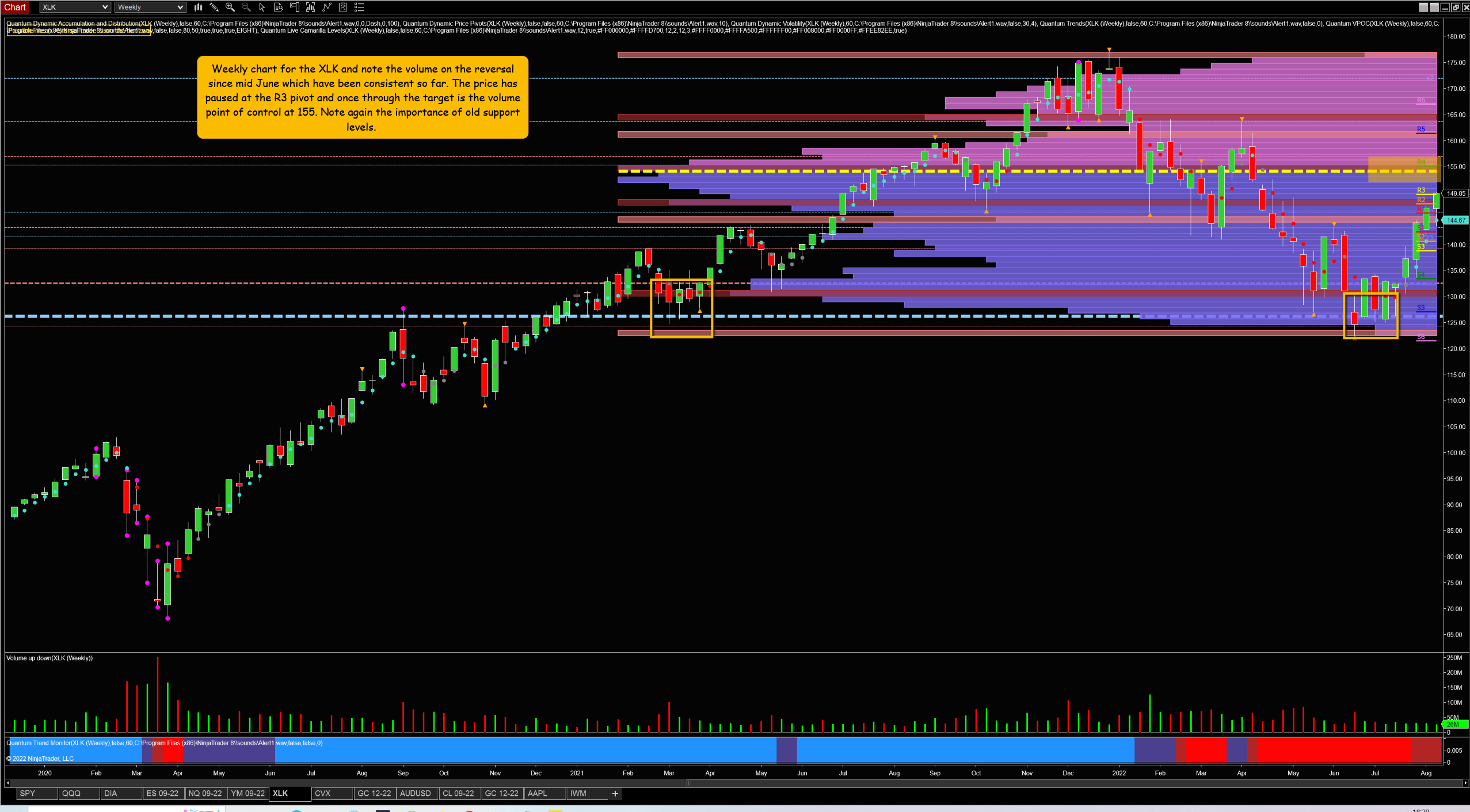

If we consider the chart of the Technology Select Sector SPDR® Fund (NYSE:XLK), we can see similarities in structure to the NQ on the daily chart.

However, on the weekly chart, the XLK has yet to achieve the volume point of control, which sits at the $155 region.

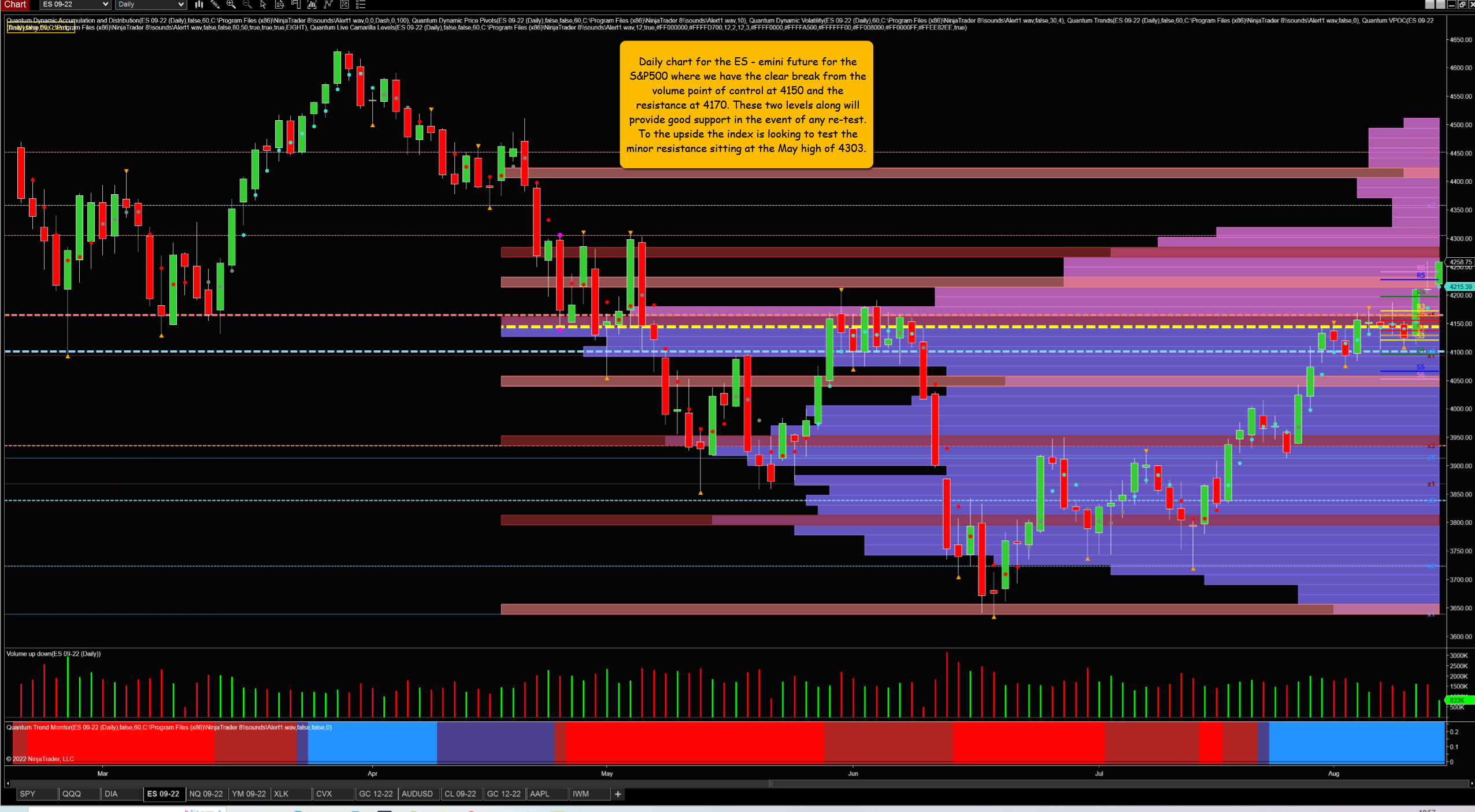

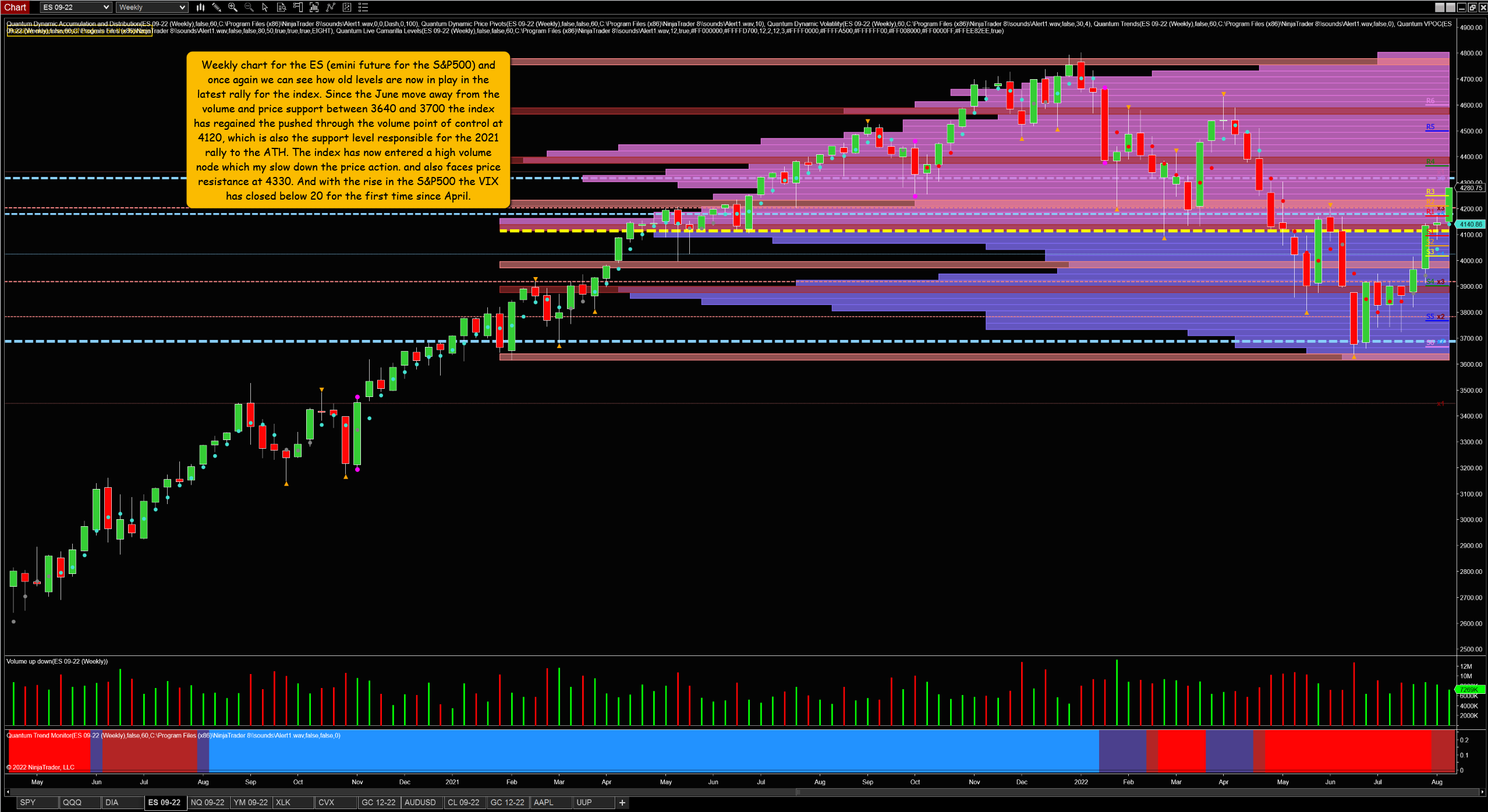

Moving to the S&P 500 E-mini futures, we have a similar candle configuration to the NQ on the daily chart.

But the price action on the weekly is more positive as the ES has already broken away from the volume point of control at 4150, with the candle only pulling back briefly from the R3 weekly pivot at 4250

From the above charts, the market’s optimism and positive price action fly in the face of the Fed’s determination to remain hawkish on inflation and stick to its aggressive agenda of rate hikes. However, the market appears to disagree. While volumes and liquidity do fall in August and can result in price spikes, we are seeing the June reversal in equities continue to play out. But whether this reversal is simply a bear market rally, a very sharp short squeeze (as I’ve read) or the start of a genuine bull rally to attack last year’s ATHs remains to be seen. All we can do is watch the price action and volume and trade accordingly. My final two charts are a for the iShares Russell 2000 ETF, where inflows suggest investors feel confident enough to move into what are considered more speculative riskier stocks.

My final two charts are a for the iShares Russell 2000 ETF, where inflows suggest investors feel confident enough to move into what are considered more speculative riskier stocks.

Stocks in the Russell 2000 have an average market cap of $1.15 billion. Many are newer, growth companies and, despite being more volatile, have the potential to deliver double-digit returns as it has been shown that small caps can outperform the large caps over long periods. The index is also more diversified because of its focus on smaller companies. It is less top-heavy and is not reliant on the performance of a few large companies.

What is also interesting is that since the June low, the Russell 2000 is up 16% while the S&P 500 has gained 13%, which we can see from the chart structure for both indices. Moreover, from a historical perspective, small-cap stocks outperform large-cap stocks in the initial stages of a new cyclical uptrend. And here, note the word ‘cyclical’ as the market is assuming this period of inflation is indeed cyclical and not structural. There is a crucial difference resulting in very different outcomes.