Looking at the Friday session, there is not a whole lot to move the markets as far as economic announcements are concerned. Looking at the economic calendar, there is Core PPI coming out of the United States, followed by the Michigan Consumer Sentiment number, and both of those can move the stock markets. Because of this, we are looking at the S&P 500 as a potential call buying opportunity.

When you look at the Thursday session, you can see that the market found support at the 2020 handle, thereby making this a market that should continue to go higher, perhaps heading towards the 2080 handle. We like buying calls on short-term pullbacks as the S&P 500, NASDAQ, and the Dow Jones Industrial Average continue to offer value every time they pullback. If we get better than anticipated numbers out of the United States during the session on Friday that could be the catalyst to continue to go even farther to the upside.

Gold markets struggled, as they fell slightly during the session on Thursday, but at the end of the day we did have enough buying to come back into the market and push the chart to form a relatively neutral candle. However, the market has a massive amount of resistance at the 1250 level, and as a result is not until we close above that level on a daily candle that we would be interested in buying calls. Short-term rallies could provide a short-term put buying opportunities.

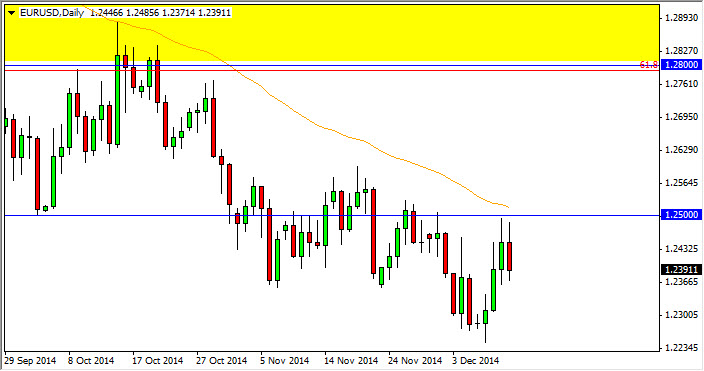

We also believe that the EUR/USD pair pulling back from the 1.25 level on Thursday only justifies put buying in this particular pair as the US dollar is without a doubt the strongest currency in the Forex world. Ultimately, on top of that we believe that the Euro will continue to be week in general so therefore we feel that the pair is going to continue to go lower over the longer term.