The technicians and chart watchers are keyed on the NASDAQ 100 and the QQQs the last few weeks, as the index has sold off hard (not surprising given the run up the large-cap and mega-cap Technology stocks have had this year), with the 50-day moving average being the key technical level. (Friday’s blog post was poorly written: with all of the market information out in the public domain these days, occasionally a chart or graph jumps out as very meaningful, and that was the Bespoke piece linked to that post, link above. A trade through the 50-day moving average for the NASDAQ 100 typically means lower forward returns for the asset-class as the article goes on to explain.)

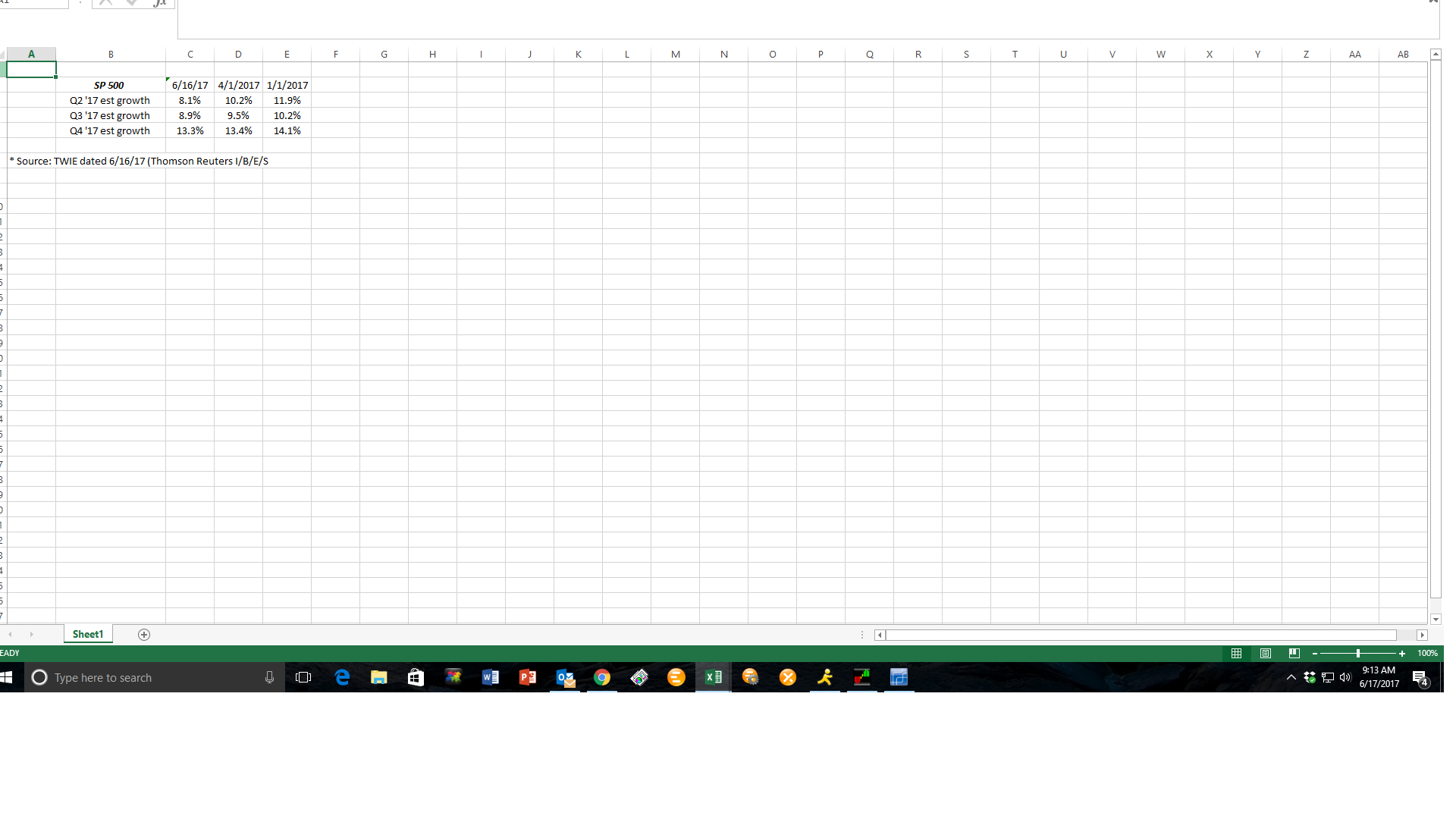

Thomson Reuters data (by the numbers): (Source: This Week in Earnings dated 6/16/17)

- Fwd 4-qtr estimate: $134.66 vs last week’s $134.83

- P.E ratio: 18(x)

- PEG ratio: 1.95(x)

- S&P 500 earnings yield: 5.53%

- Year-over-year growth of forward estimate: +9.27% vs last week’s +9.35%

Here is what caught my eye this week in the earnings data:

Apologies for the Excel spreadsheet, but what jumped out at me and what should be valuable to readers is the lack of downward deterioration in both Q3 ’17 and Q4 ’17 S&P 500 earnings estimates at this point in the year. Q2 ’17 earnings growth estimates have deteriorated at a roughly a “2% per quarter” rate since Jan 1 ’17, which is pretty normal, and the “out quarters” beyond that should be deteriorating slightly faster given the normal pattern of erosion, but the forward growth estimates have stabilized.

A “good thing” as Martha Stewart would say.

Here was a blog post from May ’16 where I noted the expectations for 2017. Same pattern. 13 months ago, the S&P 500 2017 estimates were looking for 14% earnings growth in the benchmark, and today that is 12%.

Here is another post from early April ’17, where my own forecast for Q1 ’17 S&P 500 earnings growth was +12% – +14% (today, the actual growth rate for Q1 ’17 earnings is +15.5%). My classic Irish temper gets the best of my better judgment. If you want to model, back-test and navel gaze the data, you are free to do so, but after looking at this data every weekend for for the past 17 years, the trends and changes in the pattern of the numbers can be just as “predictive” as the most sophisticated models. And the trends can be wrong too, as in mid-2008, when the “forward 4-quarter” S&P 500 earnings estimate didn’t peak until the 3rd week of July, 2008.

Summary / conclusion: Forward S&P 500 earnings growth estimates have remained stable for the last year, which is always a plus. The recent weakness in the NASDAQ 100 is not (yet) showing up in the forward quarters in terms of Technology sector earnings estimates, but Q2 ’17 earnings reports will be critical. I will watch the earnings revisions, particularly for the semiconductor sector. NVIDIA (NASDAQ:NVDA) (no positions) and the semiconductors seemed to start the decline in the Tech sector in the last week.