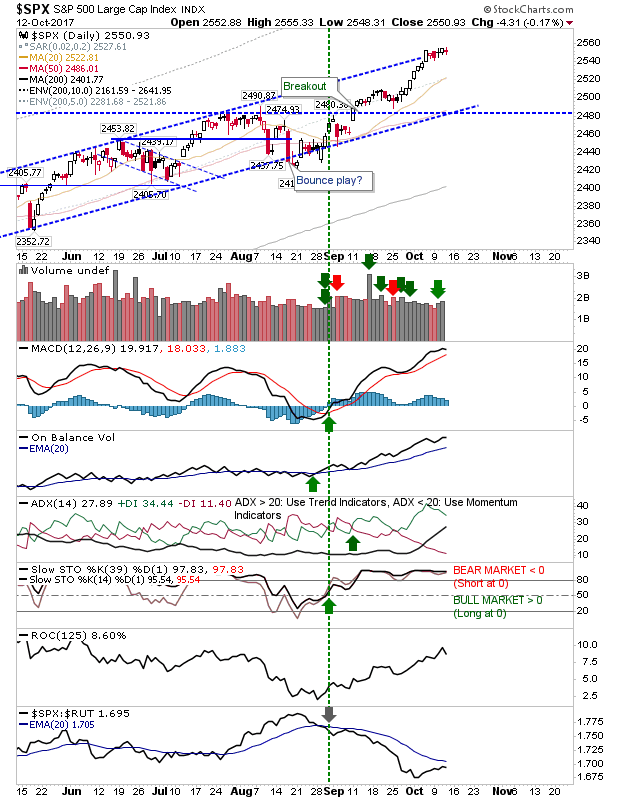

Not a whole lot to say about Thursday. Small loses didn't erode prior gains but the tight action offers swing traders the best chance for gain; trading the narrow range coil offers an attractive risk:reward. Long-term traders need to wait for an oversold condition before building their positions.

The S&P is at channel resistance suggesting shorts have the edge. Stops go around 2,560.

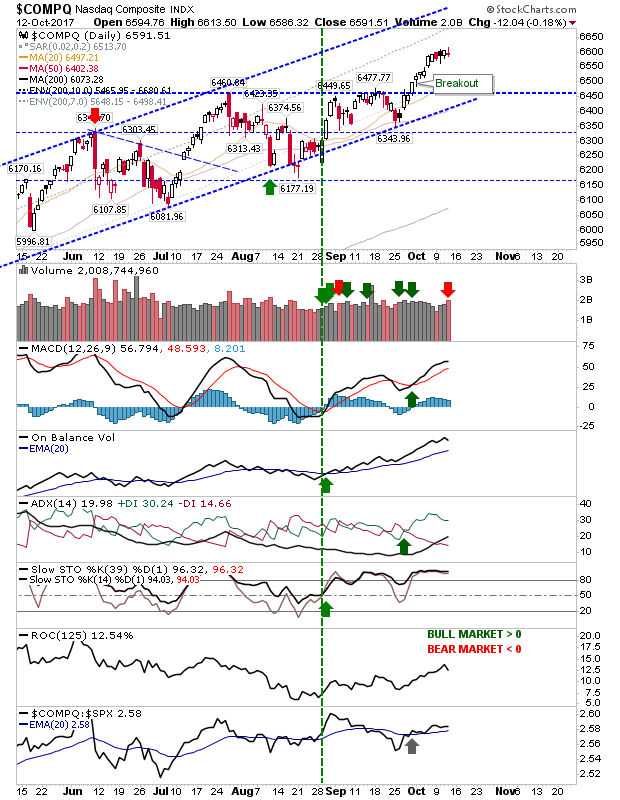

The NASDAQ is caught in the middle ground of its rising channel. Again, swing trade for a target of upper/lower range of the same channel.

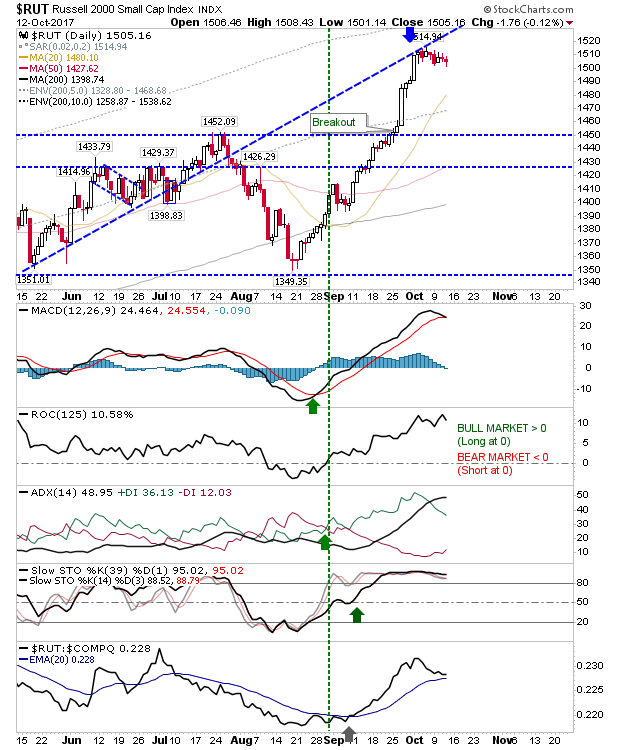

The Russell 2000 continued to drift off highs with the 20-day MA the first downward target and a chance for buyers waiting to buy the pullback.

The NASDAQ volatility index is also playing for a bounce which is bad news for the NASDAQ index and a key top could be just weeks away.

Watch for reactions from the tight coiling action of recent days. There isn't a whole lot of room for a move without consequence, so the next tradable leg may only be 1 or 2 days away.