The Dow, the S&P 500 and the Nasdaq all closed at record highs yesterday. This was the first time since 1999 (thanks @RyanDetrick). So all is well in the world right?

Well just like the response from Lily King to Yulia Efimova from Russia after a breaststroke prelim, the transports are saying not so fast. The Dow Jones Transportation Index has not made a new all-time high yet.

In fact it is still almost 15% away from the all-time high set in November 2014. This is troublesome for a few reasons. First is that it is a major sector of the market. Second for technical investors it means that the Transports have not signaled a confirmation of a bull market to go along with the new high in the Dow.

This Dow Theory signal may be one of the western worlds earliest technical indicators. But maybe most important is the fact that the Transports continue to make lower highs.

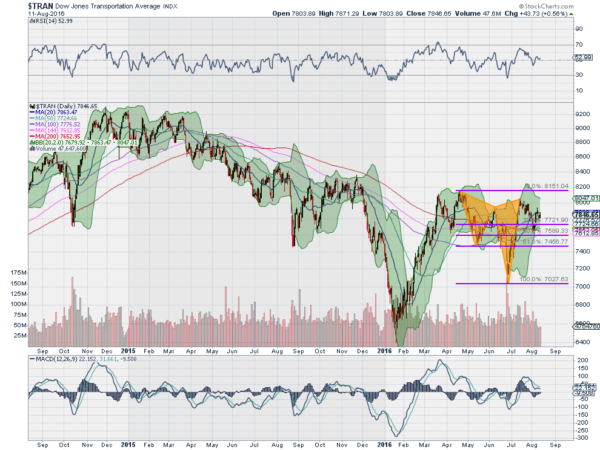

The chart above shows the sharp bounce off of a January low, with a small pullback and then a high in April. That retraced nearly 61.8% of the move down from the November 2014 high.

Since then the Transports pulled back to a higher low in June. That is promising for a possible log term reversal. But the thrust higher failed at a lower high in July. If that is all it has in the tank it is not good news.

The price action since the April high had traced out a bearish Shark harmonic (the two triangles). Since hitting the Potential Reversal Zone (PRZ) at the July high, it has retraced close to 50% of the pattern. In the short term it is reversing higher. That is potential good news.

It may take baby steps for the Index that covers large trucks, planes and trains to recover. The first step would be a move over the July high, then the April high, 3rd the November 2015 high. With each milestone it will gain power and investors.

At the moment it has momentum on its side, but barely. The RSI is treading near the mid line but over 50, while the MACD is flat after a pullback, and positive. The Bollinger Bands® are squeezing in, often a precursor to a big move. If that happens to the upside the mega rally could get stronger. A break to the downside will likely bring more rhetoric about a weak market.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.