Live from the Asia-Pacific! As we kick of the last month of the first quarter, the beginning of the end.

A positive, insightful, profitable and growth-filled week to you all. The epic piece in last week’s Macro Take, a deep dive into Russia: In from the cold of Mother Russia. (Ping me for email version) has unfortunately become even more relevant now, with the sad and recent brutal assassination of opposition leader and democracy champion, Boris Nemtsov.

In conjunction with the ratings downgrade two Fridays back, this is a big step back for the Russian people and hopefully will be a catalyst for much-needed constructive and transparent reform. For those not familiar with Russian politics, this kind of mafia hit could not have happened without the green light from the powers that be.

A step back for Russia ... Russian opposition politician, Boris Nemtsov, was shot dead in Moscow last week.

We’ll start in reverse this week with upcoming key macro data, before restating my high conviction calls for the year (long USDCHF to get to 1.02/1.05 for 2015 and long European equities +30-60% for 2015) and touching on a few thoughts across FX, equities, credit and commodities.

Do also note, volatility is down massively of late (see majors in chart below), making long option plays a lot more attractive in regards to looking for protection or to say play US nonfarm payrolls next Friday.

VIX closed at 13.34, -30.5% for the year and off of 23.43 highs. DAX Volatility on the same stats is 14.66, -22.7% for the year and off of 24.09 highs. Which to me seems odd, i.e. the European QE yield-dampening environment should see this volatility fall much more than its US equity counter parts – there is a trade there!

Volatility has come off very aggressively post the SNB, ECB and Greek events

Key macro data points that KVP is watching over next week*

Major central bank decisions in March

Remember 2015 is the year of the dovish winds in the face of a rising Fed – the only ship capable of swimming against the tide.

This week: March 2 – 6: The Reserve Bank of Australia kicks off the central bank drums on Tuesday, with the market getting more bearish on a cut as we progressed through last week. It is interesting to note that with the AUD/USD Friday close of 0.7808 we are above the 0.7800 level of the previous cut.

Thursday will see a range of central bank decisions; from East to West we have policy decisions out of Malaysia, UK, the Eurozone and Canada. Pakistan’s central bank will also make a decision between March 5 – 16, how’s that for holding market risk? ☺

Bank of England Governor Mark Carney will be speaking on Tuesday before the Treasury Committee (currency probe related).

Fed Chair Janet Yellen will be in New York on Wednesday, speaking on bank regulation. Note we also get the Fed’s Beige book on Thursday.

Next Week: Mar 9 – 13: Thailand (Mar 11), New Zealand (Mar 12), South Korea (Mar 12)

Week: Mar 16 - 20: Indonesia (Mar 17), Japan (Mar 17), US (Mar 18), BoE Minutes (Mar 18), RBA FX trans (Mar 19)

Week: Mar 23 – 27: BoJ minutes (Mar 20), Philippines (Mar 26), Taiwain (Mar 27)

Week: Mar 30 – 31: Nothing

Economic data flash: First week of the month, I smell PMIs…

China: China official PMI manufacturing data was out over Saturday, slightly better than expected at 49.9a, 49.7e – in line with the surprising HSBC Flash PMI from earlier in the week, which helped Aussie pull a bit of a squeezy. For the rest of the week we have final HSBC PMI data, as well as trade data out on Sunday Mar 8.

Japan: 4Q Capital spending, PMI (manf 51.5p); Vehicle Sales Australia: 4Q GDP +2.6%e, +2.7%p. Building approvals; Balance of Payments; Retail Sales and Trade Balance.

UK: Mortgage approvals, PMIs (manf. 53.3e, 53.0p).

Eurozone: 4Q GDP +0.9%e, +0.9%p; Inflation +0.6%e, +0.6%p; PMIs 51.1e, 51.1p, Retail Sales

US: The main event! Nonfarm Payrolls on Friday, 225k e, 267k p. ISM manf. 53.0e, 53.5p, PCE Core YoY +1.3%e, Personal Income and Spending. ADP employment change and Factory Order.

Conviction calls and thoughts on asset classes for 2015(Closes are as of Friday Mar 27)

Currencies

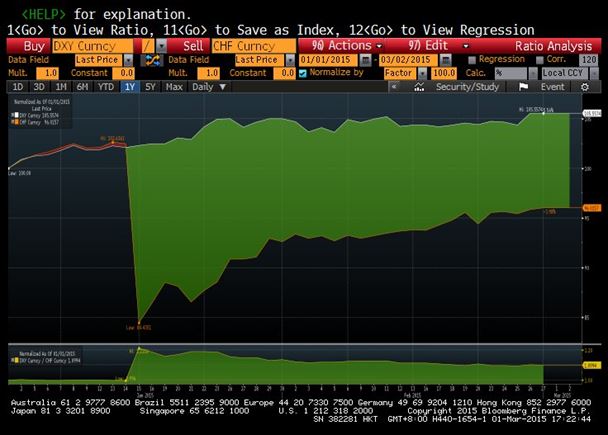

- Long USD/CHF: Last 0.9543 up +11% unlevered since my Friday January 16 high conviction call (HCC) post the SNB debacle. Assuming a conservative FX leverage of 20x, that’s +220% return in under two months. The trade has consistently closed higher for each of the six weeks since the call. Stay long and watch the grind higher. This is a structural trade, with 1.02/1.05 range by year end and 1.12/1.15 by end of 2015. Volatility has returned to normal levels on this cross, allowing people to go long the options versus the cross without paying a crazy premium. Again this is a HCC, I will limit myself to 4-6 such calls, because I believe there are only really 4-6 exceptional macro trades a year that tick all the boxes on technicals, momentum, fundamentals and some kind of inflection point. o Indecently those looking to either hedge DXY (DollarBasket) exposure and/or want more short Swissy exposure. Why not play the spread close: short DXY versus long USD/CHF, it looks super tasty.

Play the closing spread through shorting the dollar basket (DXY) versus going long USD/CHF

- AUD/USD: Last 0.7808, the gods of trading (GOT) are being kind allowing traders to revisit building their short positions in AUDUSD, we will get to 75c in the next 3-6 months, then low 70c by year end. Remember to position size: it’s been stubbornly robust. And remember with the RBA decision on Tuesday, we are actually above the 0.7800 levels of the previous cut. The recent range-bound environment have been beautiful for those that delta hedge with the aim of getting free options.

- NZD/USD: Last 0.7564, similar to AUD thank you GOT.

- GBP/USD: Last 1.5438, feels toppy to me, but I have quarantined myself from any cable calls until 2Q as I seem to have a flawless track record of calling Cable and BoE wrong.

- USD/JPY: Last 119.63, end of year target range of 125-130, and by end of 2016 it could be 140-150.

- EUR/USD: Last 1.1196 we’ve been stubbornly above the 1.10 key level that everyone is looking to be broken, yet with risk-on in European equities and the yield compression trade on the region’s bonds, a lot of capital will start going into Europe. So we may need an outright hike from the Fed to really take us down further to the next structural range. With that said, the close last week market brought new lows compared to the previous three range-bound weeks. In the year to date, 1.1098 is the record low achieved on January 26, soon after the ECB decision. Last week’s lows and highs were 1.1176 / 1.1396. It will be interesting to see if this is a new structural shift or temporary fake.

Equities

- I’ll stay focused on regions and am always happy to talk stock specifics one on one. It’s a risk-on environment for stocks globally given the deflationary environment and yield compression we are seeing. Yet some markets have a higher probability of upside than others.

- Eurozone equities. My original bullish call on European equities was tooooooo conservative. I am now making this my second HCC for the year and think +30% will be on the low end of European equities, with most of the indices most likely being up +50% when we get to the end of the year. Further, I believe peripherals such as Portugal (PSI 20), which is still well off global financial crisis highs, have shut up and gone ahead with the reform and structural initiatives and could easily double by 2016-17. Check out the chart below; KVP is not being aggressive at all. In fact most main equities in the old continent are up +10-15%, with only two months, or 17% of the year behind us – watch the grind up. Selling put spreads is going to be a phenomenal strategy in this market, as you pick up the credits on the grind up (i.e. short at the money (ATM) puts and close naked exposure by buying OTM (out of the money) puts, say 95% or 90% from ATM).

- I am bullish on China (Shanghai Comp 3,310), Indian (NIFTY 8,845) and Japanese (Nikkei) 18,798 equities – on the latter while we are up +7.7% year to date in USD, I am still comfortable with my 21,000 to 22,000 2015 Nikkei level that I called in 3Q last year (hedge FX or pick up USD denominated ETF).

Fixed income

- Broadly speaking globally yield compression is the name of the game and a powerful macro theme this year. Nowhere is this more clearly evident than Germany 10-Year bunds trading in line with Japanese 10-Year, 32.6bp vs. 32.3. I said Italian 10-Year yrs and Portuguese 10-Year would get sub 2.0% and they did, with the latter coming through just last week: we are seeing big moves. Expect Eurozone yield compression to continue, as well as most fixed income in APAC and also Canada. While U.S. 10-Year yrs should be above 2%, as I still expect capital flows into the US to dampen the move, either way I would not be long UST.

Commodities

- Crude Oil: Last $49.76 (WTI). Stay neutral to short oil; fundamentals still unchanged – I did a deep dive on this recently, happy to send the presentation through. I think we have to wait until 1H 2016 at the earliest for a sustainable bounce. The volatile, yet disciplined ranges do suggest that some range-bound trading strategies on outright futures or wide strangles could work well over the next few weeks/months.

- No other strong views on commodities. Gold (last $1,213) is looking constructive technically speaking; Silver (last $16.60) even more so. In fact, I’d put on a near-term tactical long on silver just from the chart: (Stop 16.00, target 33% 17.00 / 33% 17.49 / 25% 18.40 and time stop of 1-2 weeks), this is purely technical trading. Long term I am a massive soft commodities bull, wait until the Asia Pacific Protein Trade comes into full effect. Yes, all those Kiwis and Koalas who sink every bonus and extra cash they can into buying farmland are on to something, and will be driving their Lambos to the barn house.

* As always any feedback on my pieces is greatly appreciated, it’s a constant optimisation process, Kaizen.

Lastly, life is very similar to investing/trading, you end up with what you put up with – so set your standards high, focus on the process and a profitable trading/investing to you all – be successful and don’t forget to enjoy the journey. The effective use of our time is the most valuable commodity we have.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.