The French blue-chip CAC index has climbed by 0.70% on Tuesday. Currently, the CAC is trading at 5298, up 0.72%. The index has improved this week, after suffering losses of over 2.0% on Friday. The DAX has posted small gains of 0.10% and is trading at 11,375.

News that China was buying some 300 jet planes from Airbus elated investors and has sent Airbus shares soaring on Wednesday. The airplane maker’s shares have jumped 2.6 percent. The deal is worth EUR 34 billion, and Airbus could secure further deals as rival Boeing (NYSE:BA) struggles, following the recent crash of a Boeing passenger jet in Ethiopia last month.

European markets took a plunge on Friday, with the DAX recording its steepest decline since early February. Investors reacted with a thumbs-down after German and eurozone manufacturing PMIs slipped in March and continued to point to contraction. No less worrying, both PMIs have been slowing for months, as the global trade war continues to damage the eurozone and German manufacturing sectors.

German confidence indicators continue to raise concerns about the health of the economy. Consumer climate slipped in March to 10.4 points, after two successive readings of 10.8 points. With the eurozone mired in an economic slowdown and German numbers pointing to weaker growth, it’s not surprising that the German consumer has become less optimistic. On Tuesday, German business confidence improved slightly in March, with a reading of 99.6 points. The markets have been accustomed to releases above the 100-level, and the February reading of 98.5 was the weakest since November 2014. The survey noted that any improvement was confined to domestic sectors, such as construction and retail services. The manufacturing sector remains weak, battered down by the ongoing global trade war, which has dampened the appetite for German exports, such as vehicles and auto parts. Germany’s economy slowed down in the fourth quarter, and this bodes poorly for the rest of the eurozone.

Economic Calendar

Tuesday (March 26)

- 3:00 German GfK Consumer Climate. Estimate 10.8. Actual 10.4

*All release times are DST

*Key events are in bold

CAC, Monday, March 26 at 7:30 EST

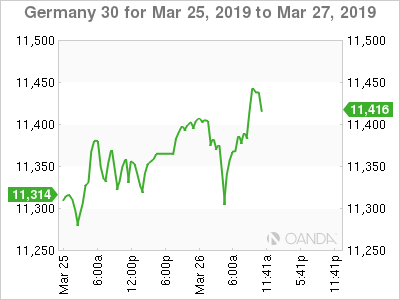

Previous Close: 11,346 Open: 11,371 Low: 11,299 High: 11,378 Close: 11,375