- Gold reaches a new all-time high as markets reassess rate cut expectations after evaluating resilient US data.

- The Jackson Hole Symposium will be a key event next week, with central bankers discussing strategies for growth and monetary policy.

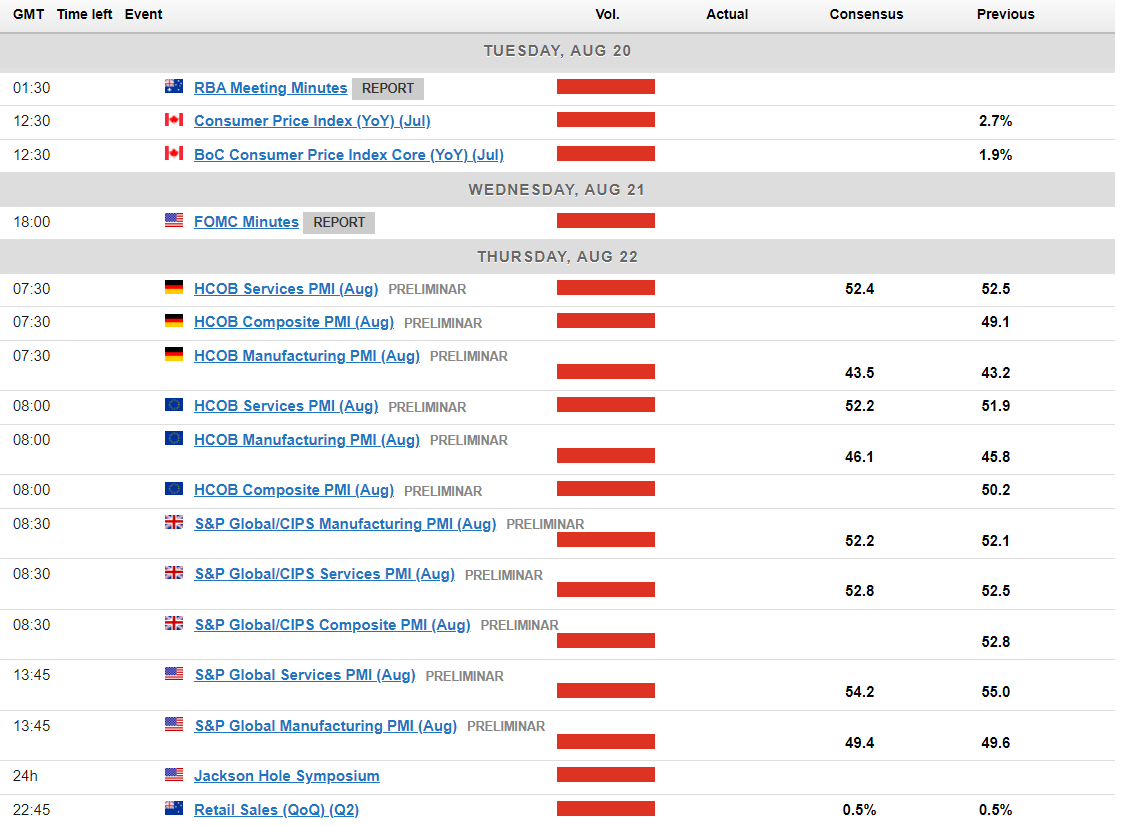

- It’s a data-heavy week in Europe and the US, with the release of FOMC minutes, PMI data, and speeches from Fed Chair Powell and BoE Governor Bailey.

Last week's economic data has led to a reassessment of rate cut expectations.

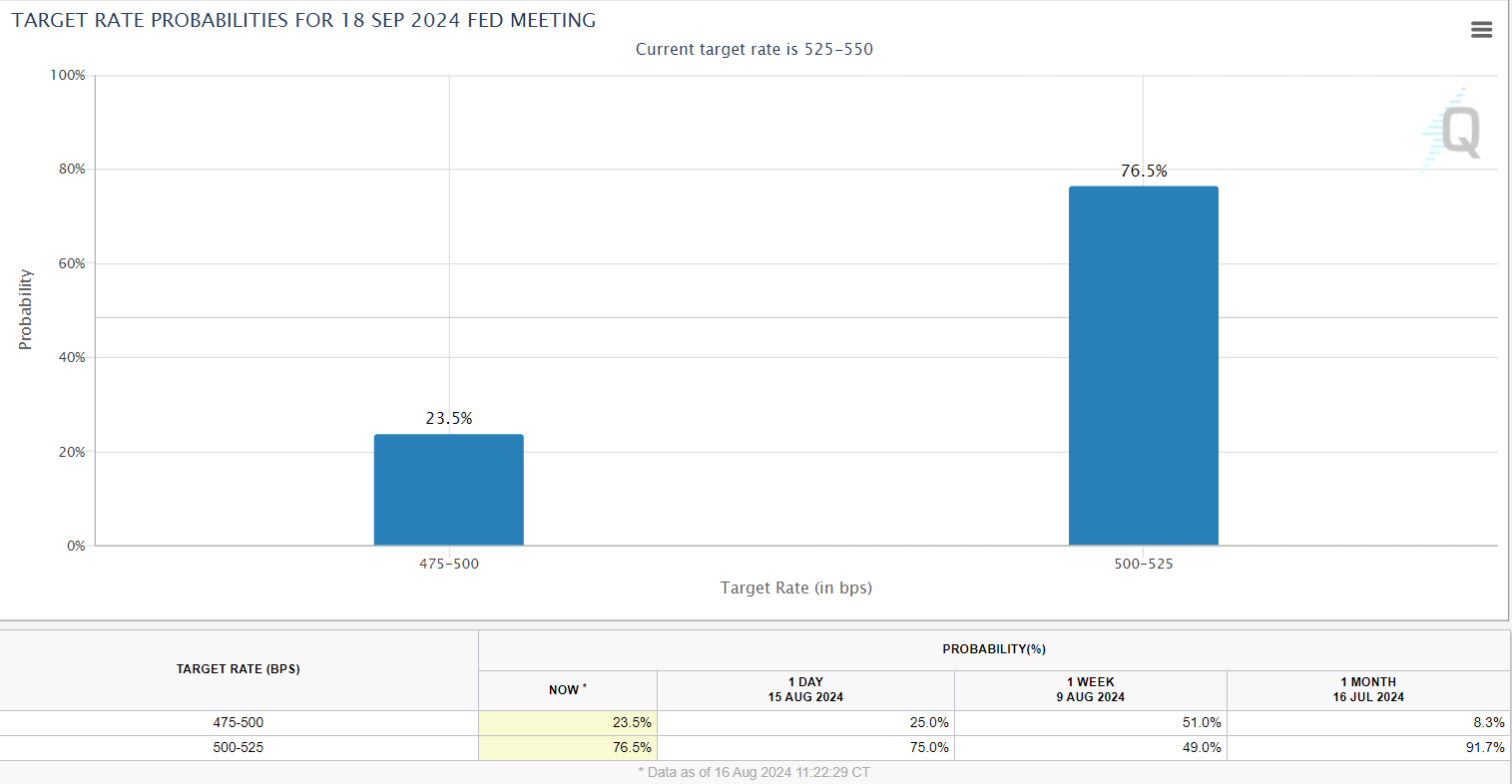

Previously, markets were pricing in a 51% chance of a 50bps cut, which has now been drastically reduced to 23.5%. Despite this, gold reached a new all-time high of $2500/oz, while both the Euro and GBP made significant gains against the USD. Source: CME FedWatch Tool

Source: CME FedWatch Tool

The GBP notably gained from a series of positive data releases, with Friday’s GDP figures surpassing expectations. This propelled Cable into the 1.2900s, with the key psychological level of 1.3000 now within reach as we head into next week.

Oil prices struggled to maintain last week’s rally, ending the week on a bearish note and resulting in a doji weekly candle that could indicate either a bullish or bearish trend.

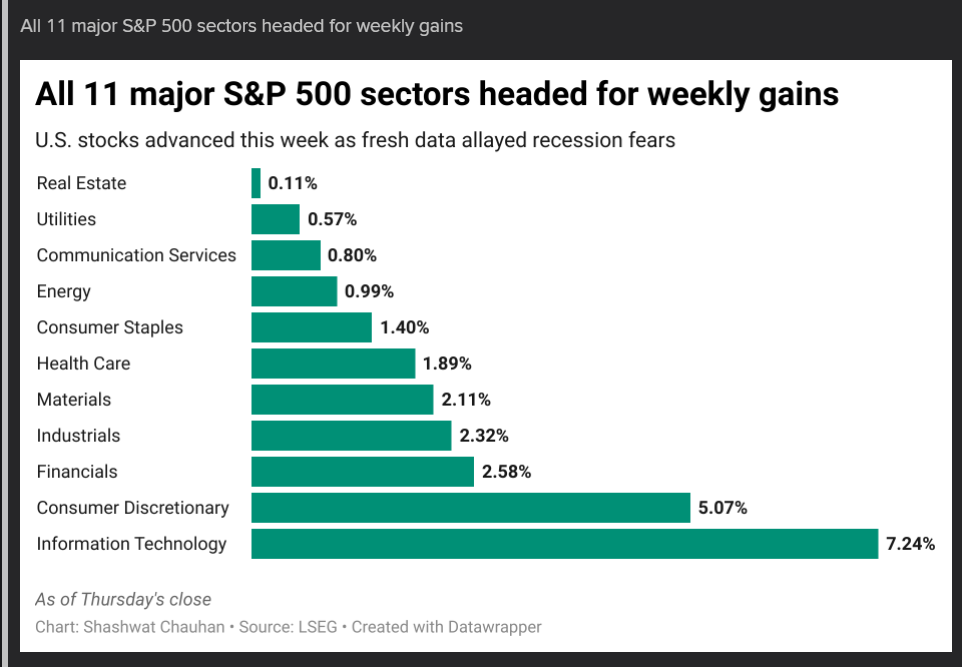

In contrast, US indices had an exceptional week, rallying significantly. The S&P 500 is poised for a 3.2% gain, while the Nasdaq 100 is on track for even stronger gains of around 5.2% at the time of writing.

This sharp shift in market sentiment was driven by a series of positive US data releases, which continued on Friday with improved consumer sentiment data and stable inflation expectations for the next 12 months.

Source: LSEG

The Week Ahead: Jackson Hole and PMI Data at the Forefront

The Jackson Hole Symposium this year holds significant importance as a gathering of global central bankers, economists, and financial market participants. This year, the symposium’s focus is once again on navigating the post-pandemic economic recovery and addressing the challenges posed by higher interest rates and geopolitical tensions.

Key topics include strategies for sustainable growth, monetary policy adjustments, and the implications of digital currencies on the global financial system. Notable speakers at this year’s event include Federal Reserve Chair Jerome Powell, European Central Bank President Christine Lagarde, and Bank of England Governor Andrew Bailey. Their insights are anticipated to shape market expectations and policy directions for the coming year

The Symposium could stoke volatility across a host of currency pairs and will need to be monitored closely.

Asia Pacific Markets

In Asia, the upcoming week looks quiet for China, having just wrapped up its significant monthly data releases. On Tuesday, an announcement regarding the loan prime rates is anticipated. No changes are expected, given that the MLF and 7-day reverse repo rates have remained steady throughout August.

Looking at Japan and the flash PMIs are expected to improve, driven by a positive outlook for service activity, despite recent fluctuations in the JPY and a significant drop in equity markets. Increased semiconductor and auto exports, along with core machine orders data, also indicate a boost in manufacturers’ sentiment. Additionally, inflation is anticipated to pick up again in July, as previously indicated by Tokyo’s earlier inflation figures.

Europe + UK + US

In Europe and the US, it’s another data-heavy week. Beyond Jackson Hole, the week starts with the RBA minutes and Canadian inflation data on Tuesday.

On Wednesday, the FOMC minutes will be released, potentially offering more clarity on Fed policymakers’ stance concerning a possible rate cut in September. Thursday is particularly busy with PMI data coming from the EU, UK, and US.

The week concludes on Friday with speeches from Fed Chair Powell at Jackson Hole and BoE Governor Andrew Bailey.

Chart of the Week

This week’s highlighted chart is the US Dollar Index (DXY), which continues to play a crucial role in the financial markets.

The DXY revisited last week’s lows but experienced a rebound on Thursday, resulting in a morning star pattern on the candlestick chart, suggesting a potential deeper recovery. However, sellers dominated on Friday, driving the DXY back towards last week’s lows around the 102.00 level.

Currently, the DXY is positioned just below a key resistance level at 102.64. A daily close at this level would mark the lowest daily close since January 2024.

If the index moves downward from its current position, it would likely find support around the 102.00 level, with attention then shifting to the significant psychological level of 100.00.

On the upside, immediate resistance is at 102.64, followed by the 103.00 and 103.65 levels as the next focal points.

US Dollar Index (DXY) Daily Chart – June 28, 2024

Source:TradingView.Com

Key Levels to Consider:

Support:

- 102.00

- 101.50

- 100.00

Resistance:

- 102.64

- 103.00

- 103.65