The economic data triggered selloff in dollar was rather brief overnight and the greenback stays in familiar range against European majors, yen and commodity currencies. Stocks also ended the day higher with Dow closed higher by 49.38 pts at 16867.51 and S&P 500 closed up by 9.55 pts at 1959.53. Both indices are staying in consolidation below recent made record highs. The more notable moves were found in long term treasury yields. 30 year yield broke last week's low to as low as 3.358 before closing at 3.381. 10 year yield also broke last week's low and reached 2.529 before closing at 2.559. Overall, more inspiration is needed for the markets to break out from recent ranges.

A major focus today is BoE governor Carney's speech as the central also delivers the financial stability report. Markets have been puzzled by Carney's talks on monetary policies recently. Earlier this month, he said that rate hike "could happen sooner than markets currently expected" and that was taken as a hint on the possibility of hike by the end of 2014. Then this week, he said that "there is room for additional spare capacity to be used up before we move rates" which somewhat pushed back the speculation of hike in 2014. Markets would be eager to have more clarity from Carney's communications today.

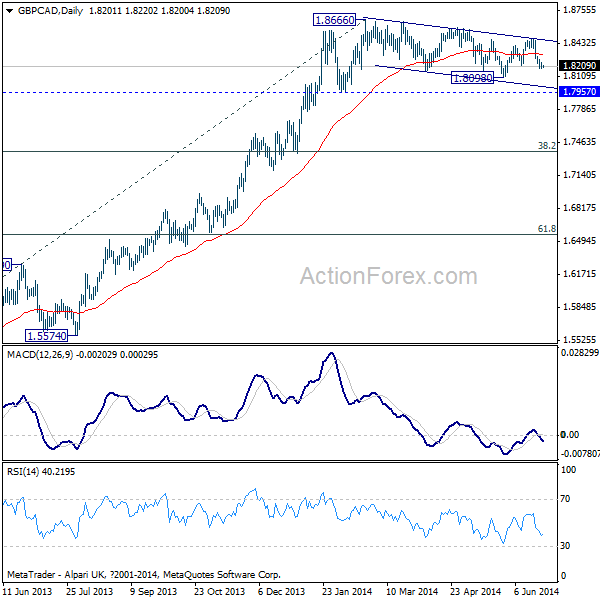

Overall, Sterling is maintaining gains against all major currencies this month except the New Zealand dollar. Though, strengthen is only seen clearly against dollar, euro and swiss franc. Sterling hasn't been that strong again commodity currencies and yen. For example, as noted before, GBP/CAD is staying in the consolidation pattern from 1.8666 and is being bounded in the medium term falling channel. Such consolidation would likely gyrate lower through 1.8098 before taking strong support from 1.7957 and stage a sustainable rally.

On the data front, US will release jobless claims, personal income and spending later today.