Sellers have near term control of indices with 20-day MAs currently under test. Markets closed yesterday on neutral doji - which gives chance for bulls to put in a low, but a larger pullback would be preferable to firm the strength of June lows. On the bullish side, the setup over the last two days can be considered as bullish-harami-doji - one of the more reliable bullish reversal patterns; a gap higher today could see a test of August highs before markets reach their next decision point.

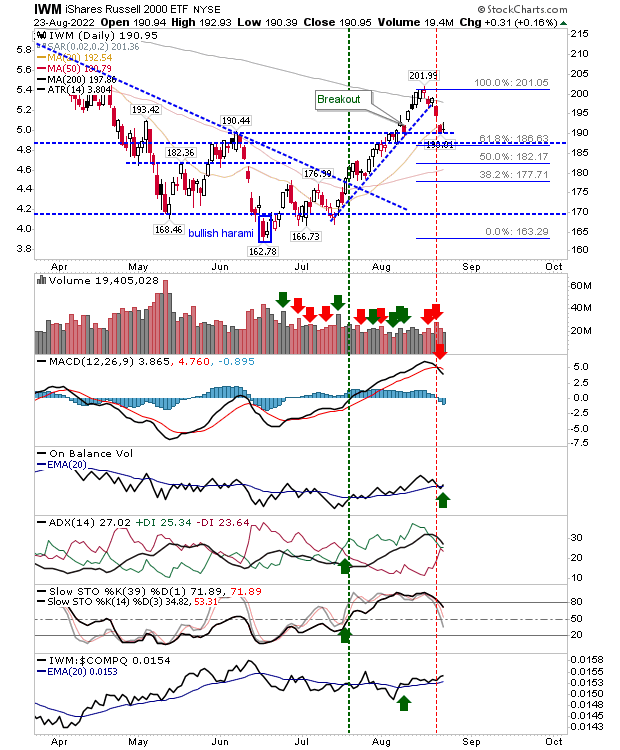

The Russell 2000 is the leading index by relative performance to its peers. However, it's working off a 'sell' in its MACD despite recovering from a 'sell' in On-Balance-Volume. If there is an index to lead a bounce tomorrow, then look to the Russell 2000 to get the party going. As an added kicker, it's holding on to June swing highs as support.

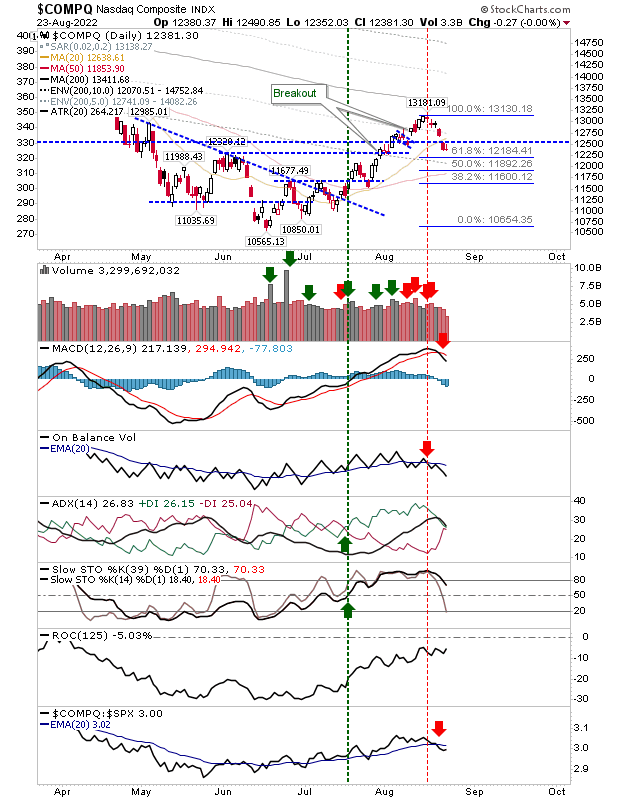

The Nasdaq isn't performing as strongly as either the Russell 2000 or the S&P 500, with confirmed 'sell' triggers in both the MACD and On-Balance-Volume. The ADX is also on the verge of a 'sell' trigger with momentum (stochastics) easing out of an overbought state. If bears are to keep control, then this is the index to watch.

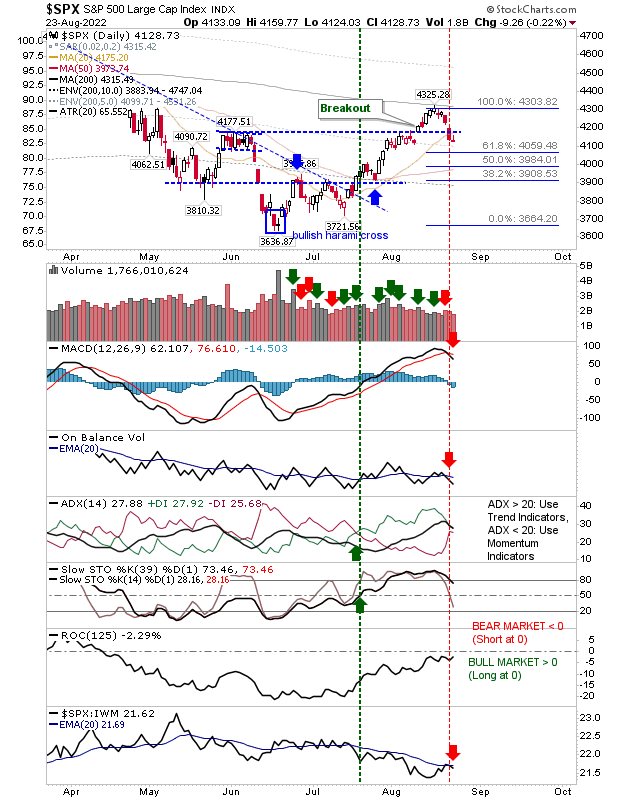

The S&P is the piggy-in-the-middle index. It might prove to be the tie breaker if the Russell 2000 goes up and the Nasdaq goes down. The MACD and On-Balance-Volume are on 'sell' triggers and the index slipped into a relative underperformance against the Russell 2000.

With markets trading near their 20-day MAs on neutral doji, they could go either way. It just so happens that 20-day MAs are caught in the middle of 50-day MAs below and 200-day MAs above; these will be the next tests (and price targets if traders decide to swing trade the break of yesterday's doji).