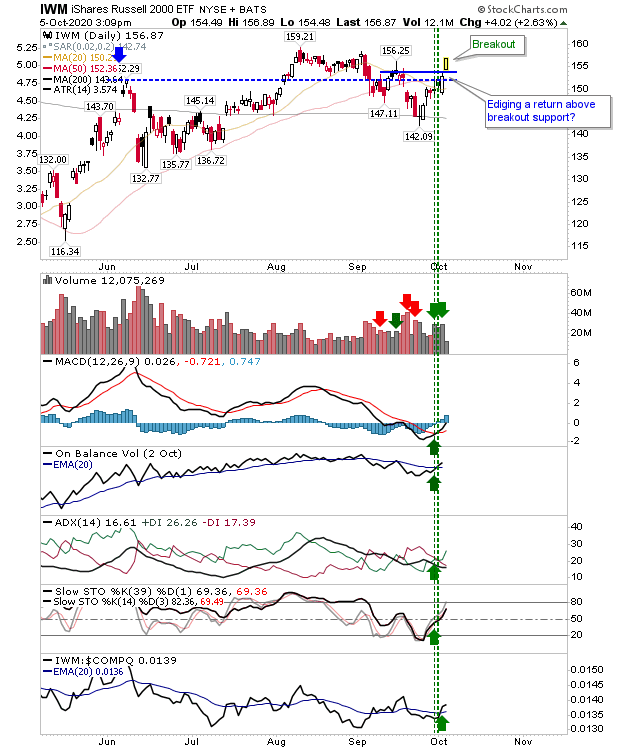

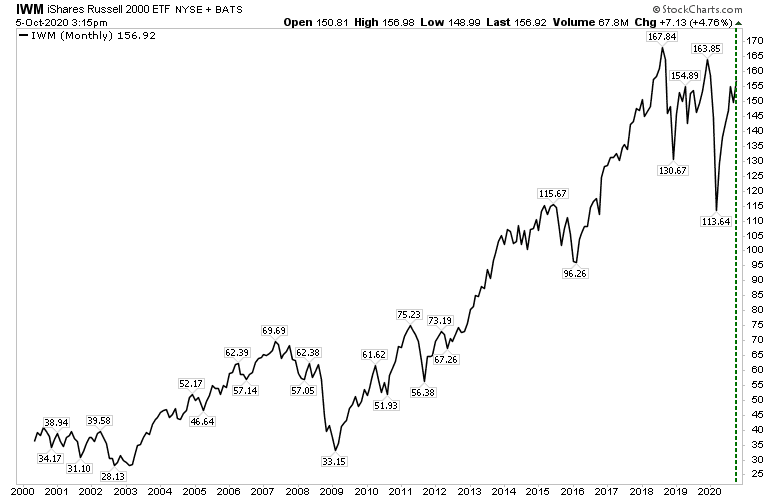

The Russell 2000 (via IWM) shown the most promise into last week's close and yesterday followed that with a move past the most recent swing high—albeit on light volume. In doing so, it returned above its 50-day MA and brings into play the August high as the next challenge. Technicals are all net bullish, including relative performance. This is perhaps the best indication we have for a trade worthy rally as it looks to return above the all-time highs of 2018.

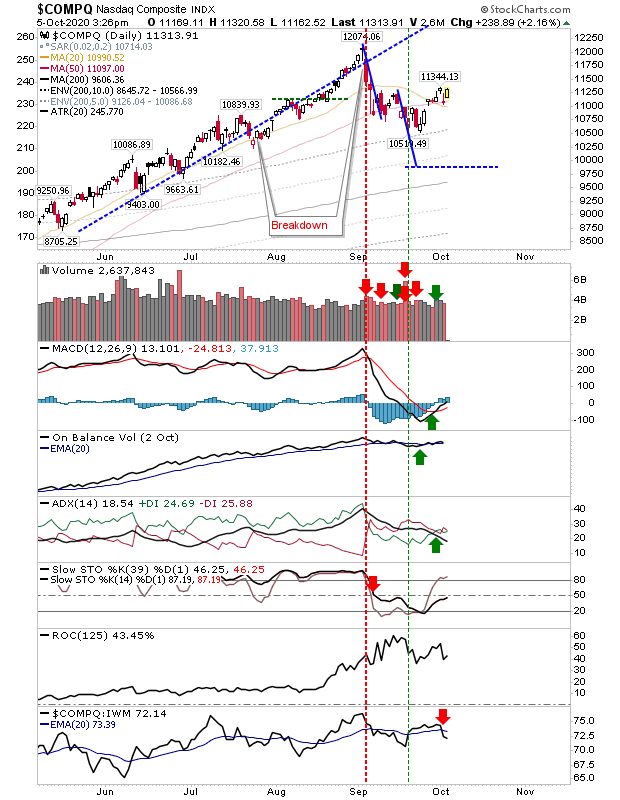

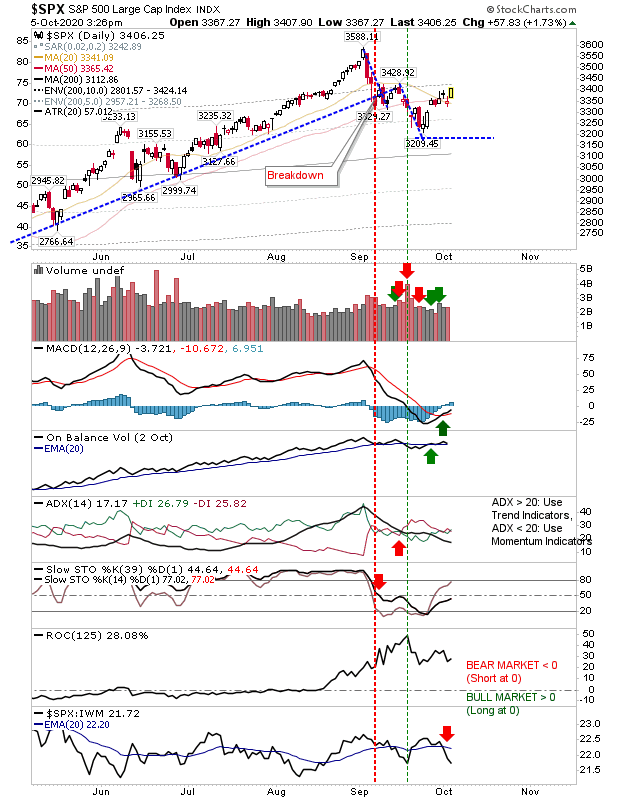

The Russell 2000 wasn't the only index to benefit from Monday's buying. Both the NASDAQ and S&P went from 'bearish evening star' to potential bullish 'island reversal' although technicals are not oversold to support the latter; a close above last Thursday's high would negate the bearish evening star.

While these indices are working off all-time highs they are not enjoying the same technical strength as the Russell 2000 but there is time for both the S&P and NASDAQ to consolidate their gains as the Russell 2000 gets its moment in the sun.

Money continues to cycle into Small Cap growth stocks which is a key driver for a broader rally. In the absence of Trump's COVID-19 diagnosis this would be very positive news but it's hard to know how things will pan out over the next couple of weeks. The election has now become the less volatile issue.