- SVB contagion fears continue to recede, spurring a global rebound in stock markets

- But the mood sours again as Credit Suisse shares sink, euro skids

- Treasury yields make a partial recovery, Fed rate hike path steepens only slightly

- US CPI not much help to wounded dollar as focus turns to ECB decision

Risk appetite on the mend but new risks arise

Investor jitters following the biggest US bank failures since the 2008 financial crisis abated further on Tuesday as a sense of normality returned to the markets after days of turmoil. Bank shares on Wall Street and in Europe made a tepid rebound, but more impressive was the recovery in rate-sensitive stocks amid the sharp drop in bond yields.

The Nasdaq 100 is now almost flat from a week ago, whereas the S&P 500 is down about 1.8%. It’s curious, however, that the broader Nasdaq Composite fares only marginally better than the S&P 500, in a possible sign that liquidity concerns continue to dog the smaller, more vulnerable tech firms.

Moreover, there’s still a significant air of caution in the markets, not only because contagion fears from SVB’s collapse haven’t completely dissipated, but also on worries about the regulatory implications of the past days’ events as the Fed considers toughening up banking rules.

The ongoing troubles of Swiss banking giant Credit Suisse may be contributing to the lingering unease and are dragging European markets lower on Wednesday, with US futures following suit.

The plunge in Credit Suisse shares today is in response to the bank’s annual report yesterday where it admitted that there were “material weaknesses” in internal controls in financial reporting. The news couldn’t have come at a worse time when the banking sector is already under pressure.

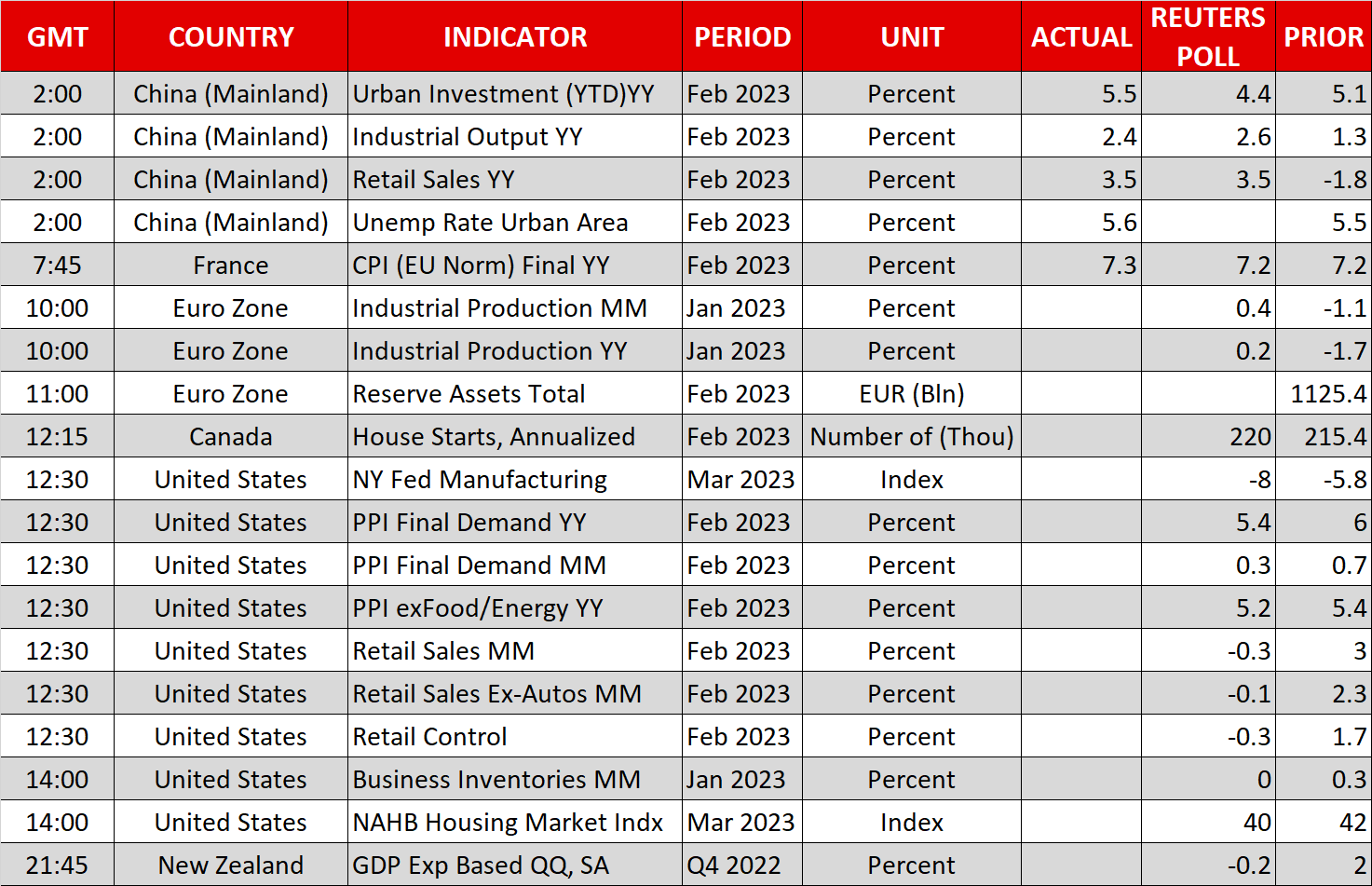

Fed rate hike bets little changed after US CPI

Bond markets backed the general picture in equity markets of some calm being restored. The 10-year Treasury yield has bounced back to around 3.65%, although that’s still some distance away from the 4% region where it stood prior to this crisis.

More crucially though, Fed rate hike expectations have firmed only slightly from Monday’s crash, suggesting that confidence in the US banking system has taken a permanent hit, with markets remaining under stress.

Yesterday’s CPI report went some way in reminding investors about the Fed’s other priorities, as securing low inflation is just as, if not more of an important factor for maintaining financial stability as is shoring up the markets with accommodative policy.

Headline inflation in the US eased to 6.0% y/y in February, meeting expectations, but core CPI spiked by slightly more than forecast on a monthly basis amid another strong increase in rental costs.

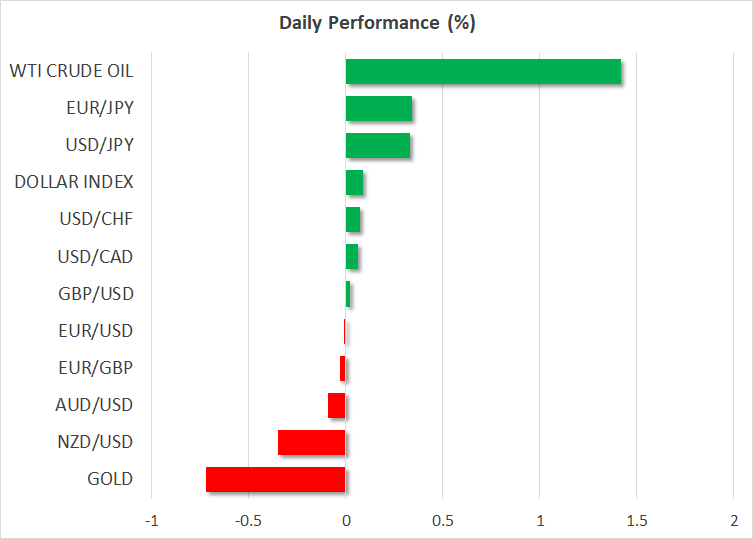

Dollar gets a helping hand from euro slide

Nevertheless, investors think the Fed at best will only hike rates two more times by 25 basis points before pausing and this is capping the US dollar’s gains. The greenback barely regained some footing yesterday as speculation about a less hawkish Fed wouldn’t go away.

But the renewed angst over Credit Suisse has switched sentiment around for euro/dollar today.

The single currency started the day on the front foot on reports that the ECB is likely to stick to its plans to raise interest rates by 50 bps on Thursday according to a source. But it has quickly become the day’s worst performer as fears grow of a new European banking crisis, potentially complicating matters for the ECB tomorrow.

Pound finds some support ahead of UK budget

The Australian dollar also slipped, reversing earlier gains on the back of some encouraging Chinese data. But the pound’s losses were contained as traders awaited Chancellor Jeremey Hunt’s Spring Budget statement due around 12:30 GMT.

Hunt is expected to keep a tight grip on the UK’s finances as he attempts to win over investors following the mini-budget debacle with Liz Truss last September. Although tax cuts are unlikely, Hunt will probably extend the support for energy bills and announce some tax breaks for businesses.