- China stimulus and rate cut bets propel stocks higher

- Dollar caught in choppy trading as crucial inflation data awaited

- Yen surges as new LDP leader in favour of rate hikes set to become PM

- Gold scales fresh record highs before easing

Markets Lifted by China’s Stimulus Blitz

Equity markets look set to finish the week in a buoyant mood amid renewed optimism about China’s economic prospects following Beijing’s latest stimulus efforts and as the Fed and ECB strive to achieve a soft landing.

Earlier today, the People’s Bank of China cut the seven-day reverse repo rate by 20 basis points and the reserve requirement ratio (RRR) by 50 bps, as announced on Tuesday, while Shanghai and Shenzhen will reportedly remove the remaining restrictions on home purchases within weeks.

The spate of measures announced this week by Chinese authorities includes debt issuance of 2 trillion yuan and another 1 trillion yuan to be injected into state banks, all aimed at boosting lending and consumer spending. There’s a possibility of further measures being revealed ahead of China’s Golden Week holiday that starts on October 1. China’s main stock indices have surged by more than 10% on the back of the stimulus announcements.

More than anything, investors are relieved that the government is finally showing that it’s committed to doing whatever it has to, to kickstart the economy’s engines.

Fed and ECB Speculation Intensify

The optimism spread through European and US markets and further aiding the positive sentiment are the expectations that the Federal Reserve and European Central Bank will slash borrowing costs in the coming months. The S&P 500 notched up its 42nd record close of the year.

Investors currently see the likelihood of a 50-bps cut by the Fed in November as a coin toss. Yesterday, the odds stood at about 60%. But with Q2 GDP growth being confirmed at 3.0%, durable goods orders for August coming in well above expectations and weekly jobless claims staying low, there’s been a slight reality check for the markets.

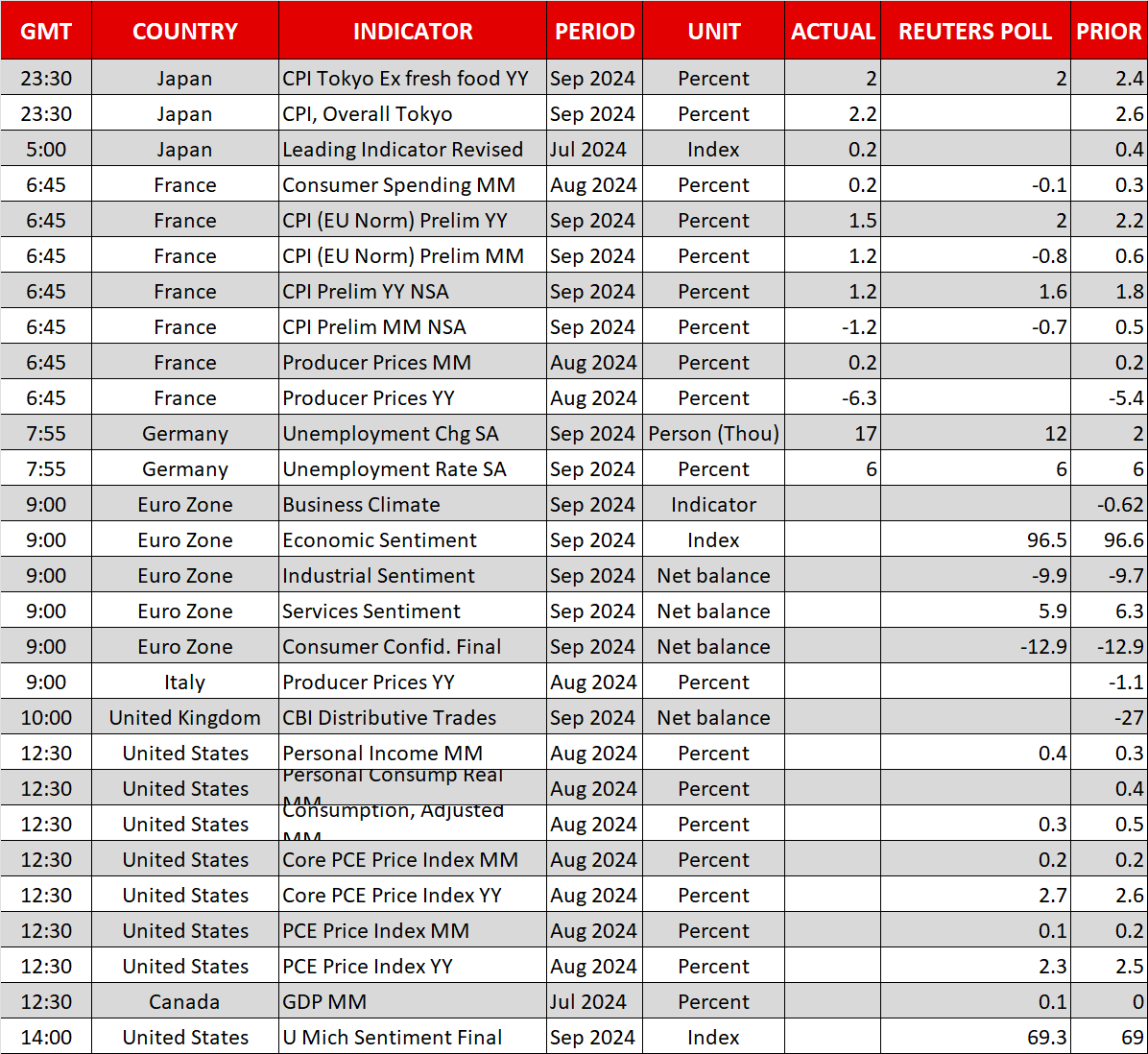

A further reality check is possible today when the personal consumption and PCE inflation numbers are released. Core PCE could edge up to 2.7% y/y, making it difficult for the Fed to justify another 50-bps cut.

For the ECB, however, Eurozone data has been surprising to the downside, so investors have ramped up their bets of a 25-bps cut in October, with policymakers performing a U-turn after earlier signaling a pause at next month’s meeting.

Euro Slips, Yen Reverses Higher, Gold Off Highs

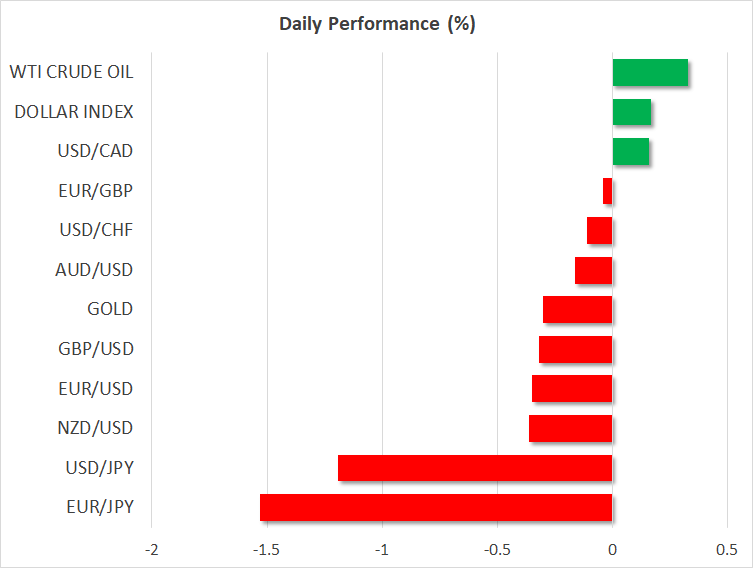

Nevertheless, there’s been no sharp selloff in the euro as Fed rate cuts are still seen outpacing ECB cuts over the course of next year. The euro was last trading lower around $1.1135, while the US dollar slid 1% against the Japanese yen.

Japan’s former defense minister Asia Politics Shigeru Ishiba won the ruling LDP party’s leadership contest and will replace Kishida as prime minister. The tight vote triggered some volatility in the yen, which whipsawed when the results were announced as markets were betting that his rival, Sanae Takaichi, would win the race.

Takaichi is known to be opposed to the Bank of Japan hiking interest rates while Ishiba has endorsed the switch to normalize monetary policy. The gains would probably have been even more had it not been for the Tokyo CPI figures, which showed a drop in the headline rate to 2.0% in September.

But the dollar’s broader resilience may be weighing somewhat on gold today as it’s eased slightly from Thursday’s record high of $2,685.

However, the prospect of lower interest rates globally in the coming year and heightened tensions in the Middle East are keeping the uptrend well intact.