Traders kept their blinkers on yesterday, even as Rome burned. There was very little reaction to the chaos across America, played on a backdrop to COVID-19 and massive unemployment. Markets trade on the future, but this future feels a long way away in what was a blip of a trading day.

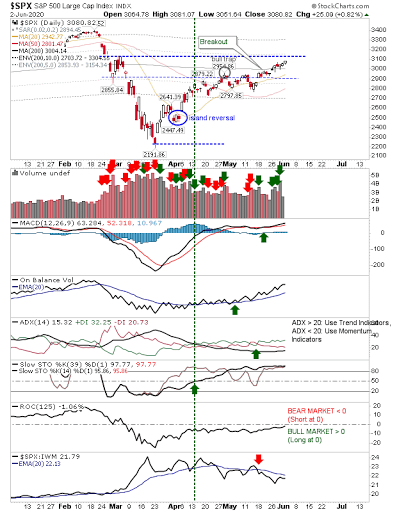

The S&P edged a little higher as it made its way towards February gap resistance.

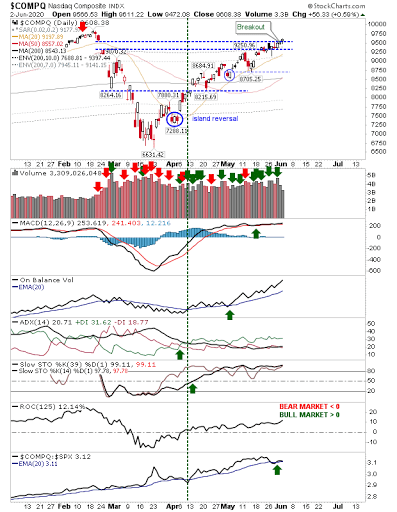

The NASDAQ is on the way to challenging all-time highs and breaks beyond the February gap down—which had been the last major resistance level to break through. On-Balance-Volume has been trending strongly higher and has gone well beyond the February peak.

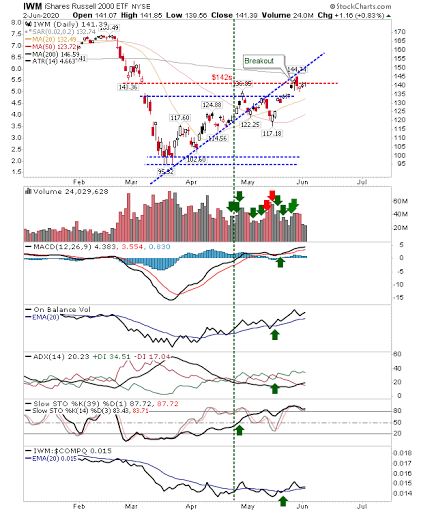

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) remains dominated by the bearish engulfing pattern from last week. While technicals are bullish, price action has struggled to get past its 200-day MA. As the days pass, this level is proving to be an ever greater problem.

Given the events of the last few days, price action was irrelevant and inconsequential.

Trump needs to go, now (President Pence doesn't appeal - but better than what we have). Mitch McConnell should be giving him the boot, but there is no leadership in the GOP so hard to see where the positives are going to come from. Republicans need to speak out, and those with any authority have all been quiet...the GOP is an empty vessel.