Market Brief

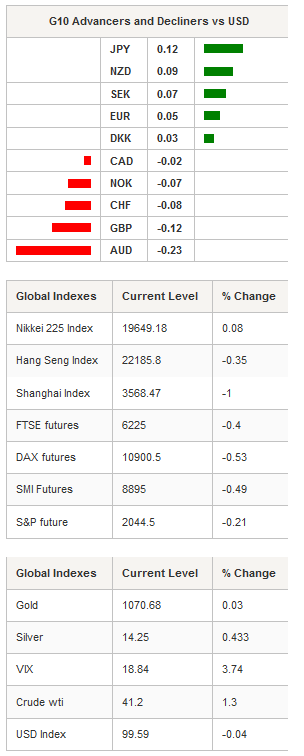

Events unfolding in Paris have once again grabbed the market’s attention, leading to subdued price action. According to the FAA, two Air France KLM SA (PA:AIRF) US-Paris flights have been diverted following bomb threats in the US and tactical police teams are shown swarming around Paris. In the G10, USD returns were balanced, highlighting a level of indecisiveness in the markets. Asian regional indices were mixed as the Nikkei 225 rose 0.9%, while the Hang Seng and Shanghai composite both fell -0.21% and -1.01% respectively. European futures are pointing to a lower open as events in Paris weigh on investor sentiment. The USD/JPY exhibited limited volatility, trading in a 20pip range between 123.47 and 123.23. AUD/USD, weakened in choppy trading to 0.7091 from 0.7117. USD/CHF continued to see solid demand, trading to a new high of 1.0170 in the Asian session. The PBoC raised the USD/CNY fix by 56pips to 6.3796, reversing yesterday’s lower fix. Commodities and commodity linked currencies continued to feel supply hitting the market. Gold dropped to $1064 but was able to rally as Europe opened its doors and coverage of Paris sent investors to the primary safe haven. Copper remained weak, falling to $206. We remain significantly bearish on basic commodities currency such as CAD and NOK as oversupply and low demand should provide a strategic theme in 2016 (alongside the Fed’s rate hike path). Crude prices did tick up slightly on evidence that US stockpiles fell and refinery activity rose, however the rally should be limited. With global social risks elevating and FOMC minutes expecting to sound hawkish, we remain constructive on the USD (despite inching closer to being fully priced in).

China data indicated that home prices are slowly recovering. The supply gut has declined as policymaker’s efforts to revive the economy through interest rate cuts and easing mortgage restrictions are starting to work. New house prices increased in 27 cities, while prices fell in 33 cities. Larges cities continued to see solid gains as prices in Shanghai were higher by 1.8% and 0.6% in Beijing. Stabilization of the Chinese housing markets is a main construct to our Asian growth recovery theme for 2016. In Australia, the 3Q wage price index, which tracks the hourly rate of pay increased 0.6% q/q and 2.3%y/y.

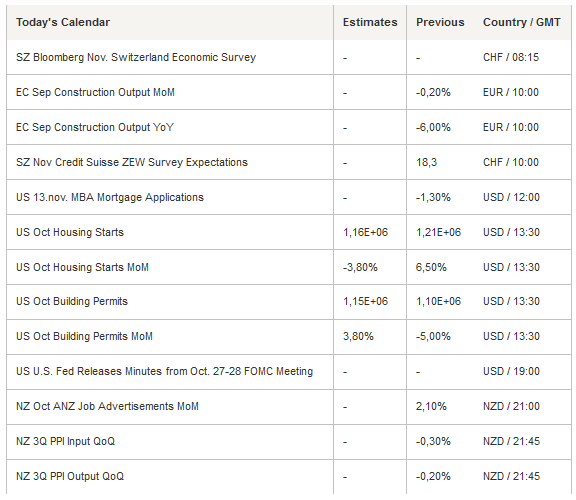

On the events calendar we have US housing start and FOMC minutes. For housing starts markets expected a decline of -3.8 to 1160k, which is still above the yearly average. With a significant amount of noise coming from Fed members, today’s FOMC minutes could provide some clarity on their current views. In our view insight into opinions on global risk will be critical for decisions for a December rate hike. Current rhetoric indicates that Fed member are not comfortable with the level of global volatility and therefore will focus on labor markets and price stability for guidance. In other US news we will hear from several Fed officials including Dudley, Mester, Lockhart and Kaplan.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0668

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5659

R 1: 1.5529

CURRENT: 1.5206

S 1: 1.5027

S 2: 1.4566

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 123.27

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.0240

R 1: 1.0129

CURRENT: 1.0133

S 1: 0.9739

S 2: 0.9476