Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

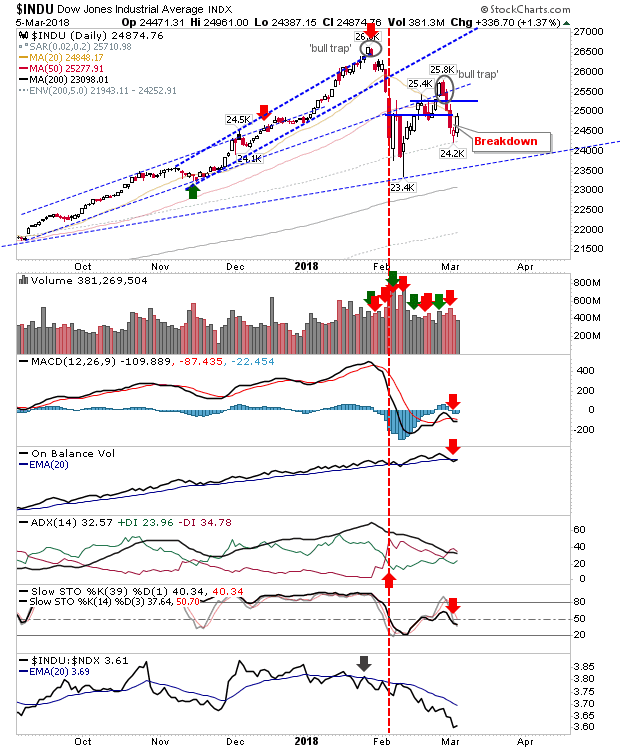

A solid day for indices as markets continued the good work from Friday. Even the Dow Jones was able to firm up a potential 'bullish morning star' sequence. There is still work to do but this looks better for bulls with anyone considering a short trade lacking a natural point of attack (yet).

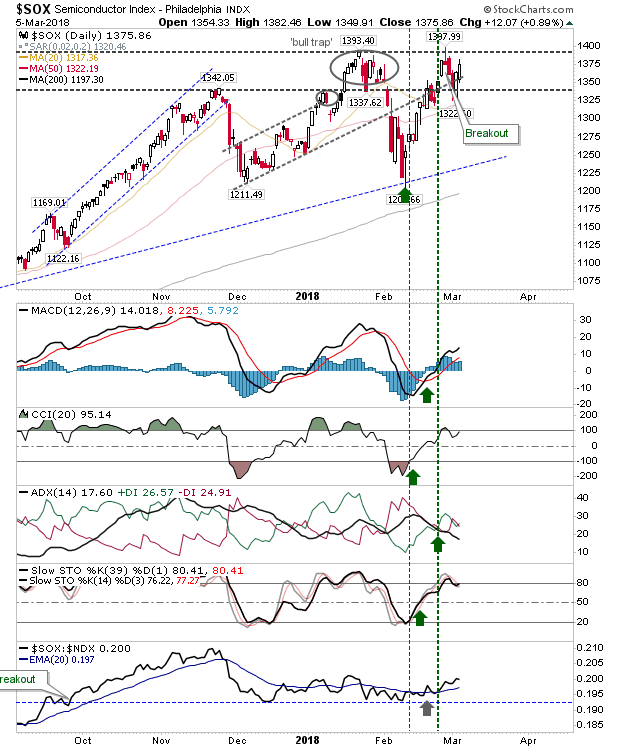

The Semiconductor Index is just a few points shy of a breakout and continues to be the index likely to lead out the next rally (or fake it).

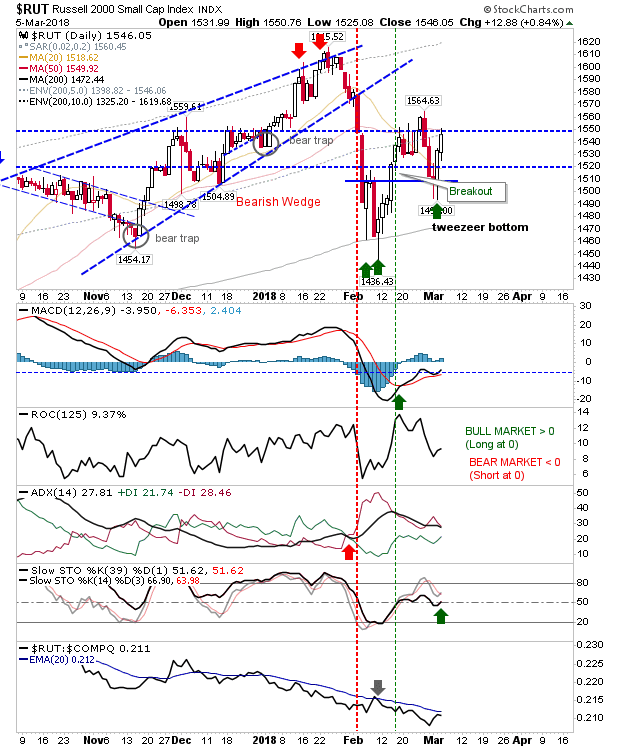

The Russell 2000 will be looking to challenge 1,564 on Tuesday. A break of this swing high will attract sideline money to trade into its next challenge of the all-time high of 1,615. There was an uptick in relative performance after months of weakness; if this metric crosses its moving average it will act as a confirmation trigger for a possible leadership switch back in favour of Small Caps.

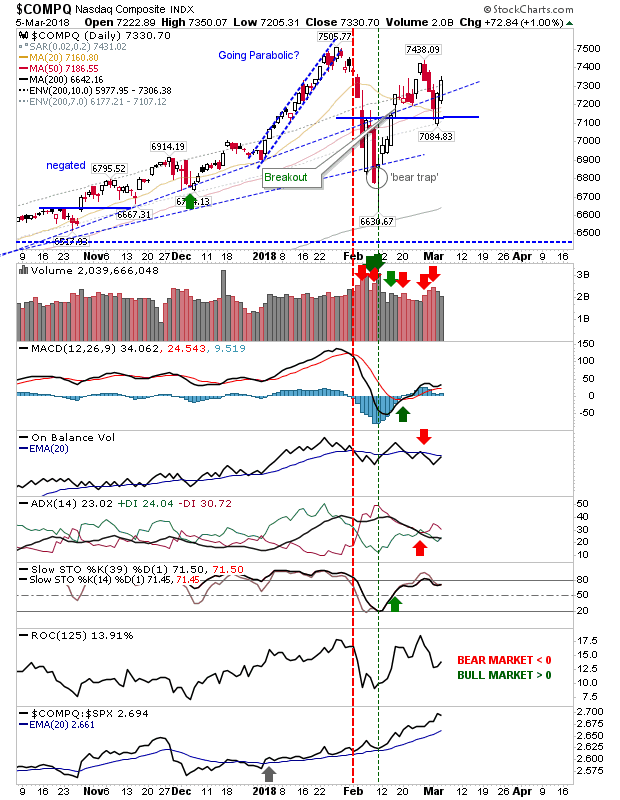

While Small Caps are making inroads against the NASDAQ, the latter index is out-performing the S&P with a sequence of new highs. Existing longs have no reason to sell yet (trailing stops on a loss of 7,085).

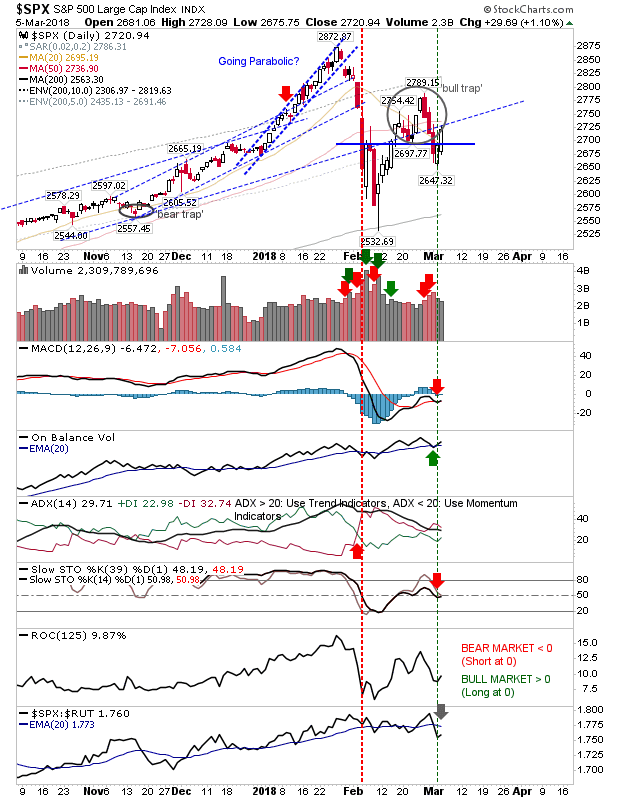

Finally, the S&P is coming into testing converging 20-day and 50-day MAs resistance as it works at challenging (and negating) the 'bull trap'. If there is an index which is going to struggle on Tuesday the S&P will be it.