Thursday's action did me favor and ensured there was no significant give-back to Wednesday's gains. What was important (for me) was that gains managed to negate the lingering bearish 'black' candlesticks from last week which were casting a bearish pall on recent action in the Nasdaq and S&P - although the Russell 2000 is now starting to struggle a little.

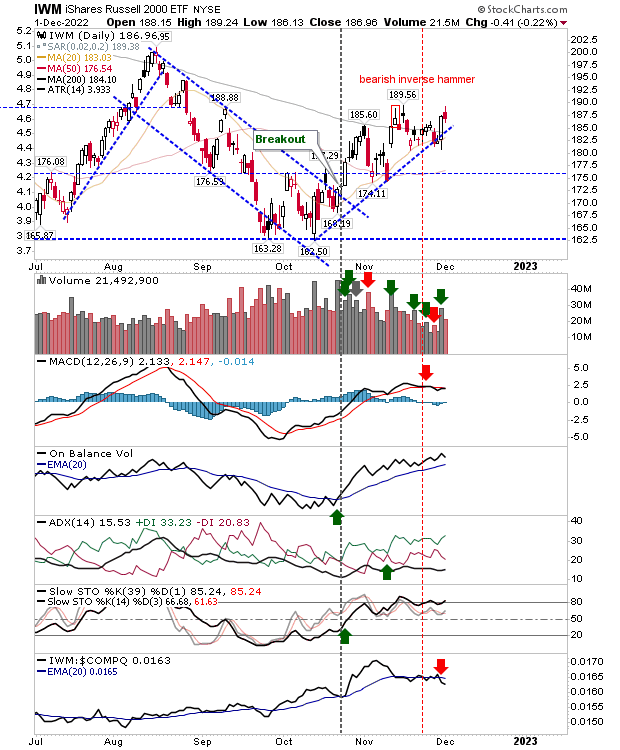

Of the Russell 2000, the index has moved to an underperformance relative to the Nasdaq and S&P and although the index posted strong gains on Wednesday - which returned it above its 200-day MA - it wasn't enough to negate the bearish inverse hammer. It may be up to other indices to help pull the Russell 2000 higher, but as long as $176 support holds (on any future decline) then bulls can rest easy.

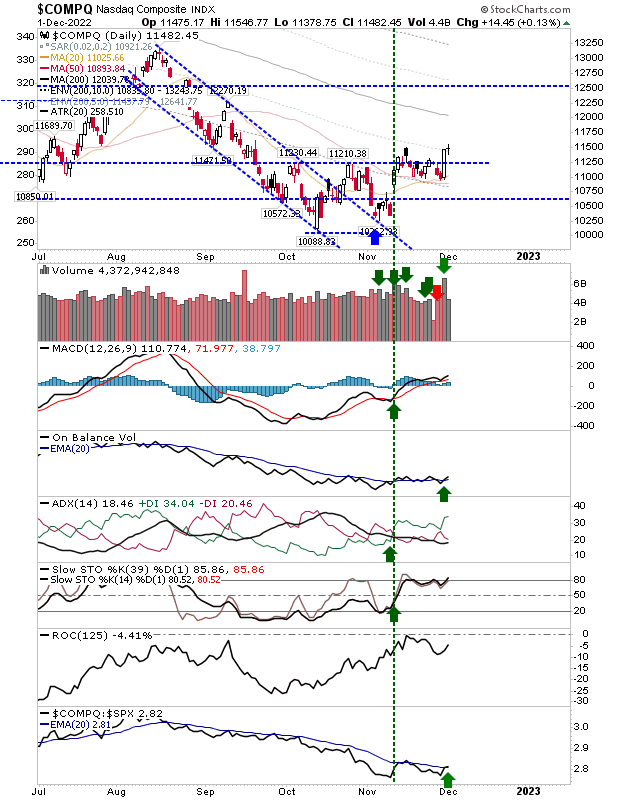

The Nasdaq was able to defend 20-day MA support as it looks to extend its base. Technicals returned net bullish with a 'buy' trigger in On-Balance-Volume. It also nicked a new relative performance gain over the S&P to make it the lead index of the three.

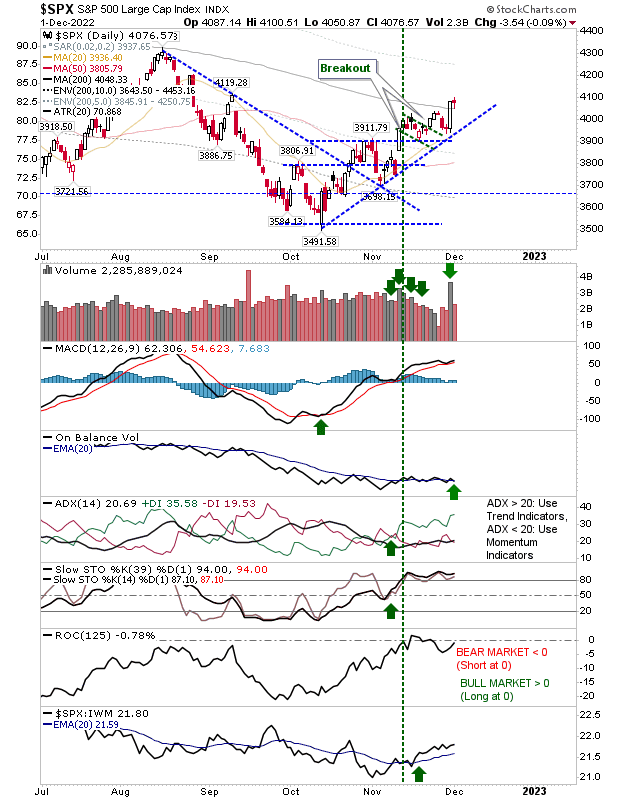

The S&P managed to close above its 200-day MA on Wednesday and held above this key MA on Thursday. As with the Nasdaq, technicals are net positive. Rising support has also managed to stay in play, giving multiple options for bulls to defend if selling returns.

From what I'm reading, there is plenty of negativity out there, but what we need to consider is that we have been looking at a market which peaked in the latter part of 2021 and has been in decline ever since. Bear markets don't end until the last swing high (of 2021 in the current instance) is breached and I suspect we won't see this until 2024 - if not later. That doesn't mean we aren't close to the low of the current decline, but we could spend the next couple of years in an extended trading range. This would help nobody in the headline industry, but it wouldn't damage your portfolio much either.