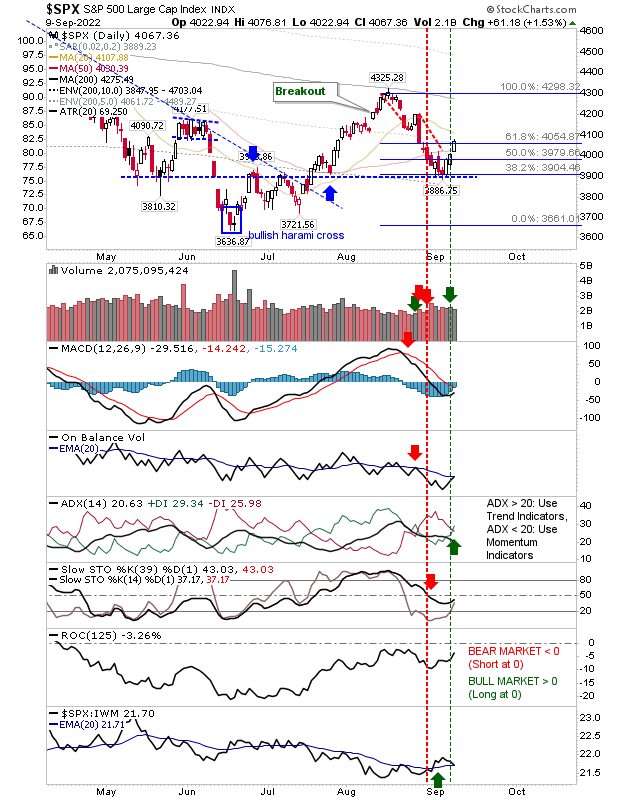

Bulls will be happy the bounce in markets managed to add another day on Friday, but the buying volume remained disappointing. However, we did see easy breaks of 50-day MAs, which opens up moves to 200-day MAs and/or August highs. Whether we get there will largely be determined by buyers stepping in with volume, but we can let price action drive momentum for now.

The S&P added to the bullish momentum with a new 'buy' trigger in the ADX, but other technicals remain bearish. The index is just above holding on to its relative performance advantage against the Russell 2000 - but is on the verge of an underperformance switch to this index. The other indicator to watch (which I don't mention much) is the Rate-of-Change (ROC). If ROC can return above '0' it would mark a cyclical return for bulls.

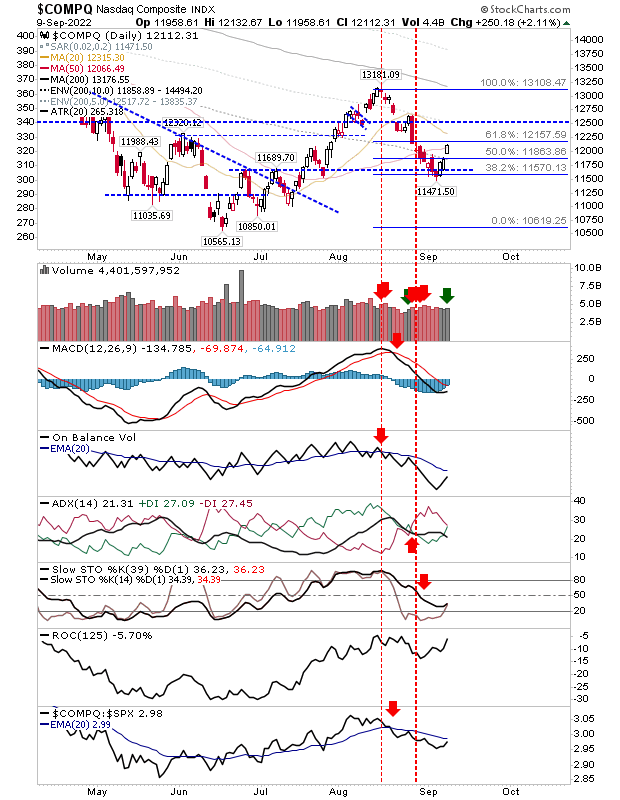

The Nasdaq is lagging behind the S&P with technical still net bearish, including a relative underperformance to the latter index. However, it did manage a close above its 50-day MA, and unlike the S&P, was able to register an accumulation day.

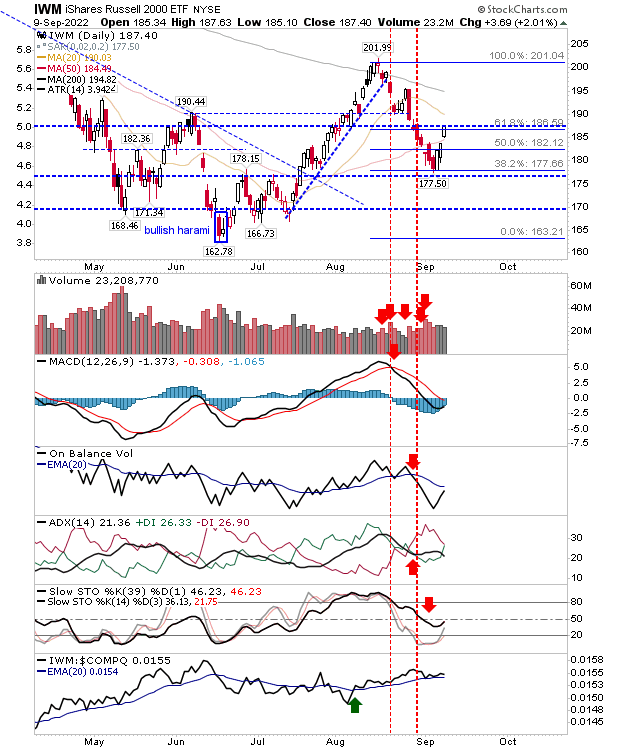

The Russell 2000 continues to outperform the Nasdaq, although the rate of outperformance is slowing. There was no accumulation (for the ETF, IWM) although slow stochastics remain very close to a bullish cross of the mid-line stochastic. Because of its relative outperformance to peer indices, it may be the first to test its 200-day MA.

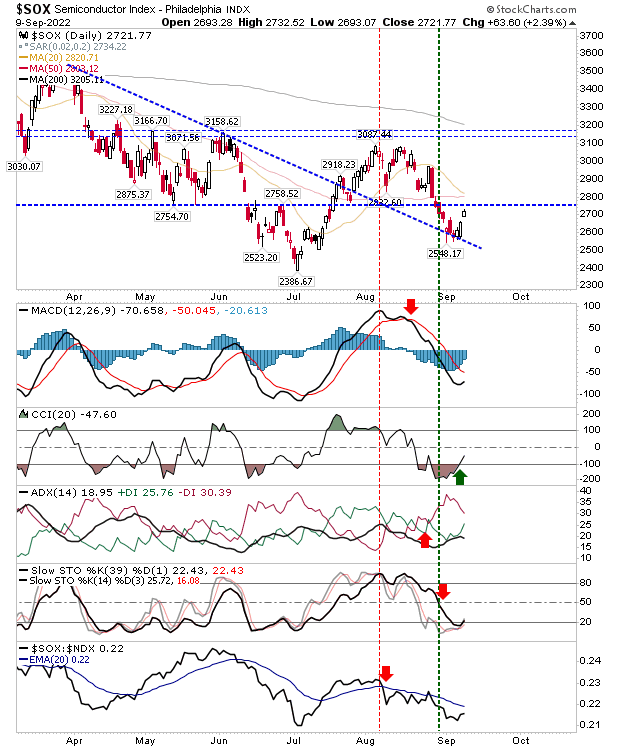

One of the bellweather sectors is the Semiconductor Index. Of all the indexes it's the one struggling the most. The sector is still to challenge its 50-day MA and has come closest to retesting July lows, but it has begun to climb out of an oversold state.

The 3-day rally is not one to inspire confidence, but as long as it continues bulls will keep their advantage. An undercut of last week's low will almost certainly deliver a move back to the July lows and shorts may want to jump on that - but until this happens 200-day MAs are targets.