Equity markets have been experiencing heightened volatility, with declines raising concerns among investors. Last week marked the worst performance for stocks since September, driven by ongoing uncertainties surrounding tariffs. As of market close on March 10, the S&P 500 has fallen over 8.5% from its February peak, while the Nasdaq has dropped more than 13% from its December high. This turbulence has caused investors to wonder when the selling might stop and to seek strategies to navigate the challenging market environment.

Tariff Uncertainty's Role in the Downturn

A key factor behind the recent market selloff is the uncertainty surrounding trade tariffs and their economic implications. The lack of clarity regarding tariff policies has made it difficult for markets to stage a meaningful recovery, as investors hesitate to make significant moves without a clearer outlook. This week will bring a bevy of economic data, including Job Openings and Labor Turnover Survey (JOLTS) job openings, consumer and wholesale inflation, on top of ongoing government funding negotiations, which hopefully will begin to clear some pockets of uncertainty.

Uncertainty Moves Yields and Volatility

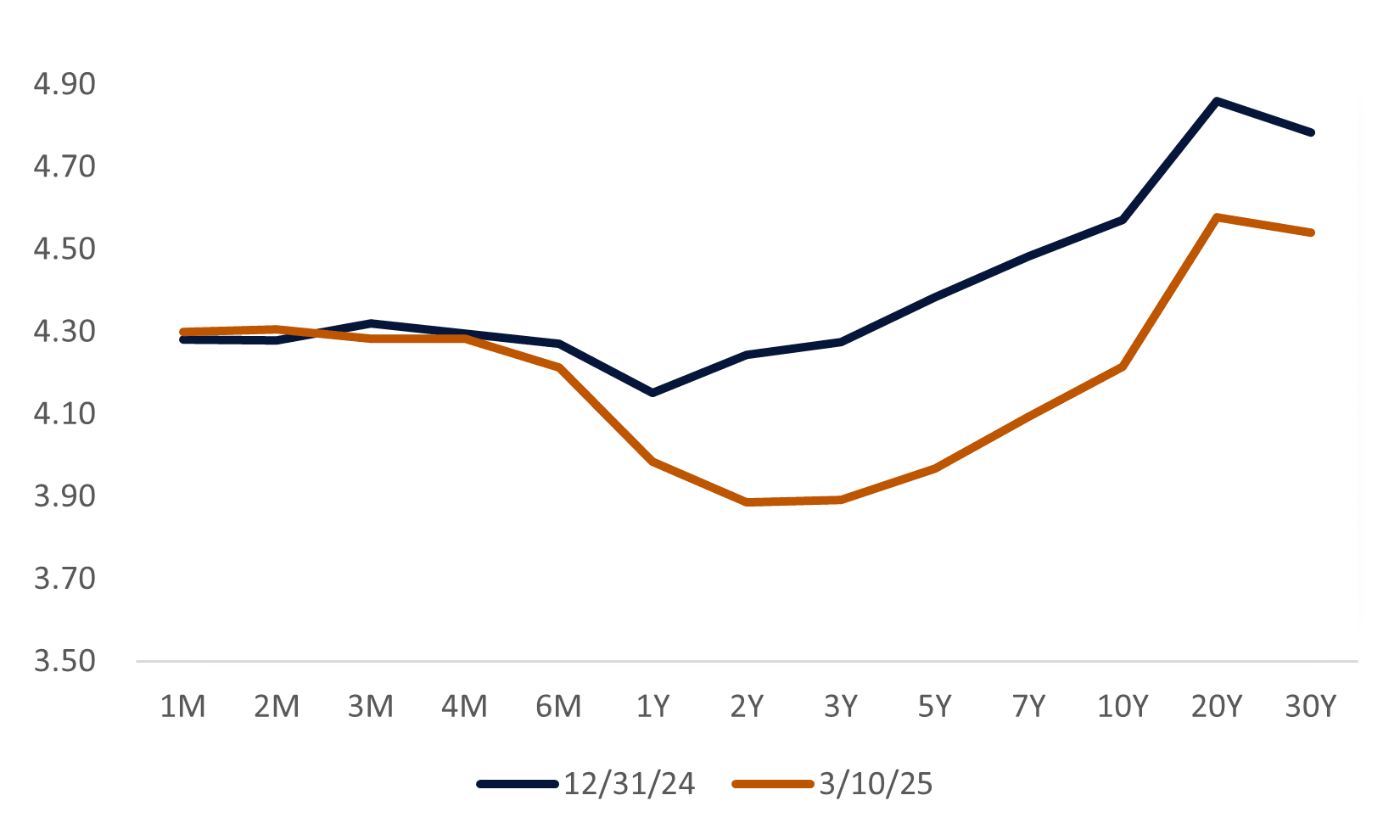

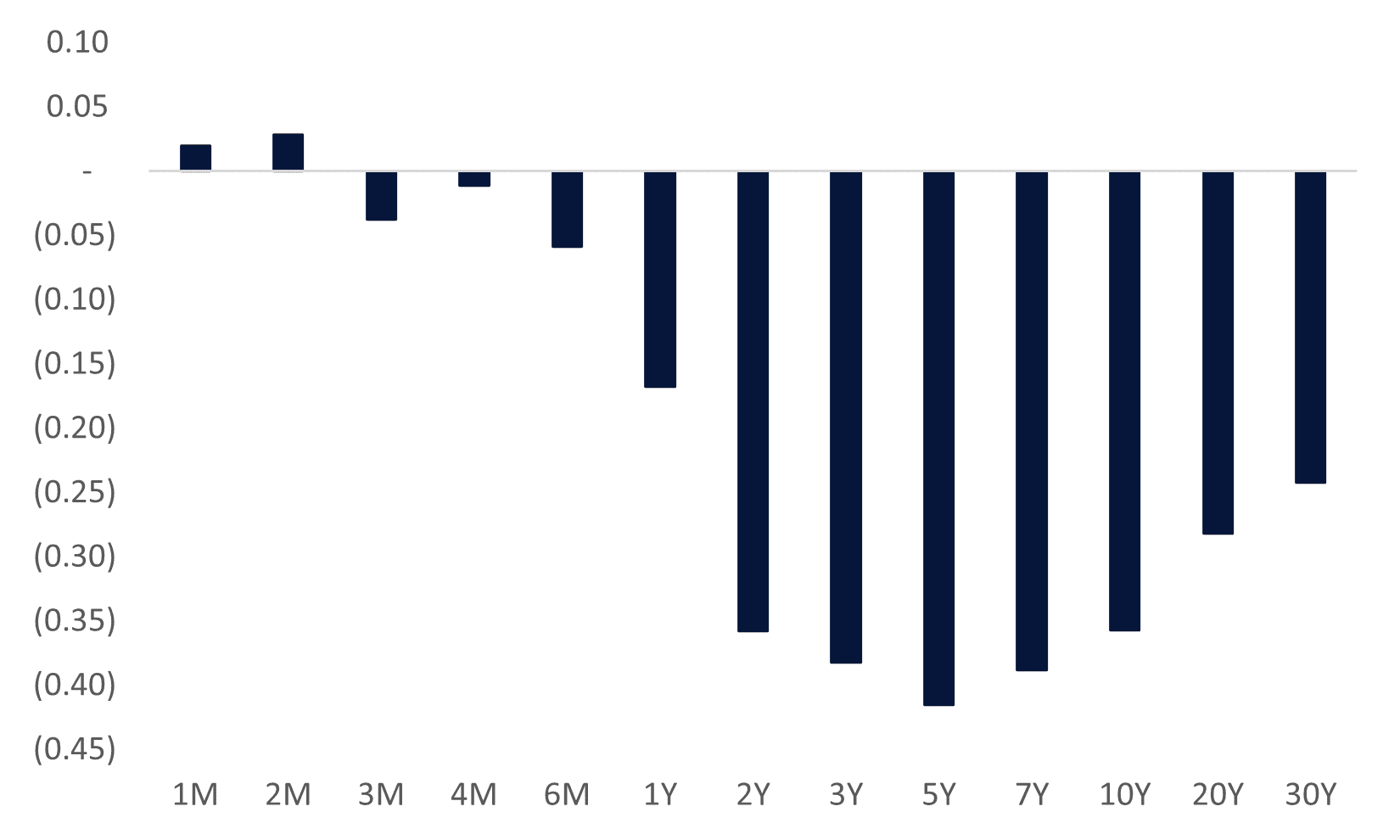

This ambiguity is fueling volatility and contributing to equity market pullbacks, also sending bond yields lower and prices higher. Recent remarks from Treasury Secretary Scott Bessent, alluding to a potential “detox period” for an economy that had become addicted to government spending, proved to exacerbate the selling as bears pointed to weakening growth forecasts. As economic worries mount, increased bond buying has taken yields lower. The “U.S. Treasury Yields Fall Amid Economic Pressure” and “Year-to-Date Changes in U.S Treasuries by Tenor” charts highlight the change in key rate tenors for U.S. government bonds.

U.S. Treasury Yields Fall Amid Economic Pressure

Source: LPL Research, Bloomberg 03/10/25

Disclosures: Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

Year-to-Date Changes in U.S. Treasuries by Tenor

Source: LPL Research, Bloomberg 03/10/25

Disclosures: Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

The Bottoming Process

However, a broader market recovery is not expected to begin until there is greater clarity on tariffs and trade relationships. This process could take months rather than weeks as markets adjust expectations for economic growth and corporate profits. At present, there is limited technical evidence supporting a "buy-the-dip" strategy, warranting caution. Last week, broader market indexes fell by 3.1%, with new tariffs on Canada, China, and Mexico taking effect on March 4. Last night the S&P 500 broke through critical support levels near its October lows (5,703) and breached its 200-day moving average (dma) (5,733), positing a legitimate test for the index and suggesting the drawdown may have more room to run.

Momentum and Breadth Indicators

Momentum indicators have turned bearish, with over 40% of S&P 500 stocks hitting four-week lows last week. Additionally, nearly 12% of stocks reached oversold levels based on Relative Strength Index (RSI) readings below 30. Historically, oversold conditions across 20% or more of the index have coincided with short-term relief rallies.

However, technical damage remains concerning; only 53% of S&P stocks are above their 200-dma — a level close to bearish thresholds. While oversold conditions seem to be approaching, a full bottoming signal has yet to emerge, suggesting that further downside may occur before stabilization. Investors should avoid aggressive buying until technical evidence supports a recovery.

Understanding Market Corrections

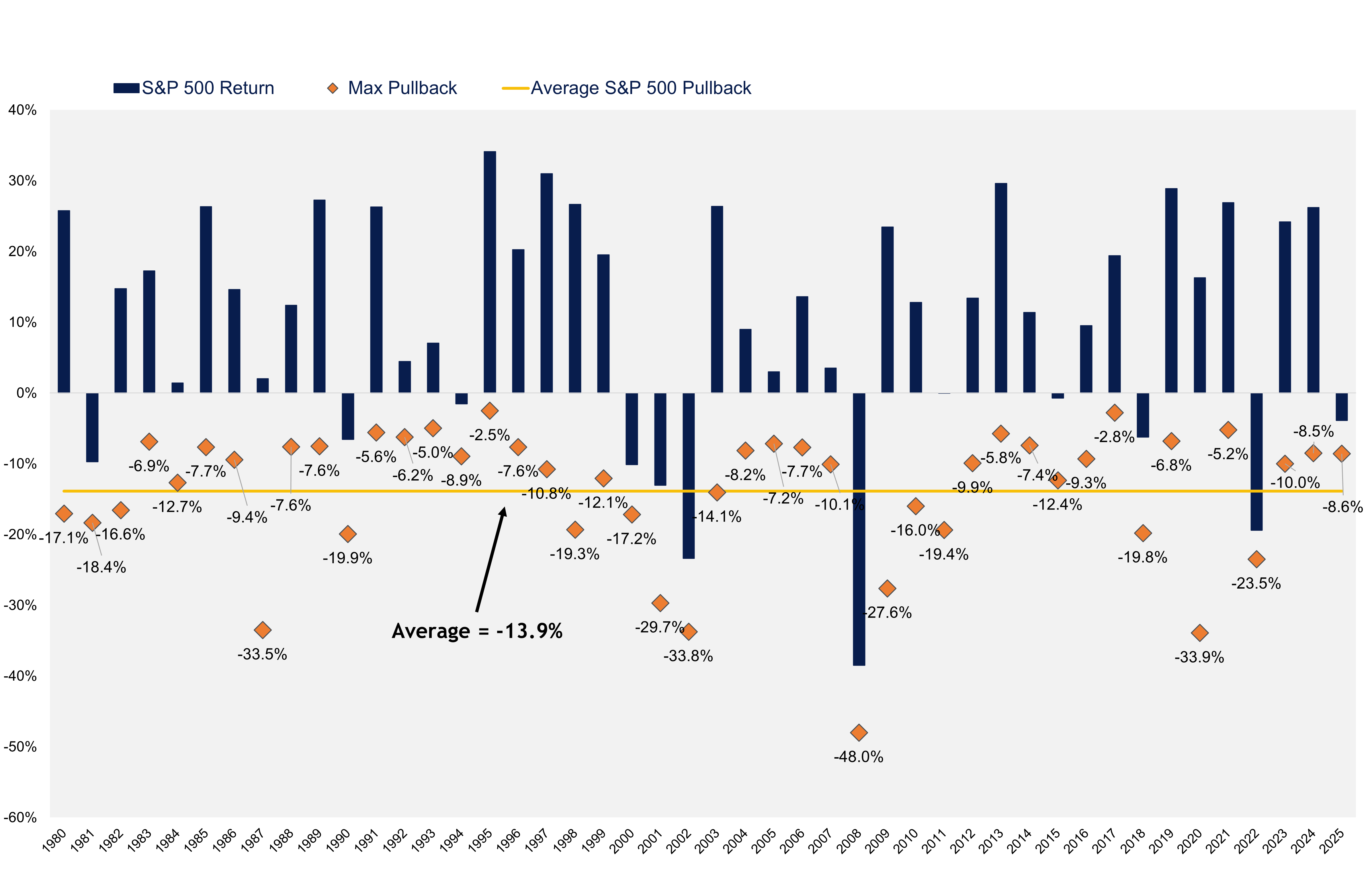

Market pullbacks of 5–10% are common, with the S&P 500 averaging three such declines annually. Corrections — defined as drops between 10–20% — occur less frequently but remain a regular feature of equity markets, with one correction typically happening each year. We plan to explore this area in greater depth in tomorrow’s LPL Research Blog but thought it would be helpful to remind readers that volatility should be expected.

The “S&P 500 Max Pullback Per Calendar Year” chart highlights the S&P 500’s maximum pullback each year since 1980, with the accompanying return for that year. The average maximum drawdown for a given year is 13.9%, while the average gain during that period (since 1980) has been 11.9%, providing evidence that market volatility is like a toll investors pay on the road to attractive long-term returns.

S&P 500 Max Pullback Per Calendar Year

Source: LPL Research, Bloomberg 03/10/25

Disclosures: Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

Conclusion

The recent equity market decline underscores the importance of diversification and disciplined long-term investment strategies. While tariff uncertainty continues to weigh on sentiment and drive volatility, these pullbacks may create opportunities, in due time, for investors to enhance returns by acquiring stocks at discounted prices. LPL Research also suggests exposure to diversifying alternative strategies for both tactical and strategic asset allocations. Products indexed to alternative strategies benchmarks have proven to be a useful tool in mitigating equity market declines this year. Staying informed and cautious will be essential in navigating these turbulent times effectively.