Investing.com’s stocks of the week

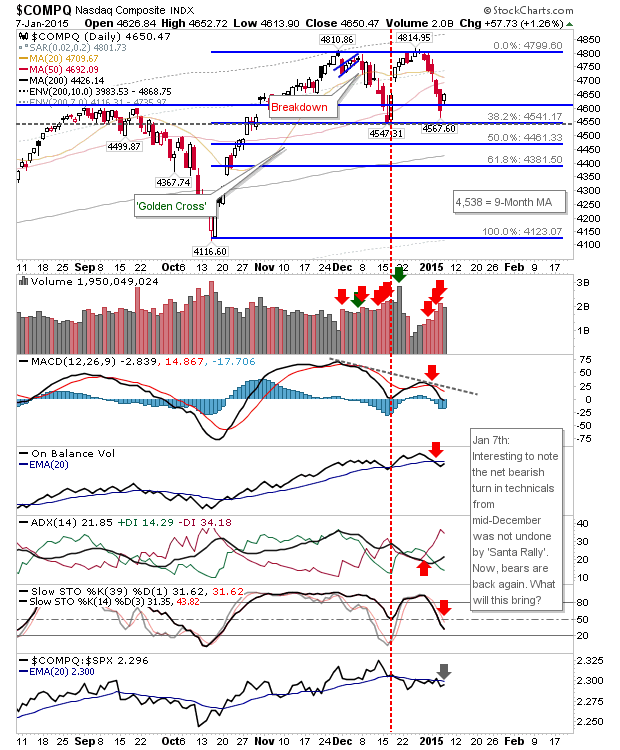

A gap higher at the start of business didn't lead to any big gains, but it did manage to put some distance on yesterday's lows. Given the risk:reward potential it's probably not a great 'buy' here, but if a higher low can be posted it will give bulls something to work with. A gap higher tomorrow would probably use a stop on a loss of today's lows.

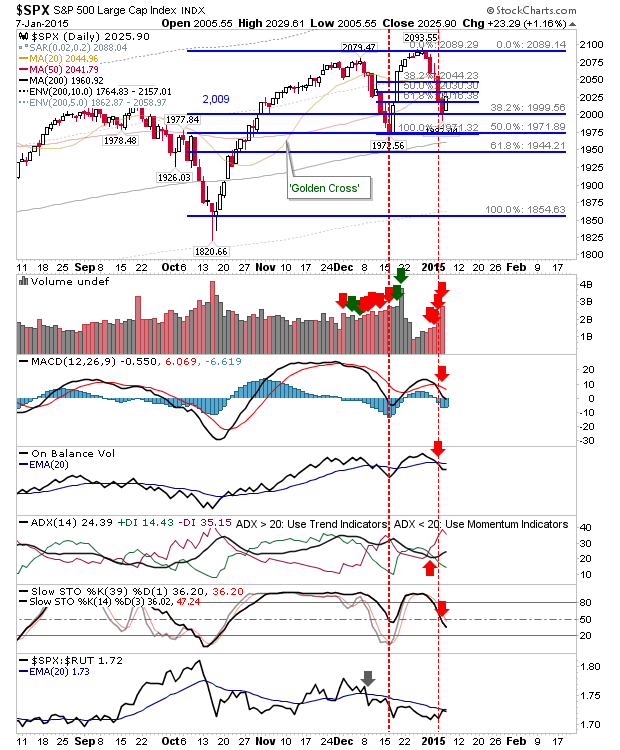

The S&P 500 made it back inside the 61.8% fib level of the December-January decline, but it may be too little to late. The 2,000 level is the stop level for longs looking for a retest of 2,089.

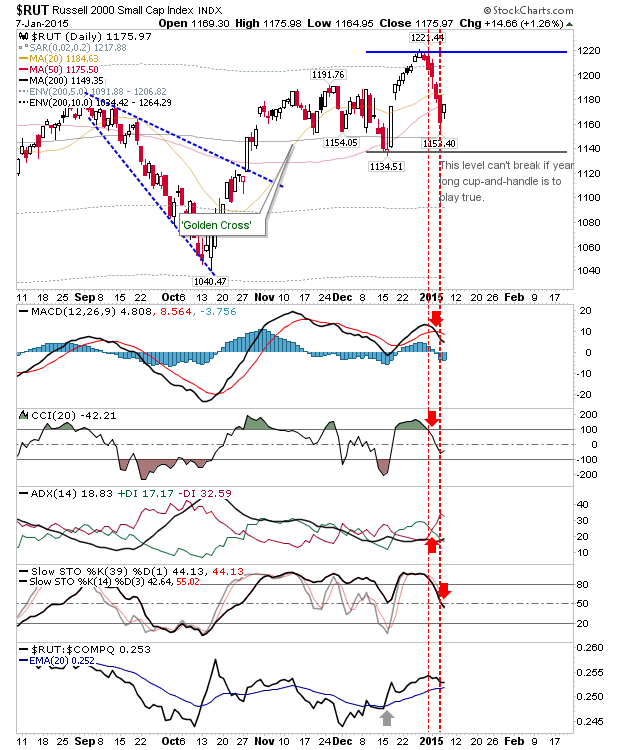

The Russell 2000 is in a no-mans land between support/resistance of the handle. Technicals are net bearish, but little more to say for now.

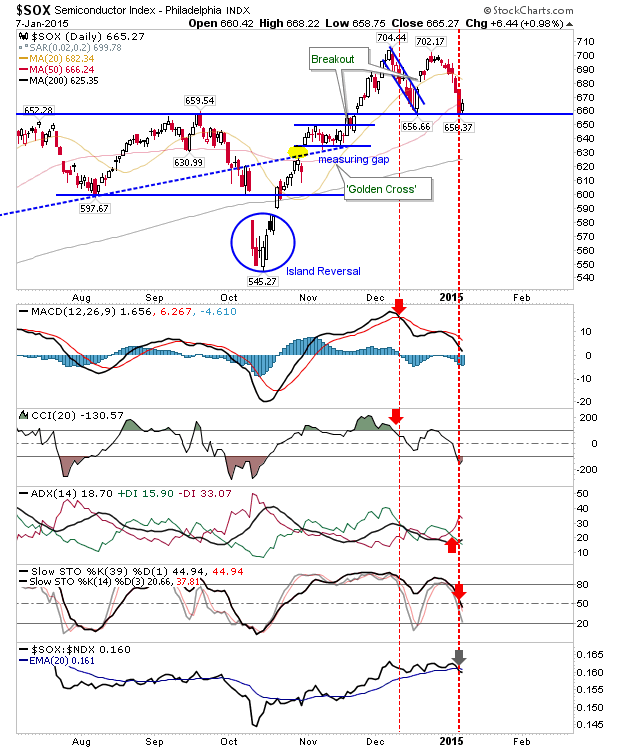

Aggressive longs can look to the Semiconductor Index as it defends 660 support. It has the best risk:reward potential, even if the current decline doesn't look like it will hold such support. Technicals are also net bearish.