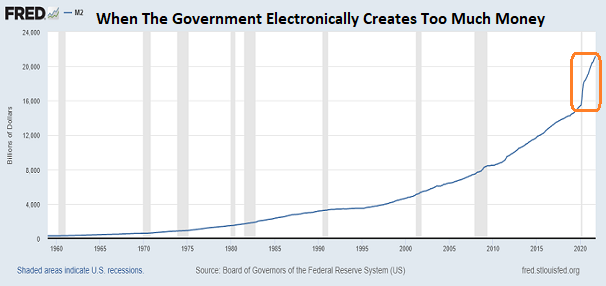

Digital money printing and interest rate manipulation seemed like a no-brainer in March of 2020. The world’s economic activity had been coming to a screeching halt.

Here at the end of 2021, however, there are too many dollars chasing a scarcity of available goods and services. Demand is dramatically outpacing supply.

The result? Persistent, pervasive inflation.

The primary way to battle inflation is for the Federal Reserve to increase interest rates. In particular, the central bank of the United States will end its money printing activity early in 2022, and then begin hiking its overnight lending rate shortly thereafter.

The tightening might lead to significantly higher borrowing costs. That would be a headwind for mortgage affordability as well as real estate appreciation. Similarly, higher borrowing costs may be too difficult for stocks to bear.

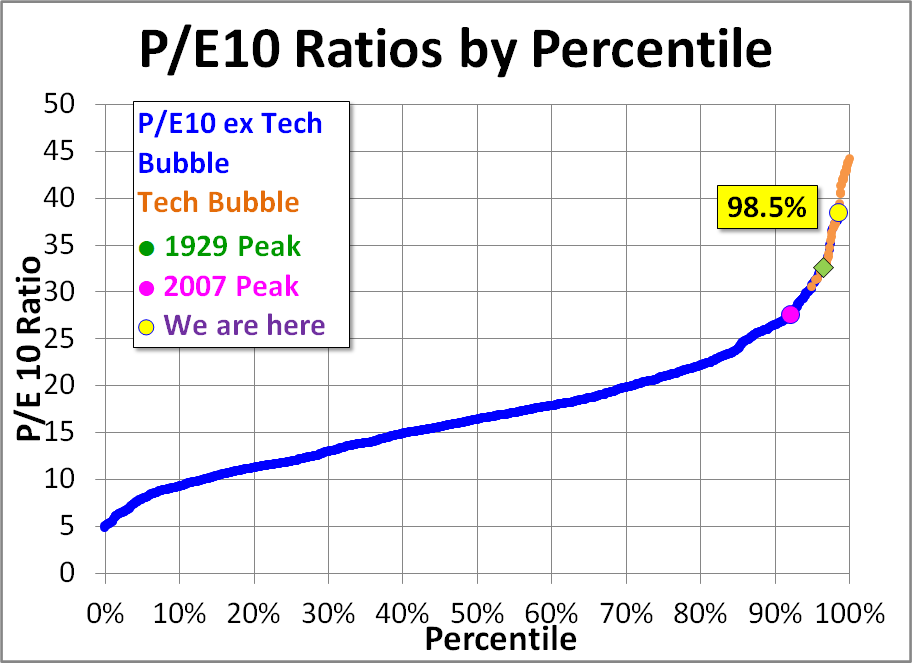

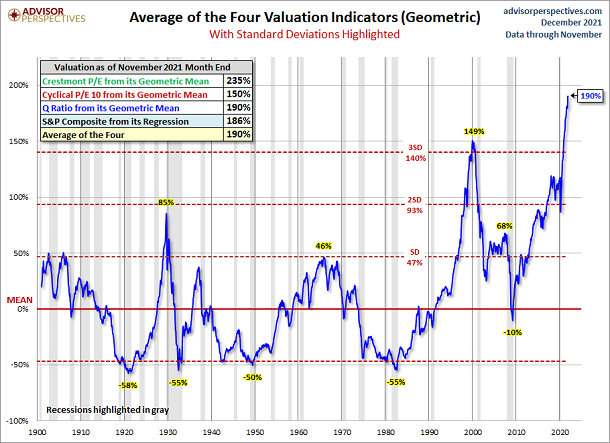

For the better part of the last decade, ultra-low interest policy and never-ending Fed stimulus made it easy for investors to dismiss stock fundamentals. Indeed, stocks are not just a little overvalued… they’re extremely overvalued.

The cyclically adjusted price-to-earnings ratio (PE10) offers a potent view on stock valuations. PE10 is higher than it was at the 1929 peak, and it is quite similar to the excesses of 2000’s tech bubble.

Aggregate measures even suggest that the 2020-2021 post-pandemic excesses are much worse than the ones that occurred in the 1999-2000 period. The 2000 bubble topped out at three standard deviations above mean or, average, valuation levels. Today? Nearly an unprecedented anomaly of four standard deviations above the mean.

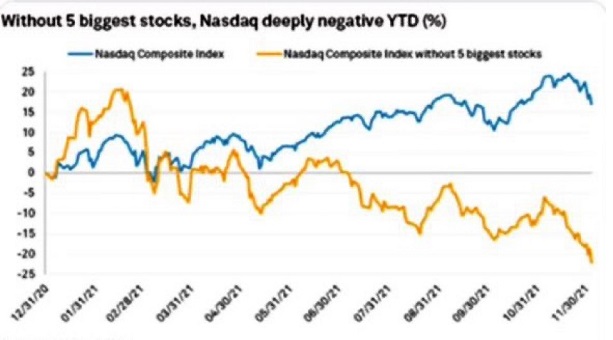

Extremely high stock valuations accompanied by a likelihood of higher borrowing costs in the not-so-distant future have already taken the shine off the NASDAQ Composite. If one removes the five biggest companies—Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Google (NASDAQ:GOOGL) (NASDAQ:GOOG), Microsoft (MSFT), and Tesla (NASDAQ:TSLA)—from the NASDAQ Composite, the year-to-date losses show the weakness within.

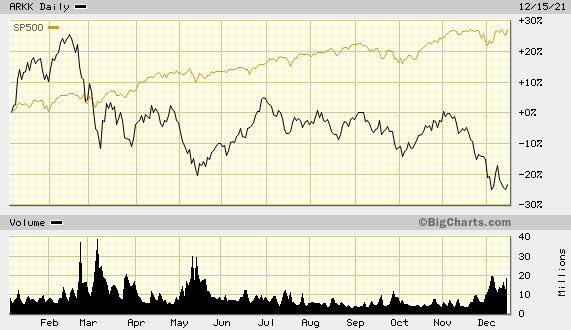

In a similar vein, the mainstream media dubbed Cathie Wood as a premier fund manager in 2020. You could barely watch CNBC without getting “insight” from Ms. Wood and her ARK Innovation ETF (NYSE:ARKK).

Perhaps ironically, the S&P 500 has gained approximately 25% in 2021. ARRK Innovation? Deep in negative territory.

A price differential of 45%? Yikes.

Some of the smart money is clearly leaving hyper-valued areas of the stock market. And while some folks have not seen losses in their index ETF investments, things are clearly getting dicier by the day.