Currencies

EUR/USD – has been bouncing around the 1.10 level the last few days as we are awaiting the ECB today. It is likely that they will not change the interest rate, but we will be looking forward to what Draghi has to say. This is the first ECB meeting after the Brexit vote, so we can get more information on how the ECB sees the repercussion from this, mainly on growth and inflation and if it will require a change in monetary policy. As the BOE didn’t change its policy, many are expecting the ECB to also take a wait and see approach.

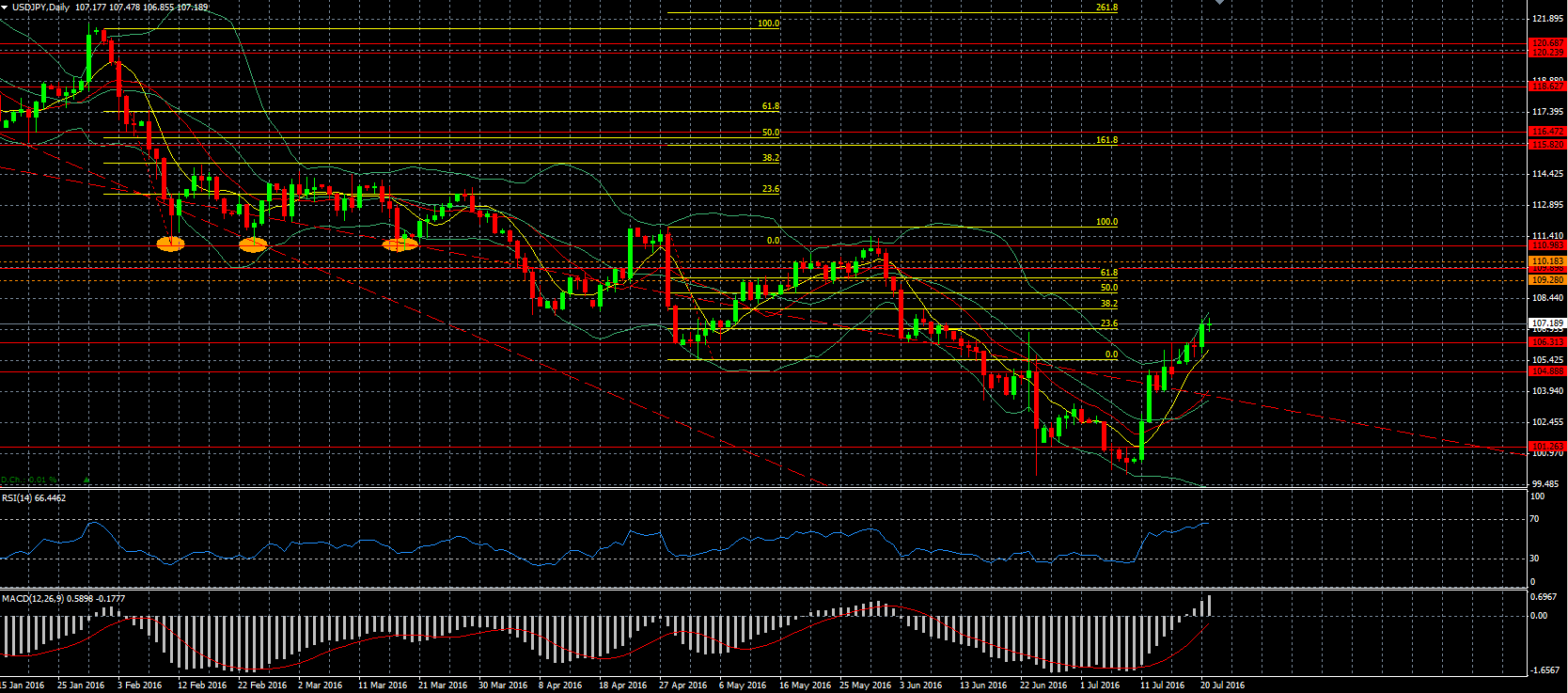

USD/JPY – managed to break through the resistance around the 106.3 level and is currently trading already above the 107 level, as some details are starting to emerge of the measures that the Japanese government wants to implement. This is reported to be a stimulus package of 20 trillion Yen ($188 billion). The big question is if the BOJ will follow suit, or will it disappoint once more and stand firm on its current policy? It has done so already earlier this year and could do so again if it thinks that the measures that the government will take will be sufficient.

GBP/USD – was able to move higher again after the employment data was better than expected. In addition MPC member Forbes is also signaling that there could be a need to measures to be taken after the Brexit vote, but that the BOE should wait for developments.

USD/CAD – moved up as oil started to drop during the day but as oil moved up after the inventories, we saw a large correction down.

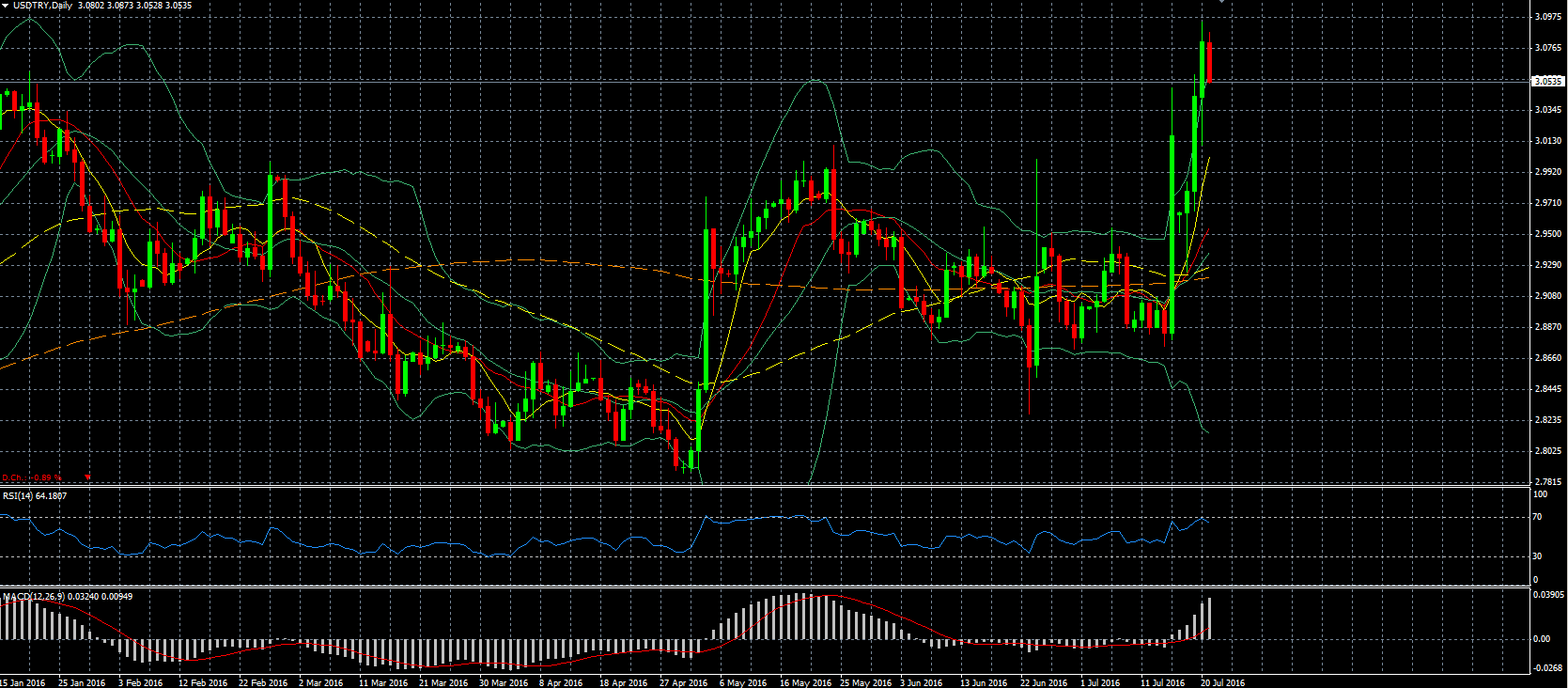

USD/TRY – has moved higher once more to reach a new all-time high, after President Erdogan declared a state of emergency for 3 month and S&P downgraded its rating for Turkey.

Indices

DAX 30 – will be waiting to see what ECB President Draghi will have to say and if they will adjust their QE program in any way.

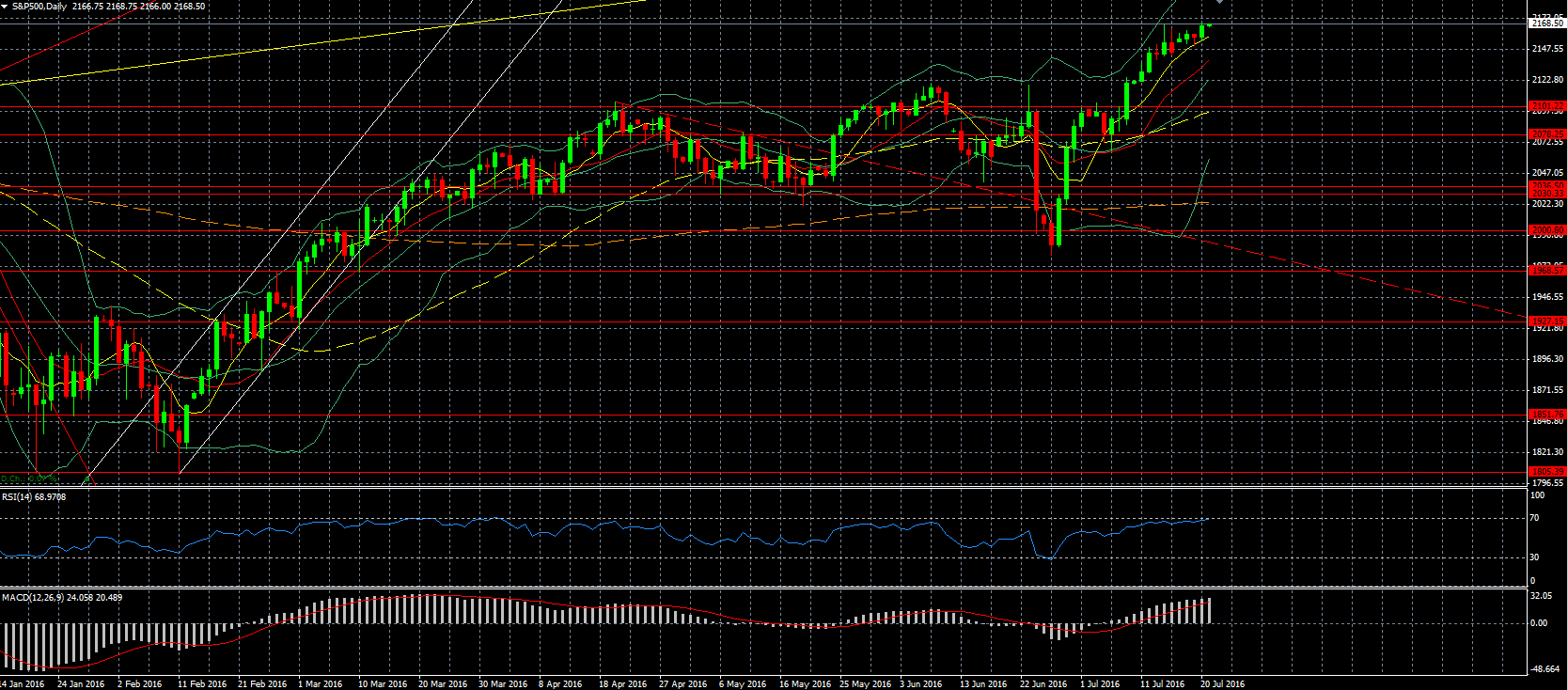

S&P 500 – closed on yet another all-time high. The question is how much more upside there is as we have been moving up virtually non-stop since the end of June, marking a rise of around 9%.

Commodities

Gold – broke below the support which could be found in the lower 1320 levels and dropped to the lowest level since the end of June.

Oil – dropped sharply ahead of the inventories, as there was likely an expectation of a smaller drawdown than expected. This was not the case and as a result we could see oil move higher. This was the first time in weeks that the crude stock and the inventories were more or less in line. We did see another increase in production for the second week in a row.

Stocks

Intel (NASDAQ:INTC) – reported weaker earnings than expected, with especially profits down compared to the same quarter last year.

Morgan Stanley (NYSE:MS) – soundly beats estimates with a revenue of $8.9 billion vs. expected revenue of $8.3 billion. In addition it announced a share buyback of $3.5 billion.

Tesla (NASDAQ:TSLA) – Elon Musk unveiled its “master plan” for Tesla and announced the company will be unveiling a heavy duty truck as well as a passenger bus. While it sounds like a great plan, one has to wonder how Tesla will actually do this, as it already has problem reaching production targets. In addition he envisions that when there will be fully automated self-driving cars, then Tesla owners can “rent out” their cars when they are not using it to generate income. He also expanded further on his vision for the company and why SolarCity is needed for this.