In somewhat of a surprise, the market has recovered quite well from the March decline. The S&P 500 is slightly up for 2020, while Small Caps are down only 5%.

A variety of factors have contributed to the rally:

- Massive fiscal and monetary stimulus (some $8-9 trillion in total, roughly 1/3rd of GDP)

- Historically low-interest rates

- Forward-looking market anticipating recovery faster than your typical recession

- Current data points becoming less bad (especially high-frequency data points such as motor oil and airline passenger counts)

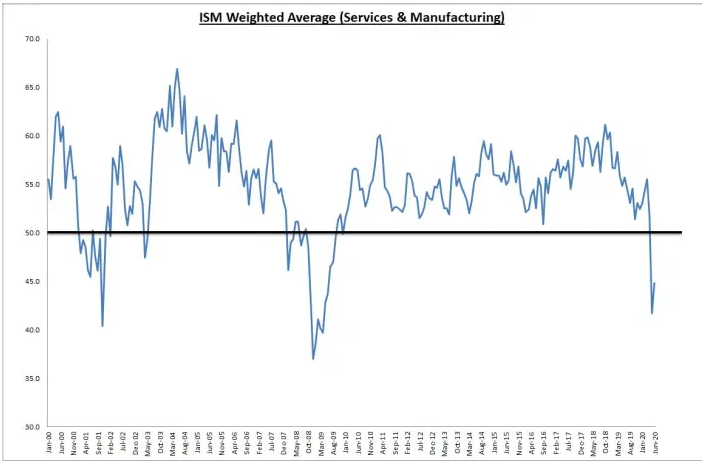

ISM Manufacturing came in at 43.1, and Services came in at 45.4, for a weighted average of 44.8, which while still in contraction is better than last months 41.7 reading.

The biggest surprise came in Friday’s jobs report. Instead of a forecasted loss of 8 million jobs, the actual number came in at 2.5 million jobs gained for the month. Fueling investor appetite for risk assets.

As the market rallies, forward earnings expectations decline. The result is a huge spike in valuations. Investors are now paying $24 dollars for every dollar of earnings expected over the next 12 months.

The 2000 tech bubble forward PE topped out at 27x, so we aren’t too far away.

But if we adjust for the historically low level of interest rates, the valuation looks reasonable. An earnings yield of 4% with a dividend yield of 2% looks pretty good when the 10 year treasury is paying 0.90%.

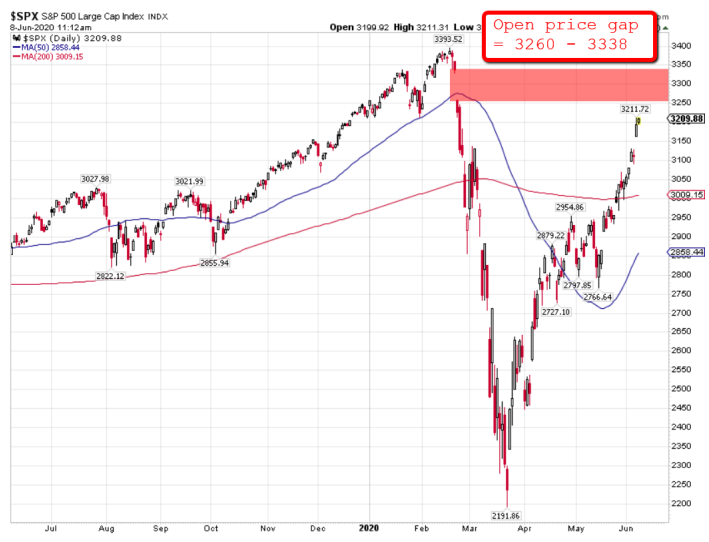

The market has pushed above the resistance zone highlighted in last month's post. The next upside target/resistance zone would appear to be the open price gap between 3260 – 3338, which began the March free fall.

Going forward I do expect the market to continue to recover and eventually make new highs (the NASDAQ has already accomplished this), but perhaps not all up in a straight line. Valuation is a concern but not so much as long as rates remain low. I hope to see the diversification benefit come back, like small caps, international, and value outperform. We are starting to see glimmers of hope on that front, but we’ve been teased many times before.