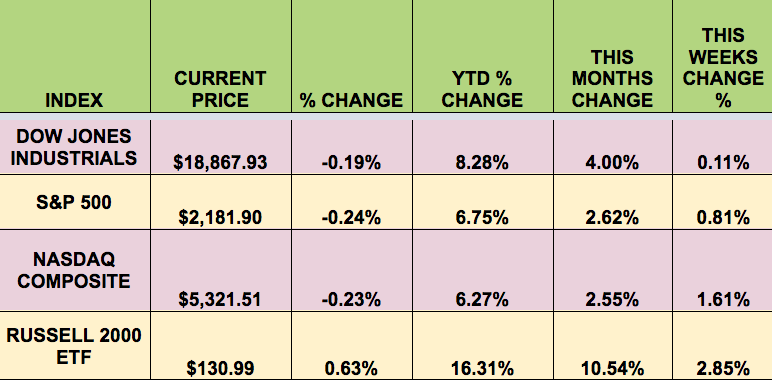

Markets: All 4 indexes had gains this week, with the Russell 2000 up 2.85% – based upon the thesis that the promise of increased US government spending and deregulation will benefit small caps more than larger firms.

The Dow hit another all-time high, but fizzled at the end of the week. The US Bond market continued to sell off, maintaining its trends over the past few months – September had the biggest outflows of US bonds since 1977.

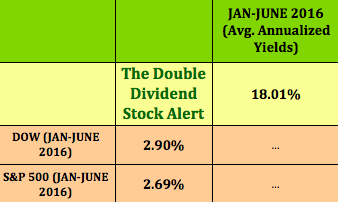

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: BGCP, MCC, SUNS, TYG, HFC.

Volatility: The VIX fell 9% this week, finishing at $12.85.

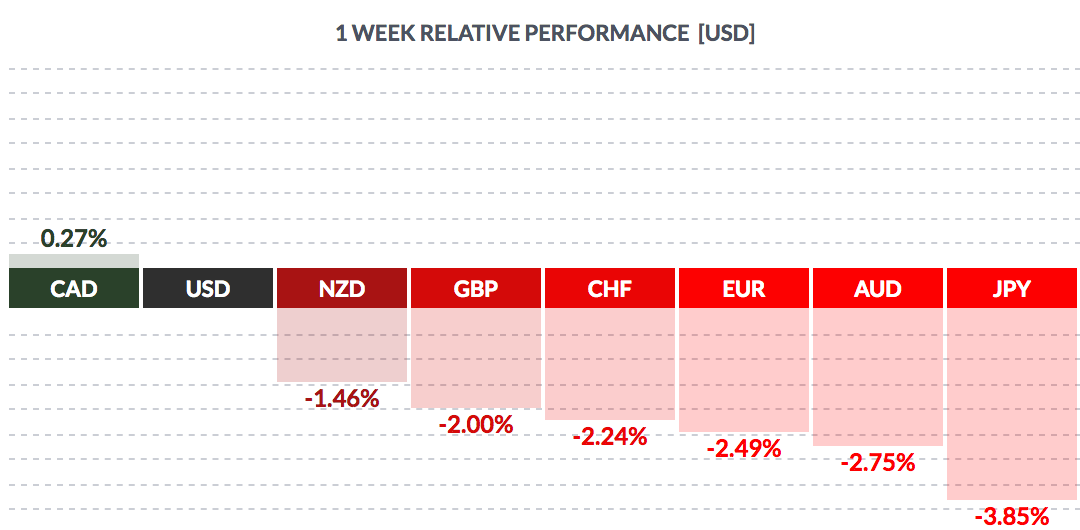

Currency: The dollar rose vs. most other major currencies, except the Canadian loonie.

Market Breadth: 13 of the DOW 30 stocks rose this week, vs. 26 last week. 68% of the S&P 500 rose this week, vs. 75% last week.

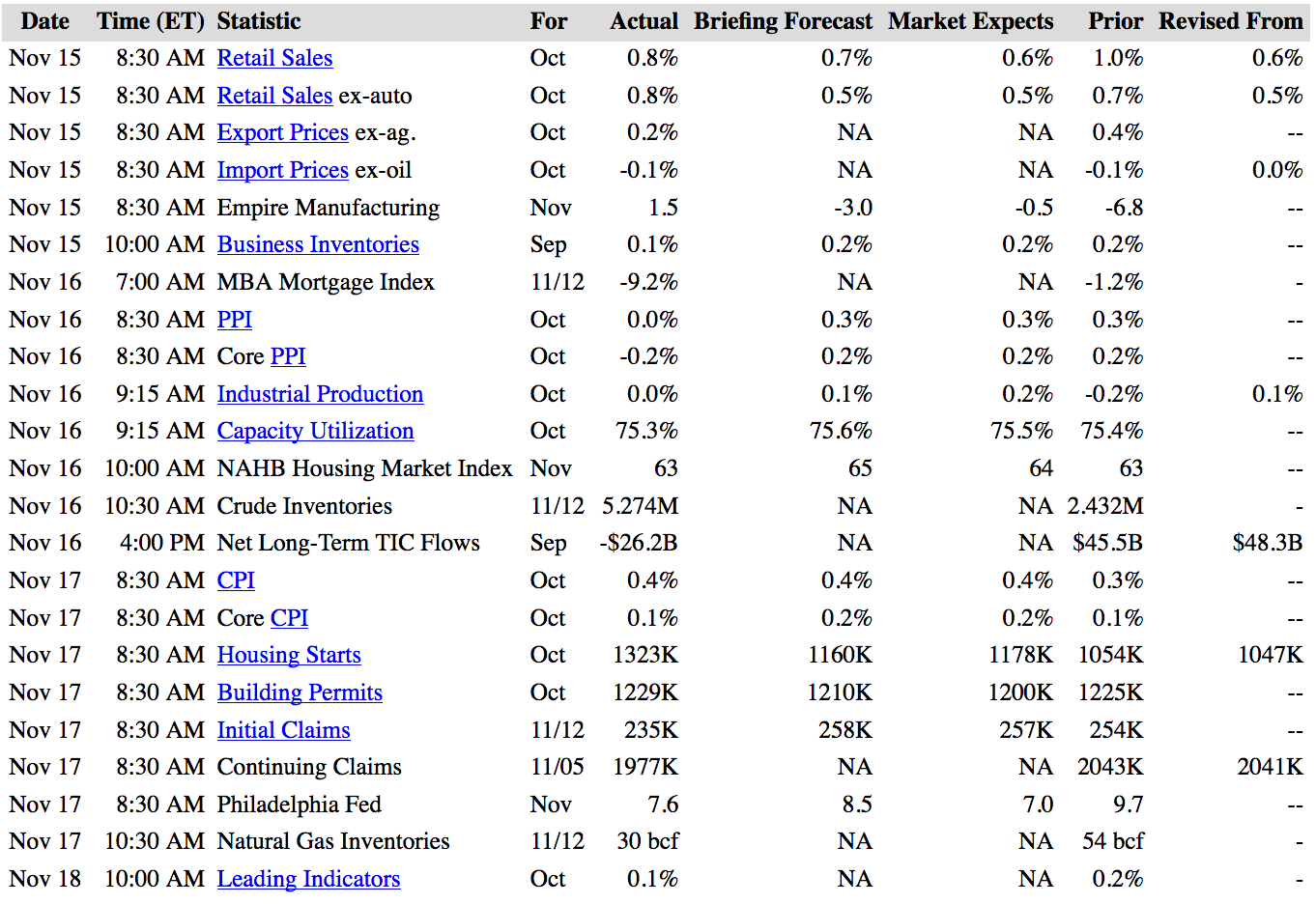

US Economic News: Jobless Claims hit their lowest point since 1973, at 235K, below the 257K forecast, Continuing Claims fell below 2000K, at 1977K. Housing Starts hit their highest mark since Aug. ’07. Energy price increases drove CPI up 0.4%.

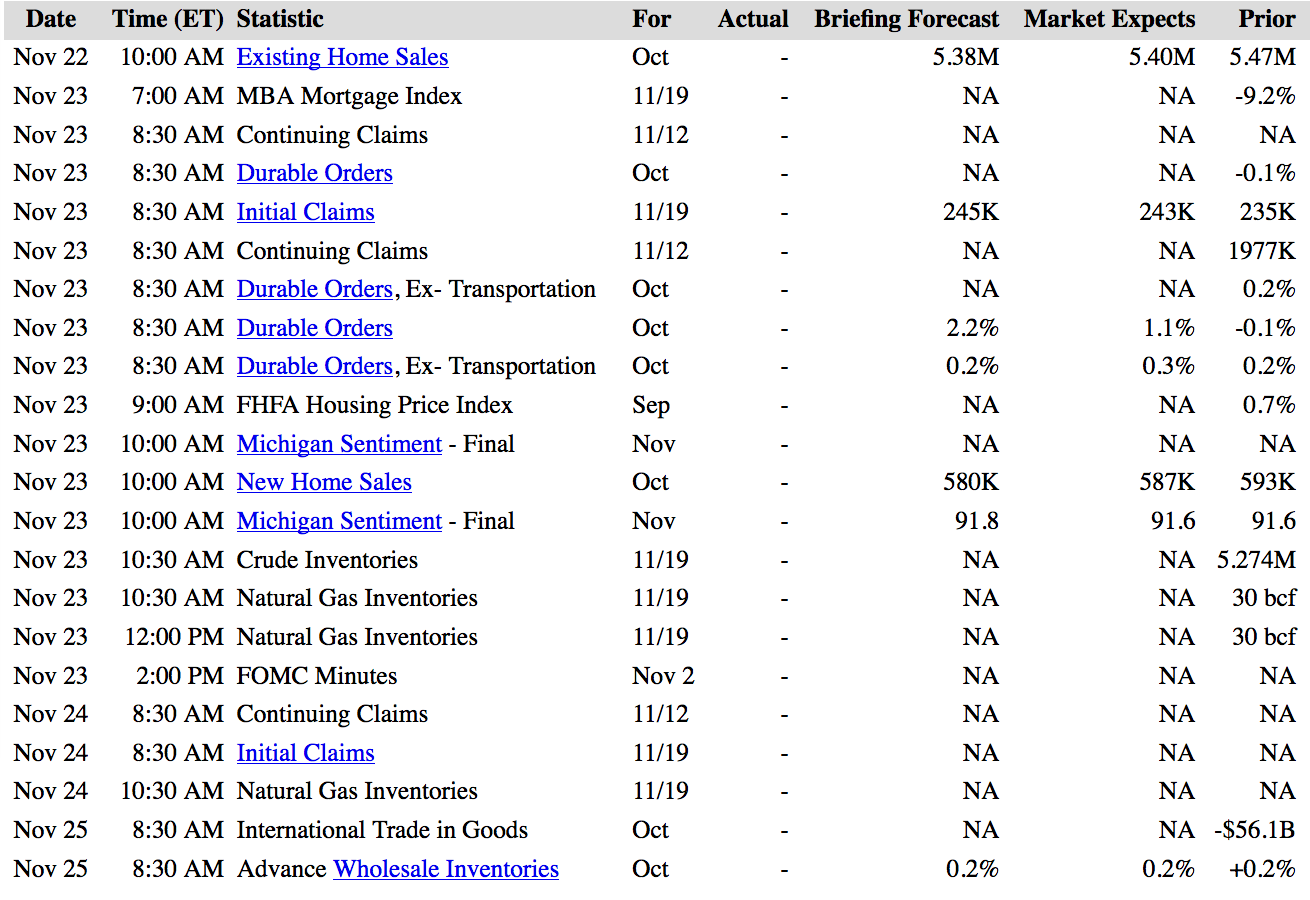

Week Ahead Highlights: . The market will be closed on Thursday for Thanksgiving, and will also close early on Friday, at 1pm. It’ll be another big data week for Housing, with 3 reports due out.

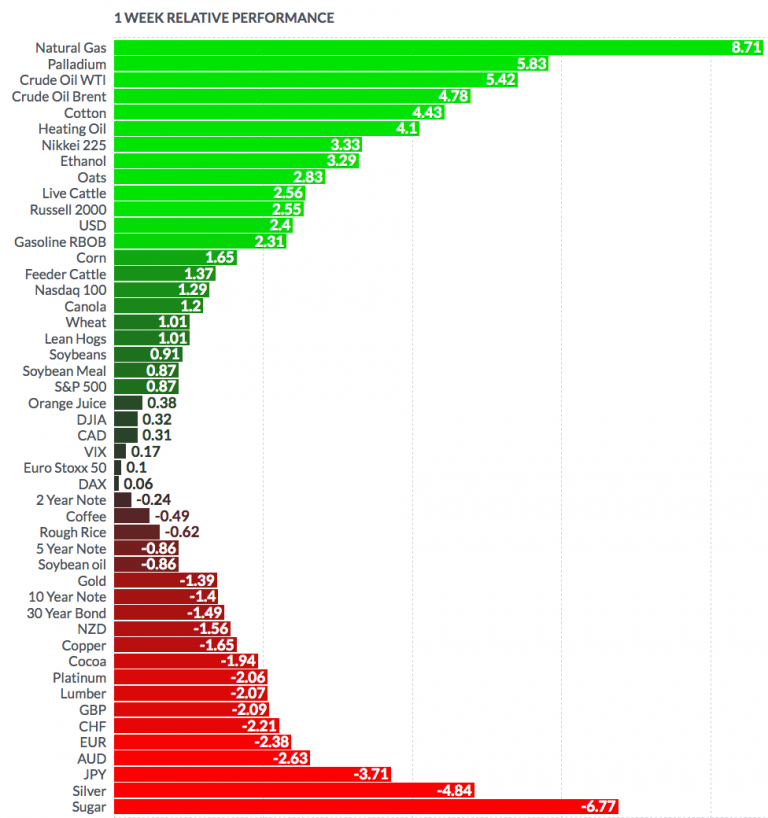

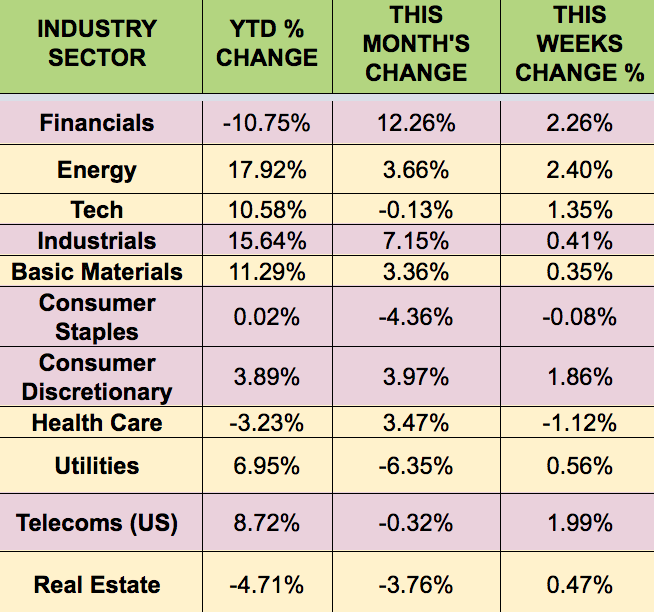

Sectors and Futures: Financials had another big week, thanks to the increased chances of a December Fed rate hike, and the possibility of less regulation. Energy also surged, while Healthcare trailed.

Natural gas led, while sugar and silver futures trailed: