Investing.com’s stocks of the week

While contrarians could argue that the US Dollar was poised for a slowdown if not a reversal of its oversold status, what appears to have moved the needle in favour of the world’s reserve currency on Tuesday, as North America came online, was a blockbuster CB consumer confidence reading at 133.4, the highest since 2010,. The reading embodies the ebullient mood in the midst of an equity market (S&P 500 as the benchmark) that keeps making history before our very own eyes by reaching fresh record levels.

Ironically, the strong US number, and widely perceived as the impulsor of the US Dollar recovery since the US morning hours, comes in contradiction to the recent Univ. of Michigan report, which disappointed in August. While not having an impact on the US Dollar per se, the sudden increase in the US July adv goods trade deficit to $72.7b vs $69b is not going to sit too well with US President Trump. The deterioration in the trading activity came mainly driven by a decrease in international agricultural exports amid a stronger USD and the introduction of protectionist policies. Watch out Trump, as the BIS (Bank of International Settlements, often referred as the bank of central banks, through its Chief Agustín Carstens, eloquently explained in a presentation at Jackson Hole, protectionism may set a ‘’succession of negative consequences’’ that jeopardizes decades of global economic progress.

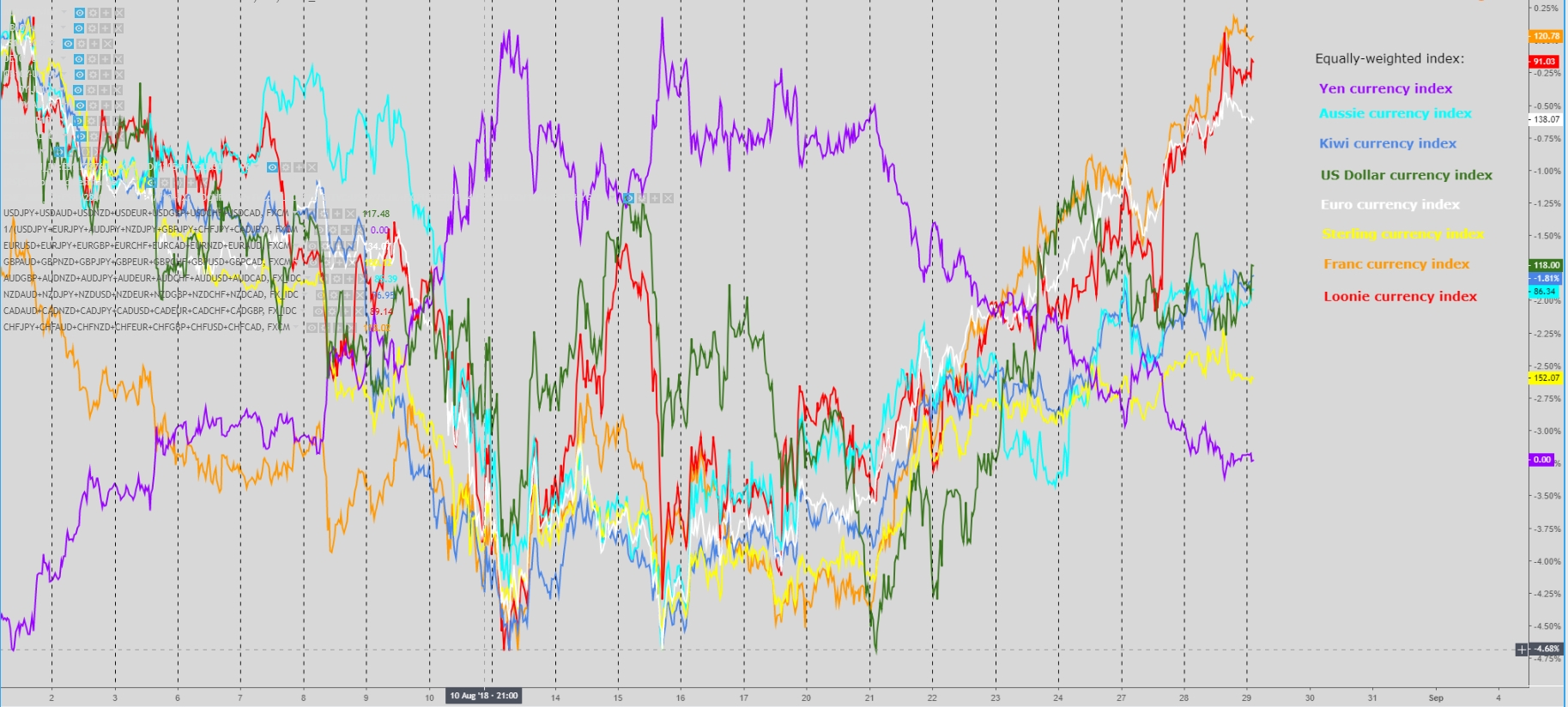

By the end of the day, the US Dollar climbed back from its hole by posting moderate gains against the Sterling (UK PM May reminded us that a no Brexit deal is better than a no deal), Japanese Yen (battered by risk on), and the Aussie (US-China trade stand-off weighs), while still more work needs to be done to violate the short-term bullish dynamics against the strong currencies this week, which include the Euro (momentum-type traders have been piling in amid widening of the 10-yr German vs US yield spread), the Canadian Dollar (given the benefit of the doubt that a NAFTA deal looms near, asserted by comments made by US Treasury Secretary Mnuchin), the Swiss Franc (exhibiting impressive strength under both risk-off & risk-on conditions in Aug), and the Kiwi (given an impulse on improved domestic data). In the commodity space, gold went back to its losing days, reinforcing the notion that the metal has very much transitioned into a proxy to express USD strength, as opposed to the conventional view of a safe-haven asset.

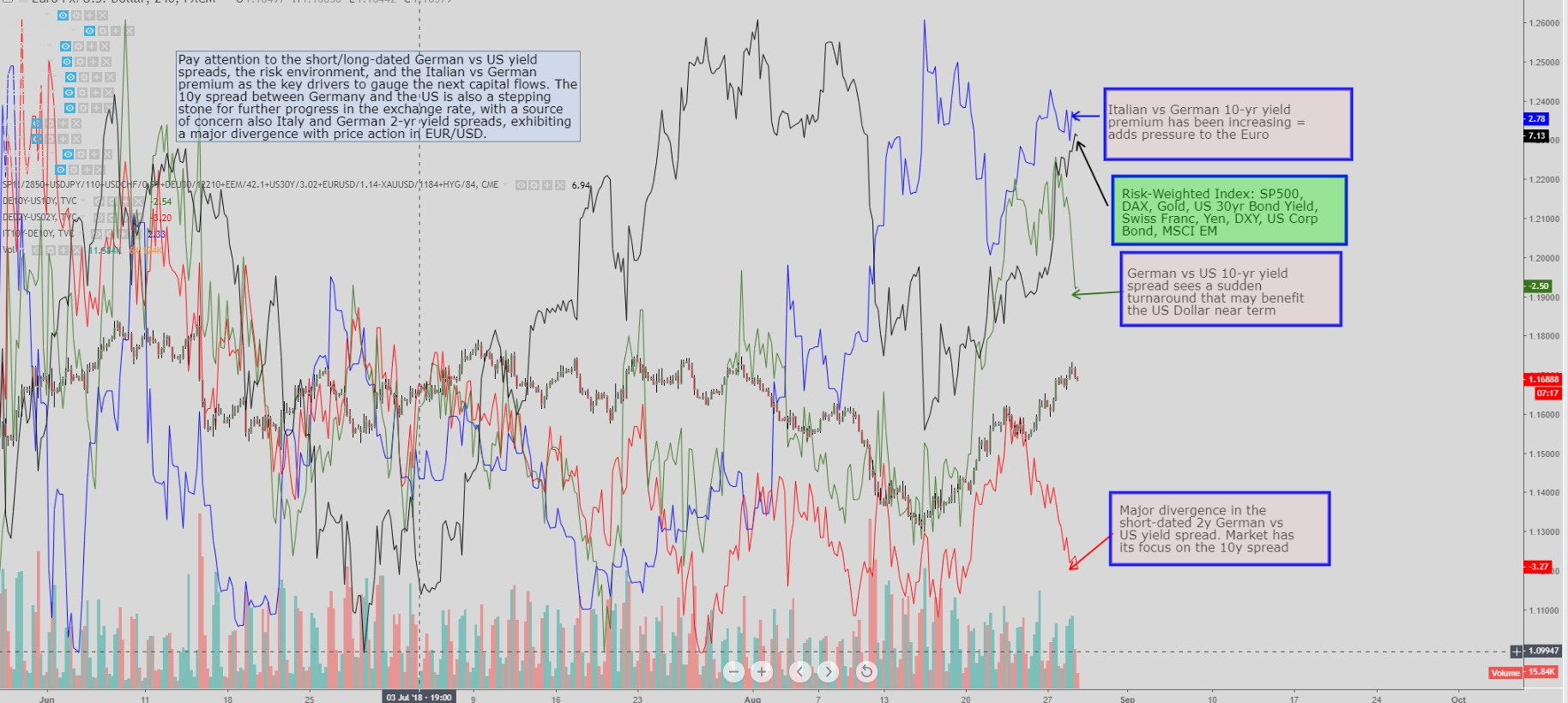

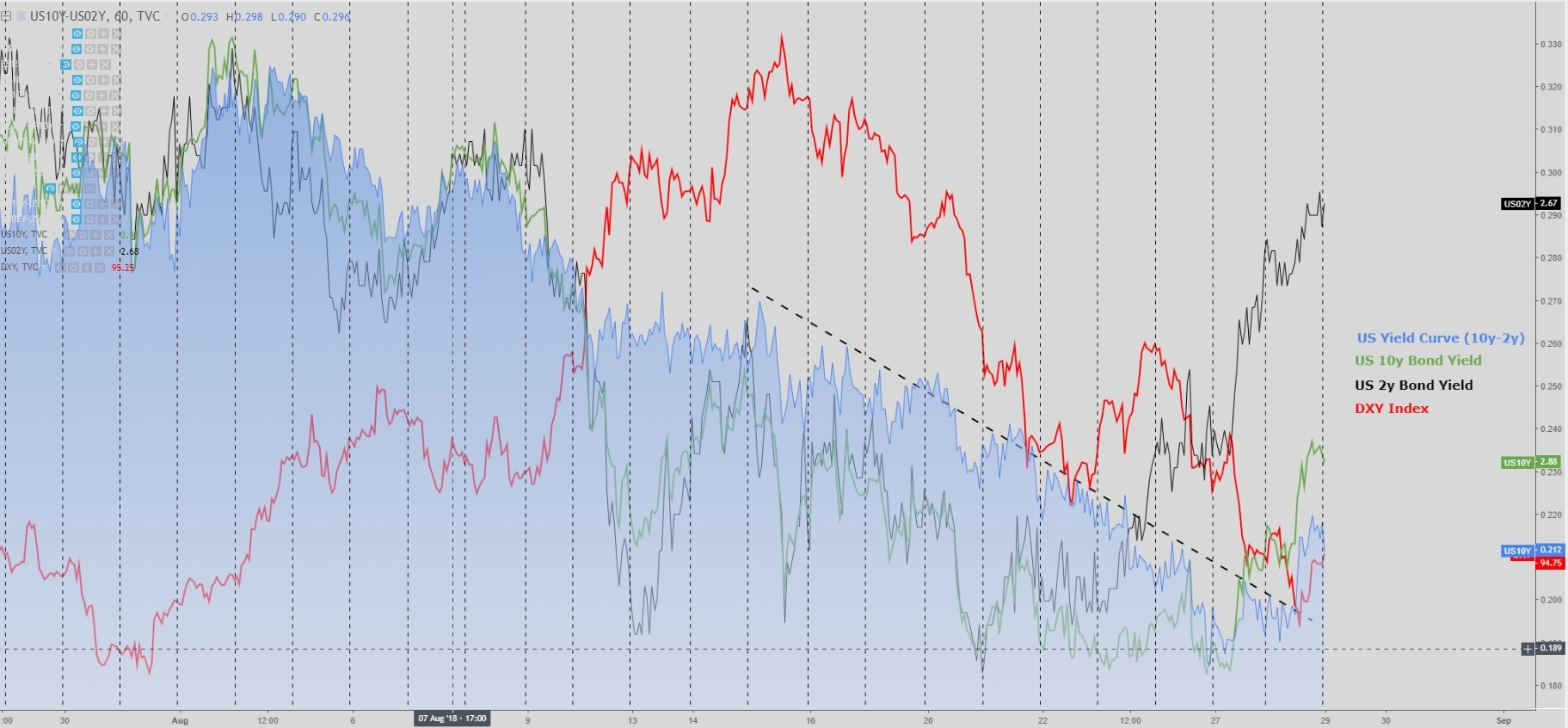

It’s worth noting that Tuesday’s turnaround in the EUR/USD comes at a critical juncture (100-day sma at 1.1730), while it also failed to close above the 1.17 round number, all well-blended and resonating with a much more bullish outlook in the long-dated 10-yr US bond yield market, spiking to 2.89% from 2.85% just 24h ago. This vigorous move has immediate implications as a potential disruptor of the bullish EUR/USD bull trend and as a result, see a more combatant USD, given that it has led to a significant steepening of the US yield curve (positive for the US economy) and similarly, to a major bearish structure breakout on the German vs US 10-yr yield spread, a key driver of a higher exchange rate as of late.

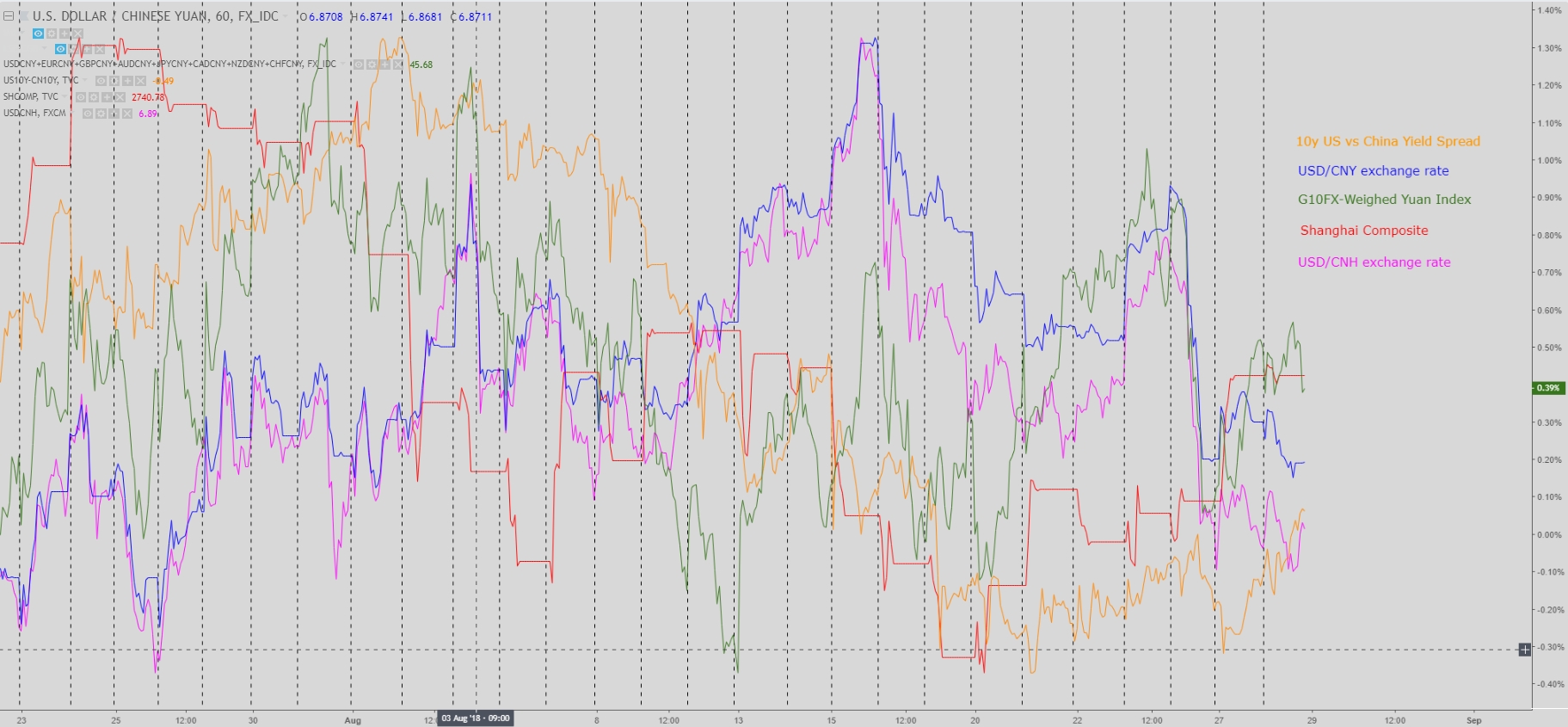

What should tentatively appease market participants and allow to keep risk currencies fairly well bid is the fact that the Chinese Yuan has continued to strengthen against the US Dollar as speculators flee the market, last trading circa 6.8, on par with the offshore USD/CNH. While it may be argued that the Aussie may see mounting pressure from this week’s hard-line stance by US Trump on China, blatantly stating that this is not the time to keep negotiating (focus is on NAFTA), the currency has definitely been extended a lifeline by the PBoC’s counter-cyclical measures, which in layman’s terms means, the Yuan value will be artificially set wherever the Chinese Central Bank please in the daily fixing, hence itseems a risk that can be brushed under the carpet for now.

Which leads us to the broader spectrum of emerging markets, where do we stand? Here is where investors must continue to monitor any potential setback in the risk environment, especially if we were to witness sustained strength by the US Dollar. However, the strengthening of the Yuan has really been a watershed that has ignited solid momentum behind the Shanghai Composite and the MSCI EM index, as the two most heavyweight representations of Asian equities (exc-Japan). A brief yet important note in Japan before moving on: Today, Bloomberg reports that foreigners have dumped near $35b in Japanese equities this year, in what’s seen as the biggest exodus in over three decades, according to data from Japan Exchange Group Inc. It’s hard to resist having one’s funds parked in a rather stagnant Japanese equity market when the fiscally-induced US equity market is gifting investors with fresh record highs every other day.

The gyrations in EM currencies, especially in the Turkish Lira, while weaker on renewed momentum by the USD, appear within contained ranges. A report by the WSJ that the German government is mulling the possibility of providing financial aid to Turkey unveils two hints, those are, a German bank (Deutsche bank) might be in trouble, but at the same time, further assistance is being offered, and that’s what the market cares about as it potentially increases the means to confront an escalating economic crisis amid the collapse of the domestic currency. As a precursor of what’s to come, Moody’s downgraded 20 banks in Turkey on Tuesday.

In other news of interest, the Senate confirmed Richard Clarida as the Vice Chairman of the Board of Governors of the Fed, an important vacancy that gets filled in who becomes the right-hand man of Jerome Powell. Clarida is viewed as a pragmatic, centrist and well-regarded policy-maker that represents continuity of the current normalization path the Central Bank is embarked upon. In Italy, more evidence is coming to the surface that Italy remains adamant on its intention to breach the budget deficit limit set by the EU, a worry that was well-telegraphed by bond traders, sending the Italian bond yield premium higher; while not a driver in the Euro in Aug, once Sept comes, expect the spikes seen in the German vs Italian yield spreads to add more weight into the single currency valuation as the date to finalize figures and targets (end of Sept) approaches. Last but not least, a red flag for investors is the latest reports on North Korea, as according to CNN, a letter sent to to the US warns that all the efforts to denuclearize the region may fall apart as Trump remains unwilling to visit North Korea and make further progress.