WORLD MARKETS

Further to my last post, world markets continued to plunge in Thursday's trading, as shown below.

S&P E-MINI FUTURES INDEX

The S&P 500 E-mini Futures Index (ES) is currently trading after-hours (8:00 pm ET) near its Thursday close, as shown on the monthly chart below.

Price is caught around/near major support, comprised of:

- the -1.75 deviation level of the long-term uptrending Andrew's Pitchfork channel taken from the 2009 low to 2020's high (2400ish)

- the 60% Fibonacci retracement level taken from the 2016 low to 2020's high (2400)

- the 40% Fibonacci retracement level taken from the 2009 low to 2020's high (2350)

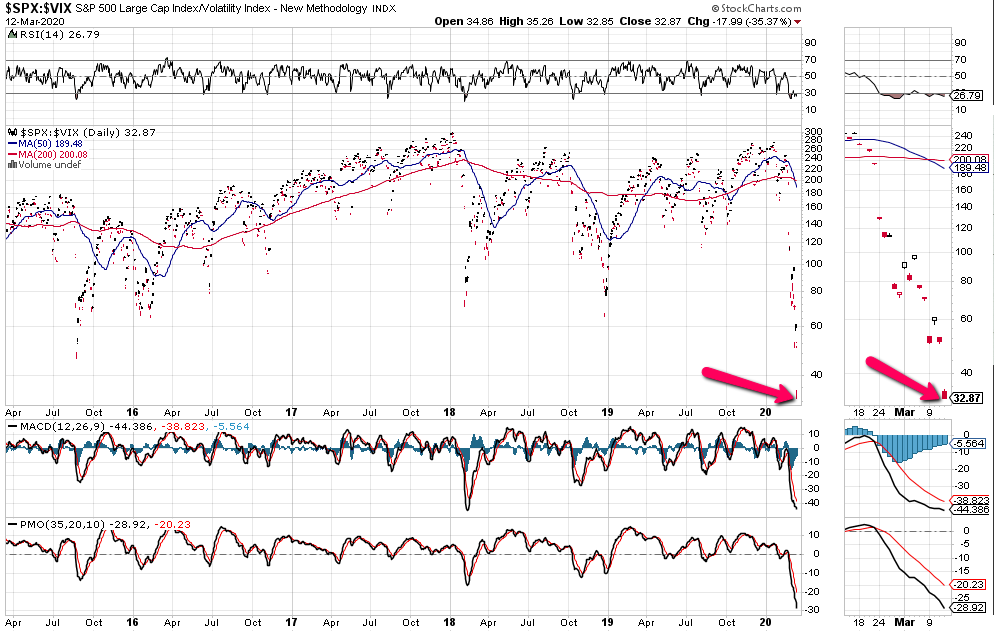

SPX:VIX RATIO

The SPX:VIX ratio has fallen off a cliff and closed at 32.87 (a level last seen in 2009), as shown on the following daily chart.

The moving averages have formed a new bearish Death Cross, signalling more weakness ahead for the SPX.

If that crossover holds, look for extreme levels of volatile price swings in both directions, with possible lower prices on the SPX around 2350ish, until we see a sustainable bounce, with conviction, and a possible retest of the lower edge of the channel around 2750.

A drop and hold below 2350 could produce a catastrophic spike down to somewhere between 2140 and 2030, or lower.

U.S., GERMAN And CHINESE FINANCIAL SECTORS

Finally, keep an eye on the XLF:SPX ratio daily chart. It's now down near a 5-year major support level and the moving averages have formed a new bearish Death Cross, signalling more weakness for the Financial Sector (XLF).

Price is attempting to stabilize the last several days, but if it drops lower, it could drag the SPX down, as well.

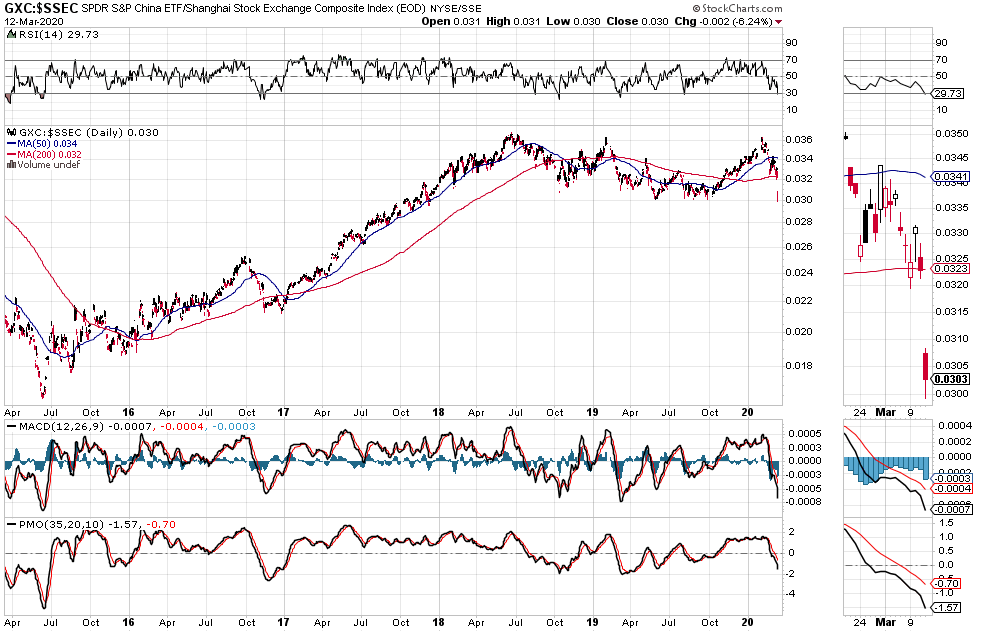

And, keep an eye on the next two ratios.

The first is the EUFN:DAX ratio (the European Financial Sector ETF compared with the German Index, DAX), and the second is the GXC:SSEC ratio (China's Financial Sector ETF compared with the Shanghai Index, SSEC).

They're also both at their respective major support levels.

A drop and hold below current price will likely drag their respective indices down, as well.

BOTTOM LINE

If the above-referenced three financial sectors remain much weaker than their index counterparts, then we'll likely see more weakness in world markets, in general, along with heightened volatility, notwithstanding a variety of monetary and fiscal stimulus measures currently being deployed or planned by central bankers and world governments.

As I mentioned in my last post, 2008/09 was a bank financial crisis.

This is an economic crisis, health crisis, and global supply-chain crisis, and one that is multiplying every several days in depth and breadth...not easily or quickly resolved by monetary and fiscal stimulus, particularly if they're not adequately and correctly targeted.

If conditions persist and market weakness persists, this may also become a bank financial crisis.

Watch for drops in consumer confidence and spending, along with rising unemployment numbers, for possible clues in this regard.