The market is set to drop after yesterday’s rebound as debt ceiling woes continue. From a frenzied Friday to manic Monday, a rebound on Tuesday, it has been a rocky start to October.

However, don’t believe the media hype that recent market gyrations are abnormal. They are not. In fact, since 2019, the S&P 500 changes by .87% a day on average. Over each of the last four days, it has moved on average by only 1.28% per day—not much more than average. Ignore the media hype and focus on the technicals. With yesterday’s gains, we are not out of the woods but there are not many signs of significant trouble ahead either.

What To Watch Today

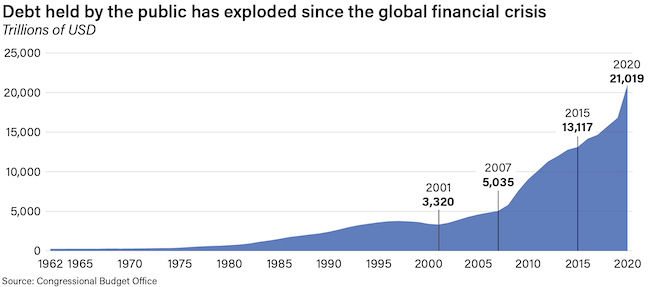

The Debt Ceiling – It’s Bad Either Way

“With just under two weeks to go before the pivotal Oct. 18 deadline, Treasury Secretary Janet Yellen told CNBC on Tuesday the U.S. economy could spiral into a full-fledged downturn if Congress doesn’t raise the government’s statutory deficit limit. In a nutshell, frequent fights over the debt ceiling have become a Catch-22 between paying bills the government has already incurred—or continuing to spend money it doesn’t actually have.

Trump articulated that idea when he told Yahoo Finance that,

"we’re in trouble no matter what…if you raise it, bad and if you don’t raise it, bad. It’s a bad situation to be in."

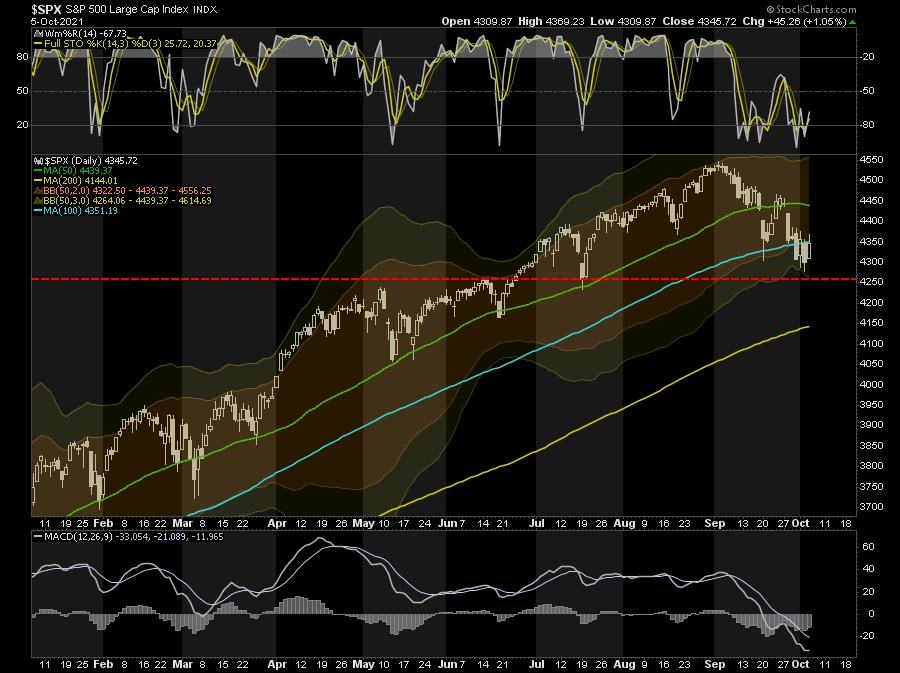

Market Rallies To Resistance

The market rallied off support yesterday and back to the 100-DMA. While the market did breach above resistance, it failed to hold above it into the close. This morning, futures are lower again over concerns of the debt ceiling which is pushing yields higher. We are going to look to retest support again, which needs to hold. A failure at current support will lead to a test of the 200-DMA, so it is worth remaining cautious near term. Any rallies should be used to reduce risk and rebalance holdings accordingly.

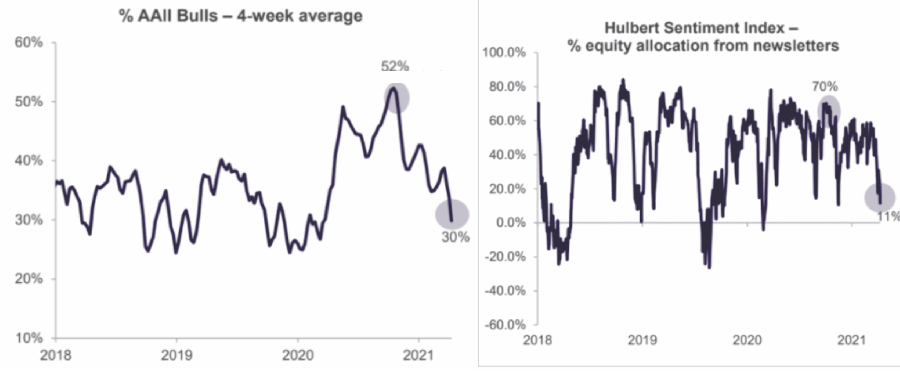

Sentiment Getting Very Bearish

Investor sentiment, both from professionals and individuals, is getting extremely bearish. Such is usually a decent contrarian indicator for a short-term rally. Given volatility did not spike and short-term technical indicators are getting stretched, such bodes well for a short-term reflexive rally.

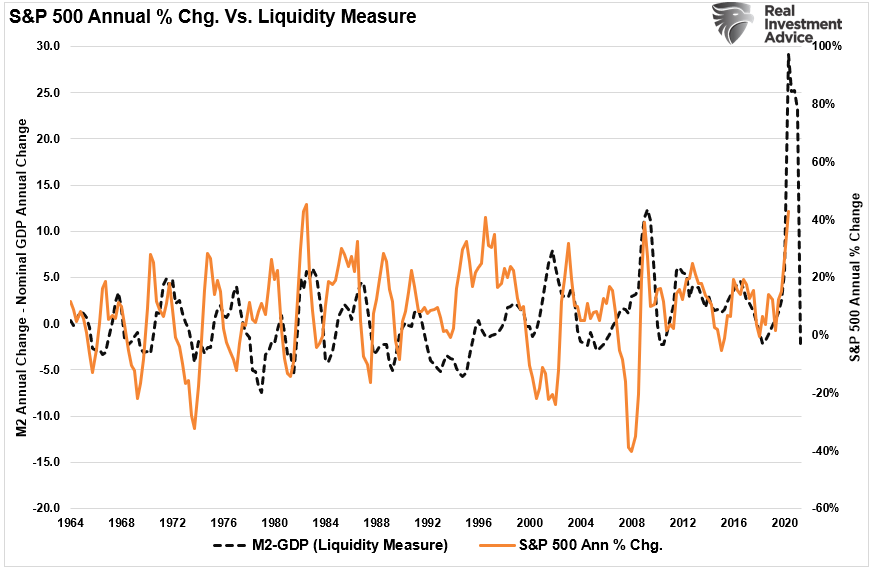

However, as shown, with our measure of liquidity declining rapidly, the risk of a deeper correction as we head into 2022 is rising.

ISM Services Weakening

The services sector is not showing nearly as much strength as manufacturing. Last week we noted the ISM Manufacturing Index rose to 61.1, which, while off recent highs, is still at levels commensurate with prior peaks over the last 20 years. ISM Services on the other hand fell to 54.9 today and is 15 points below recent highs of 5 months ago. It is now normalized with pre-pandemic levels.

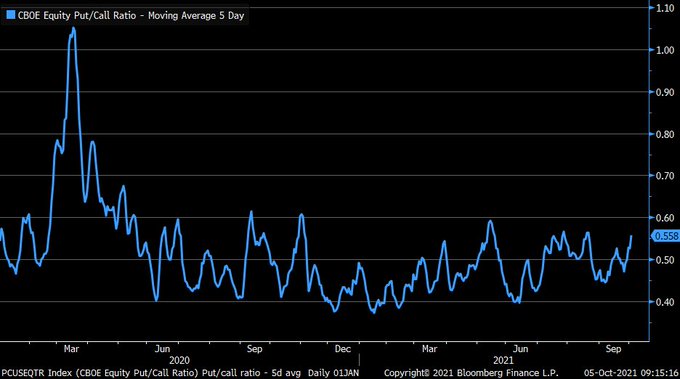

Put/Call Ratio Is Not Fearful

In Monday’s commentary, we showed the VIX is higher but not rocketing to levels that would cause more concern. The put/call ratio, another indicator of investor stress, is elevated, but like the VIX, not at concerning levels. As shown, the ratio is still below levels seen in prior 2-5% declines over the last year. The current instance pales in comparison to the surge in March 2020.

Can Markets Rally Post Manic Monday?

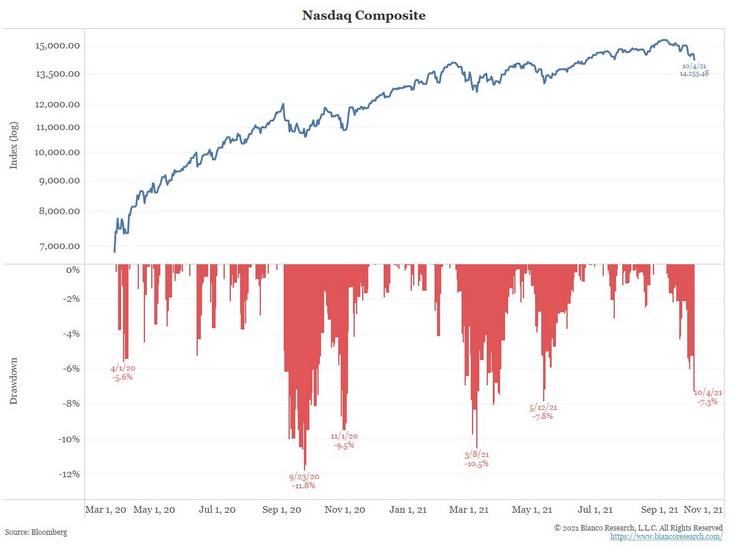

Perspective

The graph below, courtesy of Bianco Research, helps put the recent 7% sell-off in the NASDAQ into perspective. As shown, there have been four other declines which have been greater than the current one in just the last year. While recent price action may be concerning, the markets have not done anything overly concerning. That said, valuations are sky high and the Fed is about to embark on tapering QE, so we want to manage our risk closely.

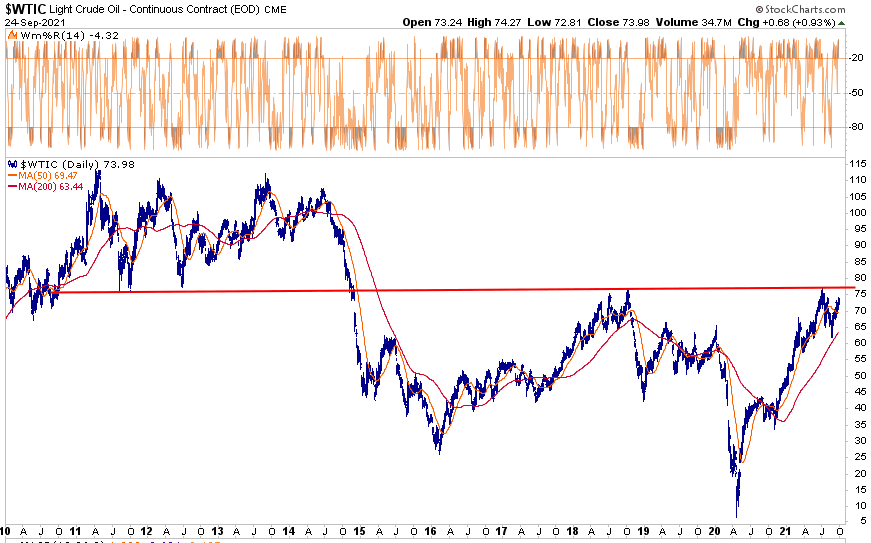

Energy Defying The Market

Despite the S&P 500 falling by about 1.50% yesterday, the energy sector (NYSE:XLE) rose by a similar 1.50%. As we have shown previously, crude oil ($77.70) is bumping up against long-time resistance of $76-78. A break above resistance could lead to a substantial rise in oil prices.

Crude was up over 2% yesterday as rumors spread that OPEC will follow its plan and increase production by 400,000 barrels in November. Some traders were expecting a larger increase in an attempt to limit higher oil prices. Further helping many of the oil companies is a surge in the price of natural gas. Yesterday it rose over 2% to $5.75, more than double its price from spring.

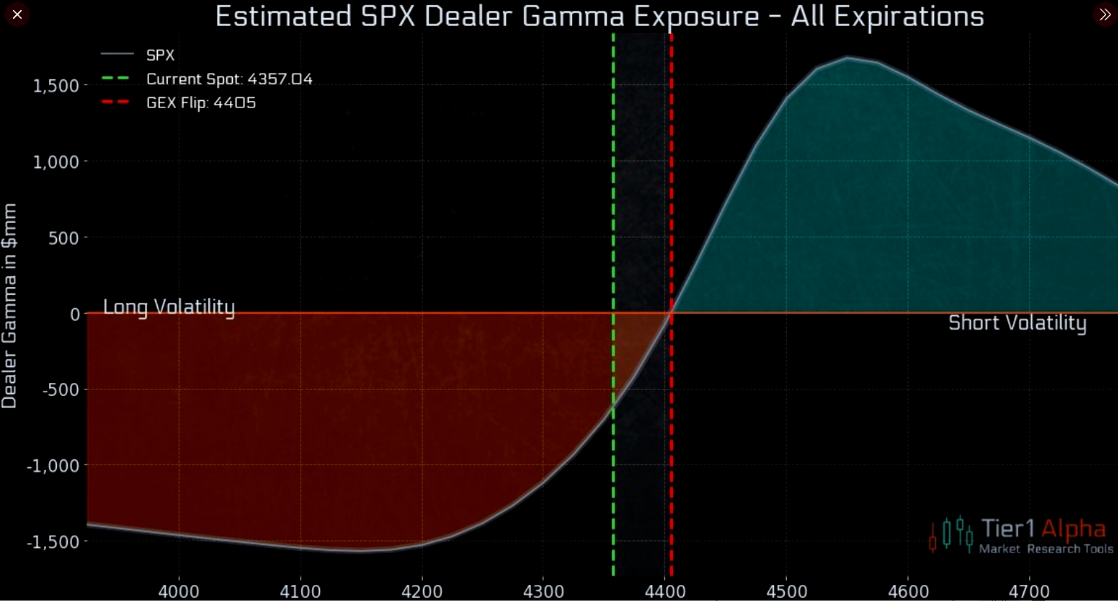

Gamma Matters

In yesterday’s Gamma Band Update, Erik Lytikainen wrote:

“There have been three straight weeks that the SPX has failed to overtake the Gamma Flip level, which is currently near 4,440. Our risk-avoiding model currently has an allocation of 30% to SPX and 70% cash. If the market closes below what we call the “lower gamma level” (currently near 4,285), the model will reduce the SPX allocation to zero.”

Erik’s model is reducing exposure because options gamma has flipped negative. Simply, it is at a point where further moves lower in the S&P 500 result in increasingly more selling by options dealers. When prices are above the gamma flip, traders need to buy to hedge their books. The graph below from Tier1 Alpha confirms his analysis, showing the Gamma Flip level just north of 4400. Given how large options volume has become this year and general market illiquidity, options hedging is a significant cause of price change and may result in more volatility.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.