(Wednesday Market Open) It’s the last day of trading before the Thanksgiving holiday and the market seems poised to gain some ground after two sessions of steep selling. But participants aren’t exactly gobbling up stocks, and the gains seem relatively muted.

It’s arguable that U.S. stocks may have gotten oversold. If that’s the case, investors may be covering some short positions ahead of the holiday to take a bit of risk off the table. But it doesn’t look like momentum has shifted much, as this morning’s up move in equities index futures is relatively mild.

Amid an apparent repricing of assets including shares of Apple (NASDAQ:AAPL) on iPhone sales worries, investors seem to be looking for other places to put their money. But it doesn’t seem like they’re moving headlong into bonds, cash, gold or VIX futures as alternatives.

What they may be doing is simply keeping some powder dry until after they get some clarity on the U.S.-China tariff situation, which could happen in coming days around a meeting between leaders of the world’s two largest economies. The repricing also may be an attempt to position participants based on forecasts for next year’s earnings.

For the meantime, it looks like some traders may be squaring up their positions heading into the Thanksgiving holiday so they can kick back and relax with turkey and football.

Orderly Selling Continues

Although the three main U.S. indices again ended substantially lower on Tuesday, the selling appeared to be orderly, as opposed to dumping assets in a panic. Volume was again light for the NASDAQ Composite (COMP) and S&P 500 (SPX), and that may have exacerbated choppy trading. Today, we may see volume taper off as we move through the trading session.

Also, there was sobering news on Tuesday that helped keep stocks in the red all day.

Government data on the housing market were mixed on a monthly basis but showed both housing starts and building permits were down compared to a year ago. This came after disappointing home builder confidence numbers on Monday. (See more below.)

Investors Seem Disappointed In Retail

Investors also appeared disappointed in the retail sector. Among companies whose shares faltered Tuesday, L Brands (NYSE:LB) fell sharply a day after it said it would cut its annual dividend. Target (NYSE:TGT) reported lower-than-forecast earnings and, along with TJX Companies (NYSE:TJX), reported an inventory increase. Kohl’s Corporation (NYSE:KSS) seemed to disappoint investors with its adjusted earnings-per-share guidance.

Losses in those companies’ shares helped push the S&P 500 consumer discretionary sector to the day’s second biggest sector loss behind energy.

Heading into this holiday season, which includes Black Friday at the end of this trading week, it remains to be seen how Q4 sales affect retailers’ bottom lines and how much competition the traditional brick-and-mortar stores get from online behemoth Amazon.com (NASDAQ:AMZN).

One factor that could eventually help retailers might be the fall in oil prices. Lower crude could put downward pressure on freight costs. It could also mean consumers spend less at the pump and more at the retail cash register.

The oil market has gotten hit hard recently amid concerns about oversupply and potentially weakening demand. Crude has also been on the decline alongside equities as investors have dumped assets they perceive to be riskier. U.S. crude fell more than 6% on Tuesday. This morning, like stock index futures, crude is bouncing off yesterday’s sharp selloff.

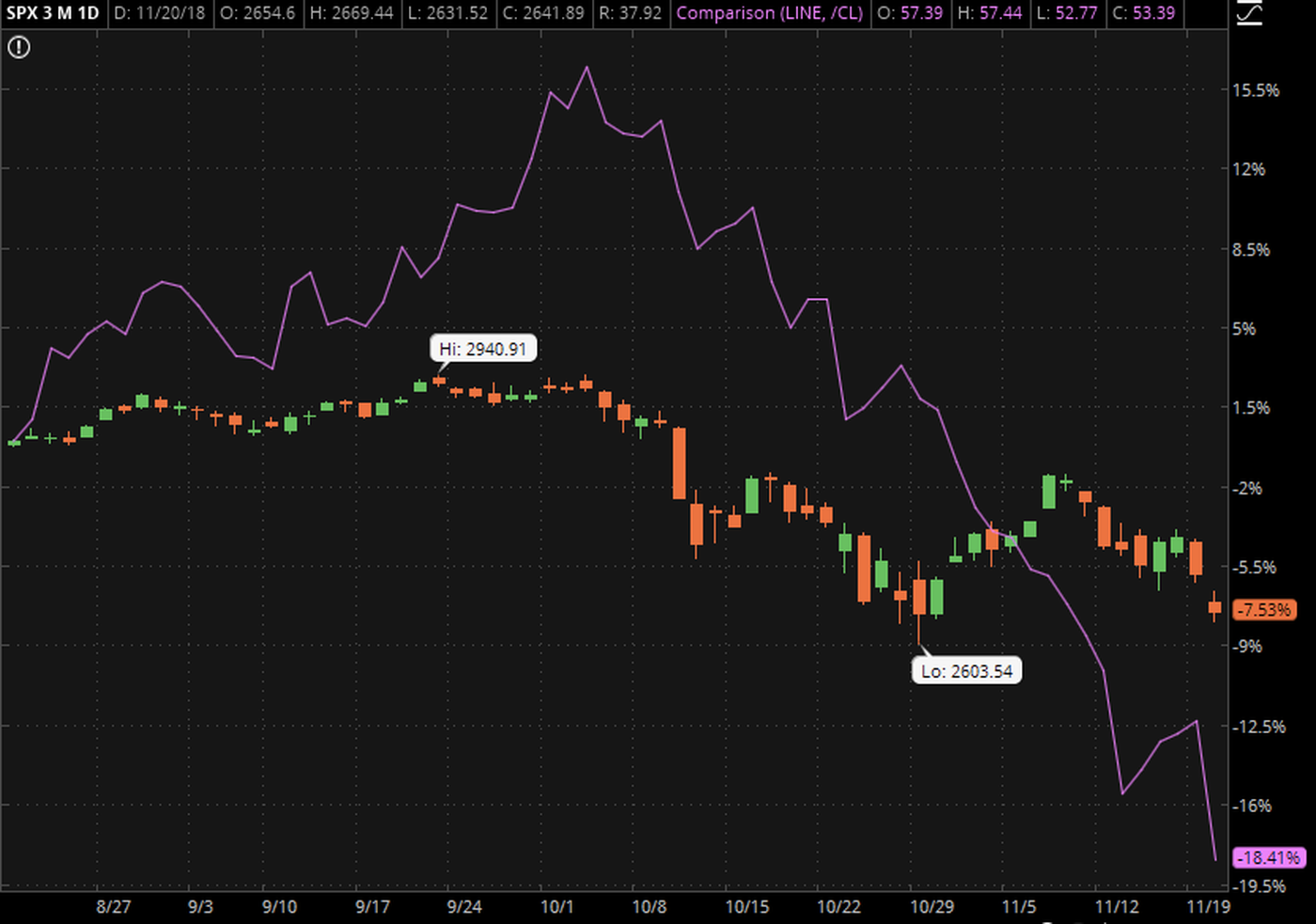

Figure 1: Crude oil and the SPX. Although U.S. crude’s (purple line) slide has been more pronounced from a percentage basis, it has in recent days often coincided with losses in the S&P 500 (SPX - candlestick chart). Investors appear to have been selling assets they perceive as riskier. Data Sources: CME Group (NASDAQ:CME), S&P Dow Jones Indices. Chart source: The thinkorswim® platform from TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future results.

Not Just Fizz. Amid recent selling, the consumer staples sector appears to have been a defensive play for some investors. The sector, which is often considered defensive because of its dividend history and relatively stable product sales even in times of economic downturn, was up more than 1.5% over the past three months through Monday while the broader S&P 500 has fallen. Components Coca-Cola (NYSE:KO) and PepsiCo (NASDAQ:PEP) have outperformed the sector, rising nearly 10% and more than 6%, respectively. It’s possible that the momentum in these two stocks is coming because income investors could be nervous about dividend stocks in the energy sector, which has been getting hammered along with oil prices of late. So they may be rotating out of some energy names into the two well-known consumer staples brands.

Housing Market Woes Continue: The latest forecast from the Atlanta Fed points to reduced expectations for seasonally adjusted annual real GDP growth. Released Tuesday, the Atlanta Fed’s latest GDPNow model estimate is forecasting 2.5% GDP growth for 2018, down from its estimate of 2.8% on Nov. 15. The estimate was pared back in part after the government’s residential construction report Tuesday morning increased the “nowcast” estimate for the contraction in Q4 real residential investment. The report showed that housing starts rose month-on-month in October to a seasonally adjusted annual rate of 1.228 million units, slightly below Briefing.com consensus expectation. Meanwhile, building permits fell month-over-month to a seasonally adjusted annual rate of 1.263 million, which was just above the Briefing.com consensus expectation. While the monthly comparisons were mixed, both permits and starts fell when compared with October 2017. “It isn't a report that should be seen as assuaging concerns about the softness in housing market activity,” Briefing.com said. “If anything, it plays right into those concerns with the year-over-year declines for total permits (-6%) and total starts (-2.9%).” Tuesday’s data come after a sobering November National Association of Home Builders/Wells Fargo Housing Market Index, which came in at 60, well under the Briefing.com consensus expectation of 68.

Goldman Sachs (NYSE:GS) Says Boost Cash Holdings: Goldman Sachs said in a report Monday that the U.S. equities market will continue rising next year, but with risk high, investors would do well to lower their exposure to stocks, boost their cash holdings, and focus on high quality companies. Overall, U.S. equities will rise 7% on an absolute total return basis in 2019, cash in the form of Treasury bills will gain 3%, and 10-year Treasuries will rise 1%, GS said. “Cash will represent a competitive asset class to stocks for the first time in many years,” the bank said. “Mixed asset investors should maintain equity exposure but lift cash allocations,” the bank said, noting that households, mutual and pension funds, and foreign investors have high equity allocations and low cash allocations compared with historical norms. “For equity investors, risk is high and the margin of safety is low because stock valuations are elevated compared with history,” GS said. “Our baseline assumption is that both economic and profit growth will be positive in 2019 but decelerate from the robust levels of 2018.”

TD Ameritrade® commentary for educational purposes only. Member SIPC. Options involve risks and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options.